With travel – and cruising in particular – roaring back post-pandemic, the competition for billions of traveler dollars is on.

And 2024 is shaping up to be a blockbuster year for the cruise industry in particular.

We’ve watched as Airbnb (ABNB) has made strides to claw its way back from concerning Consumer Happiness and web mentions.

Air travel is also attempting a comeback after bad press about equipment, pricing, and delays.

But cruising – a one-size-fits-most experience that transcends generations and cuts the hassle of extensive airline travel and finding lodging – has steadily grown in popularity and profits since travel bans were lifted.

In fact, according to a report from the Cruise Lines International Association (CLIA), 2023 passenger volume increased 7% over pre-pandemic levels. Among Millennials and Gen Xers in particular who have cruised before, CLIA found that nearly 90% of them who had cruised before planned to do so again.

The industry’s comeback can be summed up in what Michelle Fee, CEO and founder of Cruise Planners, a 2,500-franchise travel agency, told the Chicago Tribune:

“It’s not pent-up demand anymore. It’s just pure demand. Cruising is back with a vengeance.”

Last quarter, all three names we track in the cruise industry reported “record-breaking” earnings with statements like these on their earnings calls:

- “We entered the year with the best booked position we have ever seen and now have nearly two-thirds of our occupancy already on the books for 2024, at considerably higher prices.” – Josh Weinstein, CEO, Carnival Cruise Lines (CCL)

- “We are determined to capitalize on our recent achievements and take advantage of the positive momentum and strong demand for cruise, which resulted in turning the year at all-time highs in both our booked position and pricing.” – Harry Sommer, CEO, Norwegian Cruise Line (NCLH)

- “Demand for our brands continues to outpace broader travel as a result of consumer spend further shifting toward experiences…” – Jason Liberty, CEO, Royal Caribbean Group (RCL)

Bigger Ships, Bigger Profits

But there’s one name that’s clearly sailing past its competitors: Royal Caribbean.

Royal Caribbean differentiates itself with its unique and adventurous onboard activities, including ice skating, rock climbing, and surfing simulators, which offer an exciting and diverse cruise experience.

It kicked off 2024 with the launch of Icon of the Seas, the largest cruise ship to ever hit the water. Take a look:

Royal Caribbean's Icon of the Seas.

— Massimo (@Rainmaker1973) May 12, 2024

At 248,663 gross tonnage (GT), it is the largest cruise ship in the world. The vessel has a max carrying capacity of 7,600 guests and 2,350 crew.

[📹 thecruisespotter]pic.twitter.com/9JKiXfA4Jk

The gargantuan vessel has 18 decks accessible to its 7,600 potential guests (and another two for a couple thousand crew members), with eight distinct “neighborhoods” on the ship.

Another Oasis-class ship (those are RCL’s really big ones), Utopia of the Sea, will set sail in July.

But ships aren’t the biggest thing RCL has going for it.

We’ve been watching RCL, the clear leader in the cruise game, even before we gave readers a heads up back in March to keep an eye on the catalysts affecting its stock price.

Follow the Leaders

And aside from its strategic pricing (lower than its two nearest competitors) and focus on bigger, better ships, Royal Caribbean’s leadership team has proven to be the savviest.

Royal Caribbean effectively managed its finances during the pandemic, particularly by minimizing equity issuance. This strategy preserved its share price and enabled a faster return to pre-pandemic levels.

