In the early 1900s, Ford Motor Co. (F) revolutionized the automotive industry – putting America on wheels with the Model T and making mass production possible.

However, it was the oil crisis of the 1970s that truly shifted consumer behavior.

Soaring gas prices quickly led to a demand for more fuel-efficient vehicles. But memories of long lines at gas stations and skyrocketing fuel prices lingered in the minds of consumers for decades…

Because rising gas prices are more than an inconvenience – they can be a catalyst for profound shifts in consumer behavior.

Now, we’re on the brink of another transformative shift in the auto industry with electric vehicles (EVs). And rising gas prices could yet again be the psychological trigger that accelerates mass adoption faster than we thought possible.

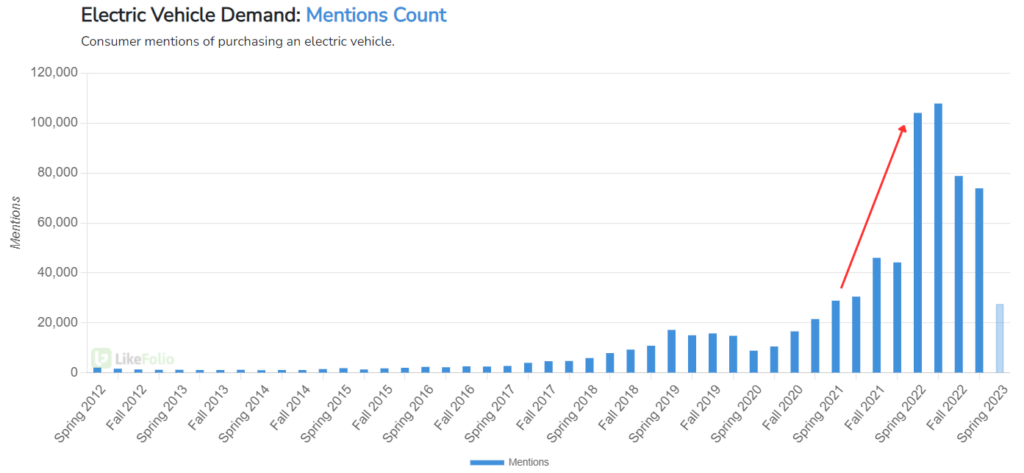

After the average price of gas surged to its highest level ever last year, we watched EV demand mentions climb to nearly 10x pre-pandemic levels:

And this trend has proven sticky.

Earlier this month, crude oil prices pushed past $85 per barrel; and as of today, gas prices in 10 states are averaging in the red-hot range between $4.120 and $5.259, according to AAA.

While these price spikes may not have an immediate impact on EV sales, they plant a powerful seed.

Car buyers have long memories. And the next time they go to upgrade their wheels, memories of price shock at the pump may lead them to an EV they would not have considered otherwise.

The profit play is clear: By investing in the right EV stocks today, you could set yourself up for the opportunity of a lifetime.

And we’re not just talking about Tesla (TSLA) anymore.

Viable competitors are emerging in this space – including one that’s a proven moneymaker with our MegaTrends subscribers.

Take a look…

Emerging Competition Gives Tesla a Run for Its Money

Make no mistake: Tesla remains the most likely beneficiary of this shift as the market leader, currently capturing over 72% of total EV company mentions:

And those of you who’ve been following along with our TSLA recommendations have seen hefty gains so far in 2023, especially as the stock neared $300 in July.

But the landscape is evolving, with competent competition adding dynamism to the market…

- The Old Guard

Ford captures the next largest share of LikeFolio mentions at 21.6%, and its reputation could give it an edge here with both name recognition and trust.

We like the approach of “electrifying” the best of its brands with the F-150 Lightning, Mustang Mach-E, and others. But as you’ve learned here before, the company has a long way to go in this race.

Ford’s EV rollout has been bumpy, to say the least: Chip shortages during the pandemic put the squeeze on Lightning production… only to be followed by recalls.

But F-150 Lightning sales picked back up in July. And if Ford can get its act together, we believe it stands a real chance of making the case against Tesla for the consumer dollar.

- The New Kid on the Block

On the other side, we have Rivian (RIVN), a relatively young player stacked up against a centenarian like Ford.

You’ll see its EV trucks on the road soon if you haven’t already: In 2022, more than 10 million packages were delivered by Rivian-made Amazon vehicles. And Amazon expects to have 100,000 Rivian EVs delivering packages by 2030.

The company is gaining steam with consumers as well – with Purchase Intent mentions pacing 49% higher year-over-year.

MegaTrends subscribers got a head-start on this opportunity in March when our system flagged that ramp-up in demand on Main Street.

With RIVN trading near all-time lows, we called this Tesla competitor a “moonshot” bet – and made a bold call… predicting it could gain as much as 200% within the next two years.

It’s already up 54% in a matter of months.

Rivian has some kinks to work out still, recently calling back 13,000 of its EVs due to a passenger seatbelt issue.

But we like the gains we’ve seen so far – and believe this company has tons of untapped growth potential ahead.

🔥 Just Dropped: Buy Alert with 500% Profit Potential 🔥

We issued a brand-new trade to MegaTrends subscribers this morning on a small-cap stock with 500% growth potential over the next four years. Go here now to find out how you can join for immediate access.

An Electric Horizon

There’s no doubt that EVs are the future. And gas price hikes will only get us there faster as they create a ripple effect…

- Awareness: Consumers become more conscious of fuel costs and start exploring alternatives.

- Consideration: EVs, once seen as niche, become a viable option for many.

- Long-term Impact: Even if gas prices stabilize, the memory of the shock remains, influencing future purchasing decisions.

With global oil demand expected to hit record highs and production cuts by major players like Saudi Arabia, the volatility is likely to continue.

But this volatility is more than a challenge; it’s an opportunity. An opportunity for innovation, growth, and a future where EVs are not just an alternative – but the preferred choice.

TSLA remains at the forefront of this electric revolution.

But the race is far from over.

From this point on, TSLA’s dominance may be challenged by these emerging players as they make significant strides in the EV market.

Beyond RIVN: You can check out the latest opportunities we’re targeting in MegaTrends by clicking here.

Until next time,

Andy Swan

Founder, LikeFolio