Until Tesla’s (TSLA) Cybertruck hit the roads this year, the only real option for consumers looking to “electrify” their beloved pickup truck was Rivian (RIVN).

The California upstart’s line of luxury “adventure vehicles” includes fully electric pickups and SUVs, adorned with a distinctive oval headlight design.

Rivian makes a good-looking truck, I’ll admit. I had a blast adventuring around Colorado in one recently. (I did miss my Tesla at home, though.)

The problem is, Rivian has faced substantial difficulties in getting its EVs to consumers. Amid mounting financial troubles, Rivian was forced to halt construction on a new Georgia production factory in March.

The company has yet to return profitable margins since its IPO; revenue has declined over the past three quarters… and it’s racked up a sizable debt.

But a new $5 billion deal with Volkswagen hands Rivian a potential lifeline.

The newly announced deal includes a joint venture to develop new EV software with Rivian’s expertise and an up-to-$5-billion investment from Volkswagen that aims to bolster Rivian’s financial stability and growth prospects.

It’s a massive move that could make Rivian a formidable competitor, even against the reigning champ…

Rivian’s Newfound Competitive Edge

Rivian has been positioned as a potential competitor to Tesla since the very beginning.

Tesla commands a clear lead in the U.S. EV market, though, holding 52.1% as of the first quarter, while Rivian and Volkswagen each held a 5.1% share.

Although Tesla’s market presence is dominant, Rivian’s strategic partnership with Volkswagen aims to leverage their combined strengths. Volkswagen benefits from Rivian’s advanced EV software, while Rivian gains critical funding and support to develop new models and reduce operating costs. And that new manufacturing plant in Georgia Rivian had to put on hold? That’s included, too.

Rivian’s competitive position was rising even before this. It’s no secret Tesla struggled with the Cybertruck launch, which faced delays, recalls, and a price increase that lost its federal EV tax credit.

Conversely, Rivian’s R2 model qualifies for such tax credit, improving its market appeal.

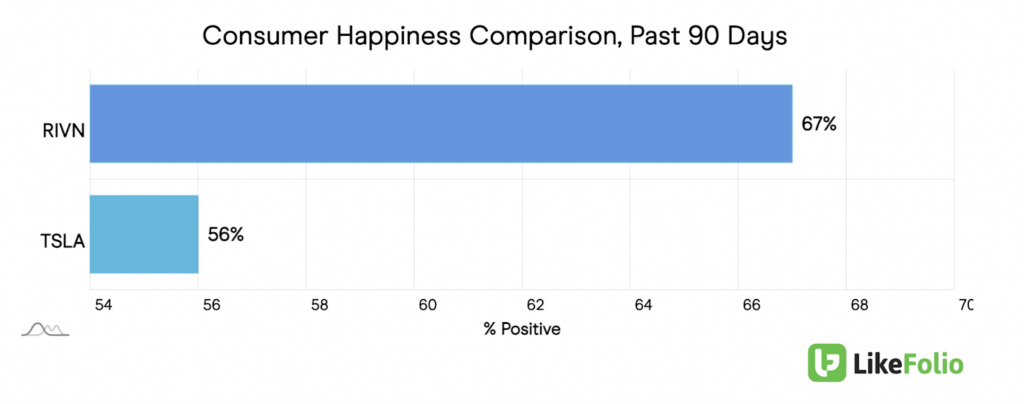

According to LikeFolio’s consumer insights, Rivian is walloping Tesla in the all-important Consumer Happiness metric, scoring 67% over TSLA’s 56% on a 90-day moving average.

This could give it a critical edge.

We still love Tesla – and it’s likely to remain the dominant player in the EV market, especially with CEO Elon Musk at the helm. The guy is brilliant, and this mind-blowing new invention is proof. (Click here to see it for yourself.)

But between this new alliance with Volkswagen and strategic cost reductions and product development, Rivian looks like a promising competitor with significant upside potential.

And we can’t help but root for the underdog.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

John Deere: The Ambitious AI Play in Your Own Backyard

This unexpected AI winner is 187 years in the making…

“Skinny Shots” Are Here to Stay: 3 Unexpected Plays

Look for next-level Ozempic plays in these unexpected places as weight-loss drugs take hold…