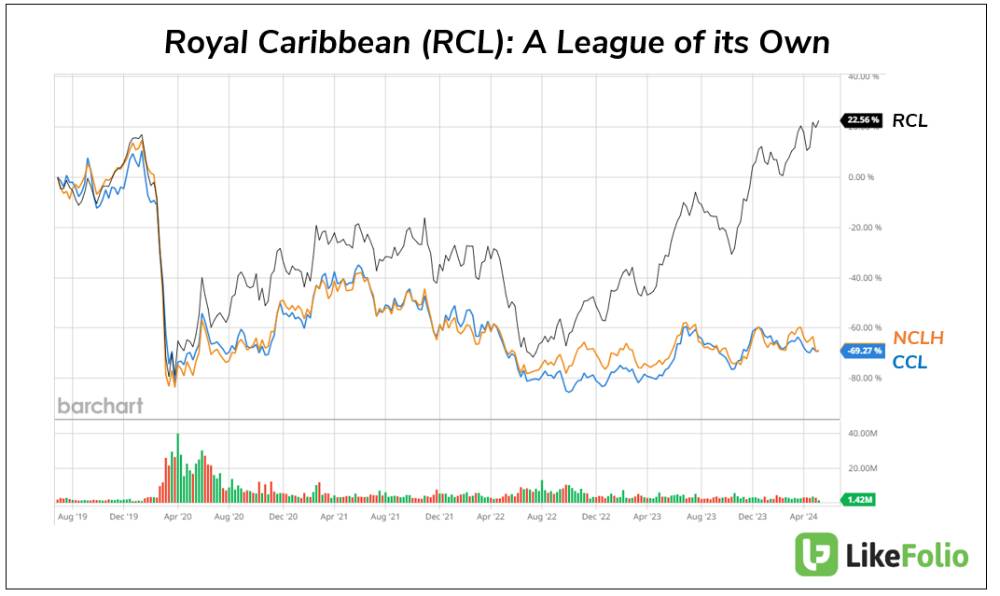

Consequently, Royal Caribbean saw the highest ticket revenue increase among its peers and its share price has exceeded pre-pandemic highs, while competitors like Carnival and Norwegian are still trading more than 70% below their 2019 levels.

Looking ahead, RCL appears to be… well, cruising.

The company is in the news after a robust hiring spree, with plans to add 10,000 new employees this year to its 100,000 strong workforce to staff ships and private destinations.

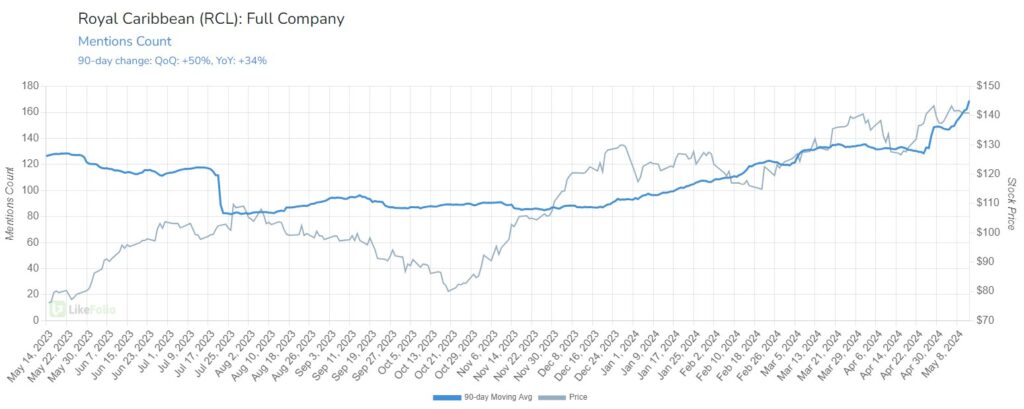

LikeFolio metrics confirm robust demand. Consumer mentions of cruising with Royal Caribbean are heading higher, up 34% year over year:

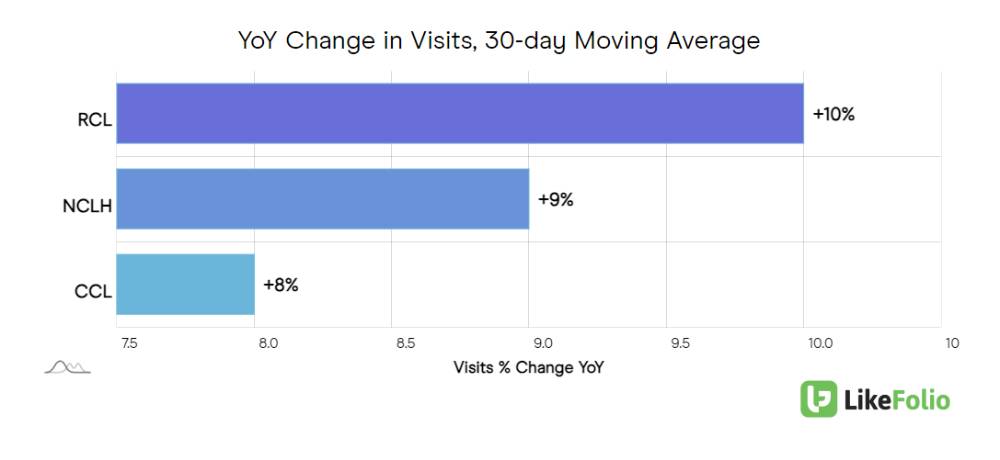

Web visits, indicative of future bookings, continue to climb even after peak “wave season.” Wave season is a period from January to March when travelers are most likely to pull the trigger on solidifying summer vacation plans.

The cruise industry at large has benefitted big time from pent-up demand, and it doesn’t look like the spring is fully uncoiled yet.

