My alma mater – the University of Alabama – had a lot to live up to heading into the 2012 football season. The Crimson Tide was the 2011 consensus national champion after shutting down LSU 21-0 in the BCS final. And folks were expecting the Tide to roll in this next season too.

But there’s a reality that holds true when you’re the top dog, whether it’s in sports, politics, or business: When you’re No. 1, you’ve got a bullseye on your back because everyone below your top spot is gunning for you.

That was certainly true for Alabama Coach Nick Saban and his players coming into that 2012 season. Saban, one of the greatest college coaches ever, knew the team had to focus forward, avoid complacency and the “championship letdown,” and be ready for stepped-up game plans from every team they faced.

The season got off to a tough start with a narrow win over Michigan and a come-from-behind victory over LSU. After that, the team seemed to find its groove and would win its first nine games – thanks to a good-enough offense and a defense that could put points on the board, even as it stopped opponents cold.

That’s not to say those wins came easily. Opponents like LSU and Georgia played their best ball against Alabama – understanding the cachet that would come from knocking off the defending national champ.

Then came the tenth game of the season against underdog Texas A&M. The Aggies brought their “A” game, and upset the Crimson Tide – dropping Alabama to No. 4 in the national rankings.

After that loss, Saban & Co. knuckled down. They won their last three games, including at least one upset, and earned their way back to the national championship game – against the top-ranked Fighting Irish of Notre Dame, a surprise contender that year.

As the defending champs, but underdogs, Alabama faced mind-numbing hype.

Faced it – but was unfazed by it.

The Crimson Tide offense rolled up 529 yards of total offense, its defense held Notre Dame to a mere two touchdowns, and they beat the Fighting Irish 42-14.

One side note: Alabama would be the last team to repeat as national champs until 2022 – cementing its place as one of the greatest college football teams of all time.

If you haven’t already guessed, I was at that game.

I yelled myself hoarse.

And I learned a crucial lesson about responding to pressure – and what it takes to keep your top spot.

You buckle down, you continually refine what you do, and you expand your areas of dominance.

EV pioneer Tesla (TSLA) is in the same spot today that Alabama was heading into that 2012 football season.

Like Alabama, Tesla is the defending champ as the leader of the electric vehicle (EV) market.

Like Alabama, Tesla faces hungry challengers.

Like Alabama, Tesla has a bullseye on its back.

Most important of all: We believe that Tesla, like Alabama, will buckle down, refine what it does, and expand its dominance.

My passion for Tesla may not run as deep as my passion for Crimson Tide football.

But I’m a fan nevertheless. A big fan.

Even with the big bullseye on its back, there are three big reasons Tesla will continue to dominate the EV space.

And those are the same three reasons you’ll want to own Tesla’s shares today…

Reason No. 1: EVs Are the Future

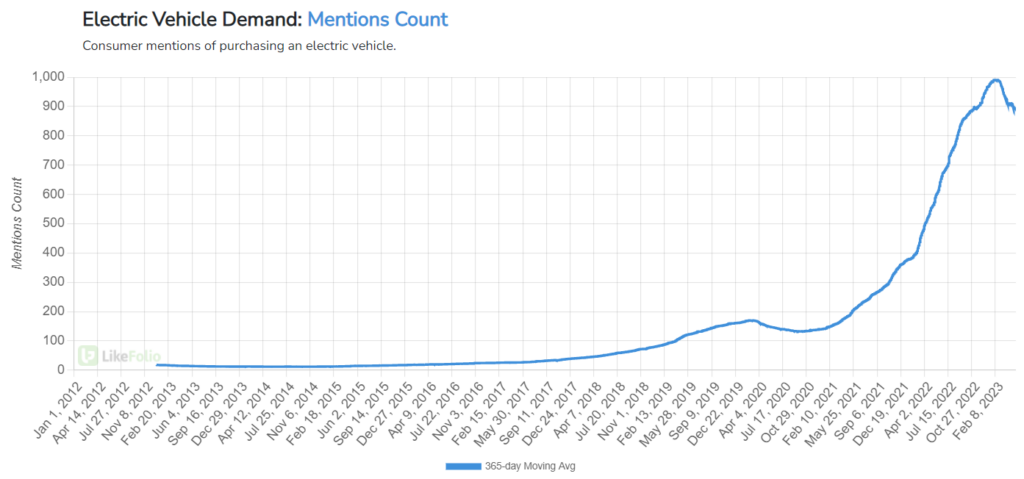

At LikeFolio, we saw the momentum building for EVs on Main Street more than five years ago. You can see the corresponding meteoric rise in demand on the chart below:

The “macro factors” – the big-picture storylines – were aligning in such a way that the EV players were going to benefit from a powerful tailwind.

Those storylines: Rising gas prices, improved performance from improved EV technology, and affordability.

Increased competition, government incentives including a $7,500 tax credit, subsidies to U.S. battery manufacturers, and falling prices of battery materials are combining to make EVs more affordable and as easy to own and drive as their gas-powered counterparts.

For example:

- General Motors (GM) will start its battery-powered Equinox crossover at around $30,000 this fall, which is only $3,400 more than the least expensive gasoline-fueled Equinox. Factor in those Washington incentives and the Equinox should be cheaper.

- Ford Motor Co. (F) cut the price of its Mustang Mach-E – the best-selling EV in America after Tesla – to make it more alluring to price-conscious shoppers.

