What does Shopify (SHOP) have in common with American Express (AXP) and SoFi Technologies (SOFI)?

At LikeFolio, we categorize these companies together not based on industry similarities but for their shared ability to excel in their respective fields.

Each has honed a fine-tuned focus, becoming masters of their respective trades rather than jacks of all trades. This approach has resonated well with consumers, propelling each company to the forefront of its sector with remarkable success.

Shopify’s recent strides in the e-commerce space exemplify this ethos, demonstrating how specialized focus and a relentless pursuit of innovation can drive superior consumer experiences and robust company growth.

Today’s earnings results proved it.

For the fourth quarter, Shopify reported 24% year-over-year revenue growth to $2.14 billion, driven by impressive holiday sales demand, along with adjusted earnings per share of 34 cents. Wall Street was expecting $2.08 billion in revenue and 31 cents per share.

Shopify trounced those expectations.

Shopify shares, however, took a 12% beating.

Whether it was because Wall Street wanted more from this stock…

Or because the timing coincided with today’s hotter-than-expected Consumer Price Index (CPI) report…

Or a combination of both…

We’re not worried.

Because LikeFolio data cuts through the noise.

Here’s why Shopify not only deserves its coveted position among the LikeFolio elite – but why this sell-off could be an opportunity in disguise…

Accelerating Main Street Momentum

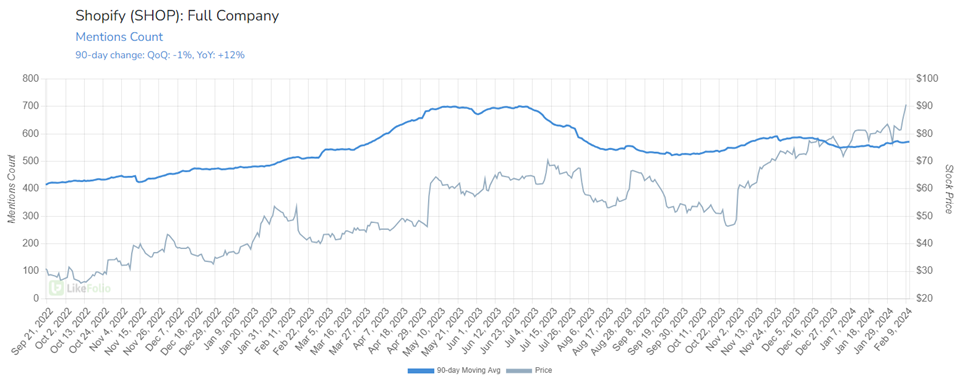

Shopify mentions have seen a remarkable acceleration, with a 12% year-over-year increase on a 90-day moving average and an even more impressive 21% rise on a 30-day moving average following a strong holiday season.

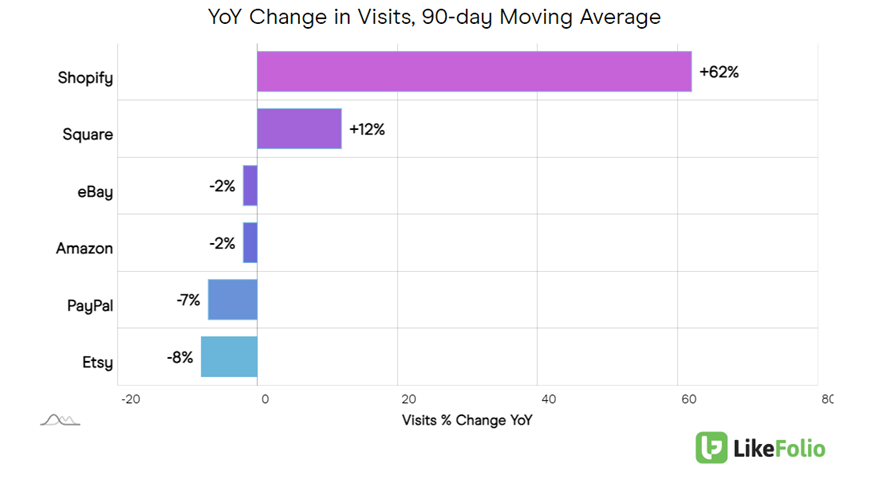

And when it comes to website traffic, Shopify is handily outperforming its peers, including major e-commerce platforms like eBay (EBAY), Etsy (ETSY), and Amazon.com (AMZN), as well as digital wallet services like Block (SQ) and PayPal (PYPL).