We expect continued momentum for cruise lines and overperformance from RCL but do note this stock has already caught up to where it was in 2019 and then some.

The Next Cruise Stock to Pop?

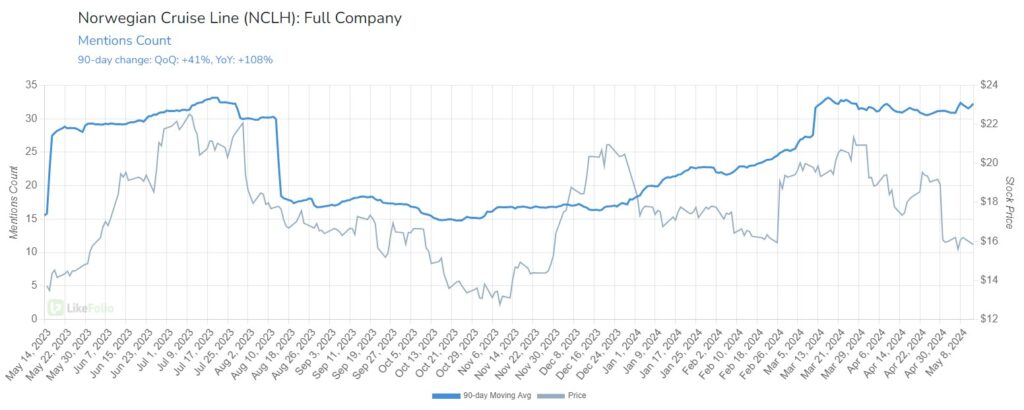

Investors looking for divergence plays may find one in NCL in particular, whose mention volume is up by triple digits year over year while its stock trades ~11% lower YTD.

This growing gap between stock price and mention volume will likely narrow, suggesting the stock could eventually follow mentions higher.

We’ll be keeping an eye on the cruise industry – especially these three heavy hitters – and members will be the first to know if the data sinks or swims.

Stock Chatter Alert: Meme Stocks Are Back in Play 🚀

LikeFolio doesn’t just monitor social media for companies and brands – we’re also tracking stock tickers to spot unusual mention volume. This is a highly effective way of finding the big meme stock plays or other opportunities before they materialize.

Roaring Kitty, the man who pushed the 2021 meme-stock run, and who’s been silent since, just posted for the first time, driving huge swings and interest in the 2021 meme stock list. Especially these:

- BB (BlackBerry)

- AMC (AMC Entertainment Holdings)

- GME (GameStop), which is getting by far the most mentions. This is the one to watch.

We’re also picking up unusual mention volume from:

- NVAX (Novavax) as its earnings run continues…

- HOOD (Robinhood Markets) after last week’s earnings blowout…

- RDDT (Reddit), which is up 50%+ from post-IPO lows…

- And NVDA (Nvidia), which hit a wall just over $900. Can it break through and retest $1,000?

We love uncovering opportunities like these in individual stocks – it’s what our real-time social media insights do best. But look, if you ever find yourself worried about whether you missed out on NVDA or you’re not sure which AI stock to buy next, check out what just came across my desk.

It’s another way to invest in AI that yields consistent retirement-boosting payouts – and it could be just what you’re looking for.

Until next time,

Andy Swan

Founder, LikeFolio

Up Next: Ever Wondered Why the House Always Wins? 🎲

Or how Las Vegas casinos make consistent profits from the games they run?

It’s down to having a quantitative system that puts the odds in their favor.

Remember how we showed you that casinos make billions on blackjack with a 51.5% win rate – while our Coin Flip earnings trades hit around 54%? Over the long term, you can rack up serious cash with a system like that.

Veteran trader Jonathan Rose has a “house edge” of his own that allowed him to become financially free at the age of 35. And to this day, he’s using it to rack up trading gains as high as 650% in three days… 1,046% in 27 days… and 1,900% in four days.

He recently lifted the lid on this system to show everyday folks like you how you can use it to take your own wealth-building journey to a new level at his Masters in Trading Summit.

More than 5,000 people tuned in. And it aired twice to accommodate demand. But don’t worry if you missed it. You can still catch the replay here – but not for long. The replay is being taken offline tomorrow.

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Biden’s War on Elon, Bitcoin’s Path to $100k, and Our Next Big Opportunity

In this new Q&A, you’ll get answers to your most pressing questions and find out what comes next…

Why MicroStrategy Is the Ultimate Leveraged Bitcoin Bet

This could be the purest Bitcoin play outside of the currency itself…