- Tesla cut the prices of its Model 3 and Model Y by thousands of dollars in January 2023 (and even more since then), making both models more affordable and competitive with their gas-drinking rivals. A Model 3 now costs $300 less than the least-expensive BMW 3 Series sedan, while a Model Y costs about as much as a comparable Lexus RX.

Reason No. 2: “Tesla” Is a Synonym for EV

Thanks to its early dominance and continued market leadership, most consumers hear “Tesla” and think “EV.” No other carmaker can make that claim.

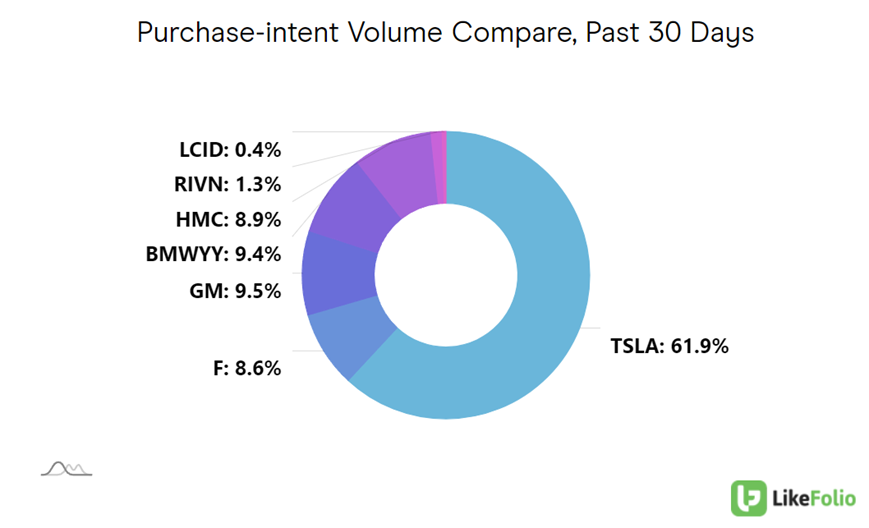

Check out the chart below, showcasing demand mention volume for TSLA compared to its EV peers over the last month:

Tesla garnered more than 60% of “I just bought a car” or “I’m going to buy a car” mentions versus its EV peers.

The EV leader still has the “it” factor in the consumer psyche.

And Tesla is outproducing its rivals on a massive scale. In the first quarter of 2023:

- Tesla produced more than 440,000 vehicles and delivered 422,000 of them, all while maintaining a gross margin of 19.3%.

- General Motors sold “more than 20,000 EVs” during that same stretch, with 19,700 of those being Bolt EV and Bolt EUV sales.

- Cadillac delivered almost a thousand Lyriq SUVs while the GMC Hummer EV was hit by production issues, halting output from last October until the end of January.

- Ford sold 10,866 battery EVs, with just under half of those sales being the F-150 Lightning pickup truck.

- Rivian (RIVN) produced 9,395 vehicles (delivering 7,946), saying it remains on track to hit its goal of 50,000 by the end of the year.

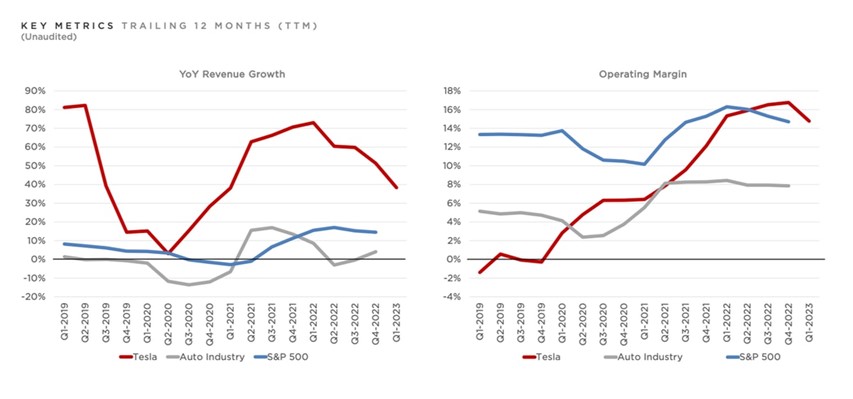

Tesla is well ahead of the auto industry at large when it comes to revenue growth and margins – even with aggressive price cuts that have crimped profit margins.

Reason No. 3: Tesla’s “Audience” Just Keeps Growing

Tesla’s recent price cuts have elicited conflicting responses.

Some analysts worry the cuts are a sign of fear (and a response to the “bullseye on its back”), driven by eroding market share and zooming competition.

But CEO Elon Musk isn’t having it.

He says the price cuts are a sign of strength – as it scales up production, it can afford to cut prices – and part of its strategy to get its cars into more garages across all its markets.

Indeed, he reiterated that view on Tesla’s most recent earnings call:

“We’ve taken a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin. However, we expect our vehicles, over time, will be able to generate significant profit through autonomy. So we do believe we’re like laying the groundwork here, and that it’s better to ship a large number of cars at a lower margin, and subsequently, harvest that margin in the future as we perfect autonomy. This is an extremely important point.”

Key Takeaways:

💡 Tesla is THE company to beat. We’re bullish.

💡 EVs aren’t going anywhere. We expect continued demand growth alongside rising gas prices and more affordable options.

💡 Near-term volatility driven by tightening economic conditions may create tantalizing entry opportunities for long-term investors.

EVs are the future of the automotive industry – and Tesla is the reigning champ.

Ford, on the other hand, can’t seem to keep up.

All the best,

Megan Brantley

VP of Research