Shopify web visits have gained 62% year over year; the closest competitor in this metric, Block (formerly Square), trails with a 12% uptick, while the rest experience declines.

And I haven’t even gotten to the best part yet.

Bucking the Trend

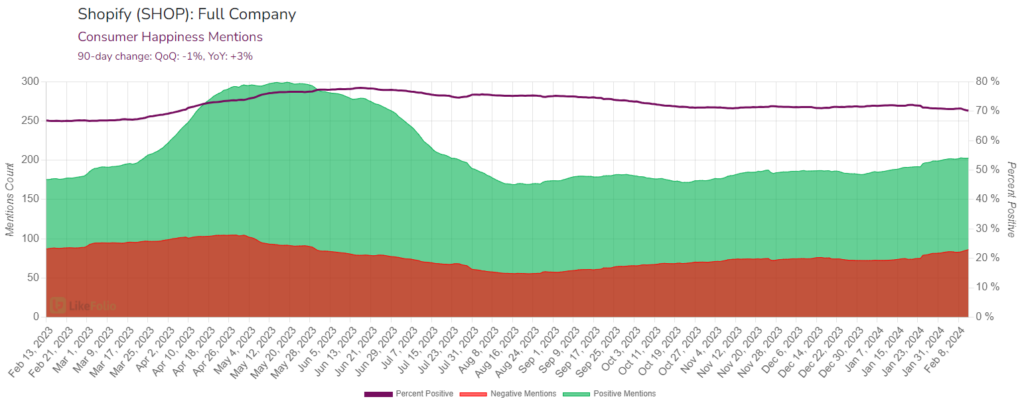

In the decade we’ve been tracking consumer sentiment, we’ve learned that the more a company or brand gains exposure on social media, the more negative mentions they tend to attract.

In LikeFolio-speak, that translates to a common pattern: Higher Mention Volume = Lower Consumer Happiness.

But amazingly, Shopify bucks this trend.

As SHOP mention volume has ticked higher over the last year, we’ve logged a notable improvement in Consumer Happiness, gaining 3% year over year to 71% positive.

Positive consumer sentiment is closely linked with brand loyalty and spending.

So this is a strong indicator for Shopify’s future growth.

Cost Control and Strategic Partnerships Pay Off

In 2023, Shopify made significant strides in controlling its operational costs, including reducing its workforce by 20% last May and divesting its logistics services to supply chain software startup Flexport.

These measures not only streamlined operations but also sharpened Shopify’s focus on its core competencies: connecting consumers directly with brands and facilitating seamless transactions.

The company rolled out a suite of AI-powered features last year with Magic and Sidekick, giving it a clear runway in the “second wave” of AI investing.

A landmark partnership that integrates Shopify storefronts with Amazon logistics through Buy with Prime further exemplifies Shopify’s strategic approach to leveraging synergies within the e-commerce ecosystem.

The Bottom Line

For investors, Shopify’s trajectory and strategic initiatives offer a win-win scenario.

The company’s ability to adapt to market demands, coupled with its innovative partnerships, position it well for sustained growth.

Our SHOP Bullish Alert from April 2022 has already delivered a 108% profit to LikeFolio Investor subscribers – but if you didn’t get in back then, this sell-off could be your opportunity.

As Shopify navigates the complexities of the digital marketplace, its commitment to delivering superior consumer experiences and facilitating direct connections between consumers and brands is likely to keep it in the limelight, promising a bright future.

Shopify investors have a lot to look forward to – especially those subscribers who got in early.

And we just banked another 101% opportunity in LikeFolio Investor earlier this week.

Our real-time trade alerts take the guesswork out of investing so you’ll know what stocks to buy and when, plus get notified as soon as it’s time to take profits.

Here’s how you can get the next double-your-money winner delivered straight to your inbox.

Until next time,

Andy Swan

Founder, LikeFolio

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

Welcome to the Great Live Sports Shakeup of 2024

A major shift in the sports broadcasting landscape is underway with massive implications for consumers and investors alike…

The Sectors (and Stocks) at Risk This Tax Refund Season

Tax refunds are usually a boon for these sectors. But this year, they could be in trouble. Here’s what we’re watching…