Reduced to a meme stock in January 2021 that just declared bankruptcy on April 23, Bed Bath & Beyond (BBBY) serves as an invaluable investing lesson – stay ahead of trends.

There were a lot of things the company did wrong but one of its critical mistakes was being slow to embrace online shopping.

Before climbing his way up the corporate ladder to become Bed Bath & Beyond’s CEO in 2003, Steven Temares joined the company in 1992 as Director of Real Estate and General Counsel. Before that, he’d earned a graduate degree from the University of Pennsylvania Law School in 1983.

One private banking analyst described him as an “old-school retail merchant” whose business mantra could be summarized as “stack it high and let it fly.”

That model was fine in the late 1990s and early 2000s, as walking through a store packed to the brim with home accessories offered a nice indulgence-induced buzz.

But online shopping started changing consumer shopping habits; it cut down the purchasing experience from hours to minutes.

No more driving to a store, circling around for a parking space, searching for where something is located, standing in line to check out, having the cashier pressure you into signing up for a new credit card to earn rewards, and maybe having to stop and fill your gas tank up on the ride back to your house.

With online shopping, all it took was a couple of mouse clicks from the comfort of your own home, and voila – errands are done.

The shift to online shopping was particularly challenging for Bed Bath & Beyond as an “it will be nice when I get it” retailer rather than an “I have to have this immediately” retailer.

You can get by for a few days without decorative throw pillows, cabinet organizers, doormats, juicers, and towel warmers – just order those items online and wait for them to arrive.

The company could’ve worked alongside the shift in consumer habits. Instead, it chose to double down on its retail presence, boasting at one point over 1,500 locations in North America.

That refusal to adapt to consumer trends finally caught up with Bed Bath & Beyond around 2015, as the stock price plummeted over 83% from February 2015 to December 2018:

Facing pressure from activist investors, Temares stepped down in May 2019, and former Target (TGT) executive Mark Tritton was brought in to turn things around.

Tritton tried redesigning the stores, along with a few other initiatives…

But with supply chain disruptions due to COVID-19 bringing even more chaos into the fold, it was ultimately too little too late.

“If Bed Bath & Beyond was going to survive, they needed to do something probably 10 years ago, to put themselves on a new trajectory toward a new model that would give consumers a sense of unique value. But they didn’t,” retail industry Doug Stephens said in a report from Modern Retail.

Here’s the lesson investors can learn from BBBY’s spectacular failure…

Forward-Looking Trends & Real-Time Data Are Your Investing Edge

Because of the lack of forward-thinking planning, Bed Bath & Beyond expects to close its remaining 360 namesake stores along with 120 of its buybuy Baby stores.

Upwards of 40,000 people could soon be without jobs through no fault of their own.

And any investor who has been holding onto the stock since 2015 will have practically lost everything, with the BBBY shares opening at a meager 18 cents yesterday (April 25).

The Bed Bath & Beyond tragedy proves the power of trends – and highlights why LikeFolio’s consumer insights are such an important tool to have in your investing toolkit… So you can keep your portfolio safe from ticking time bombs like BBBY.

From our proprietary data, we can see that Bed Bath & Beyond may not be the last retailer to get in trouble because of having too many brick-and-mortar locations.

Just take a look at how consumer trends like in-store and mall shopping are falling off:

Mentions of shopping at a mall are down 16% year-over-year while mentions of shopping in a store are down 2% over the same period.

This trend could get even uglier for retailers as the odds of a recession increase.

But the thing about investing is that there is always a way to make money if you know where to look, especially when you have our data in your corner.

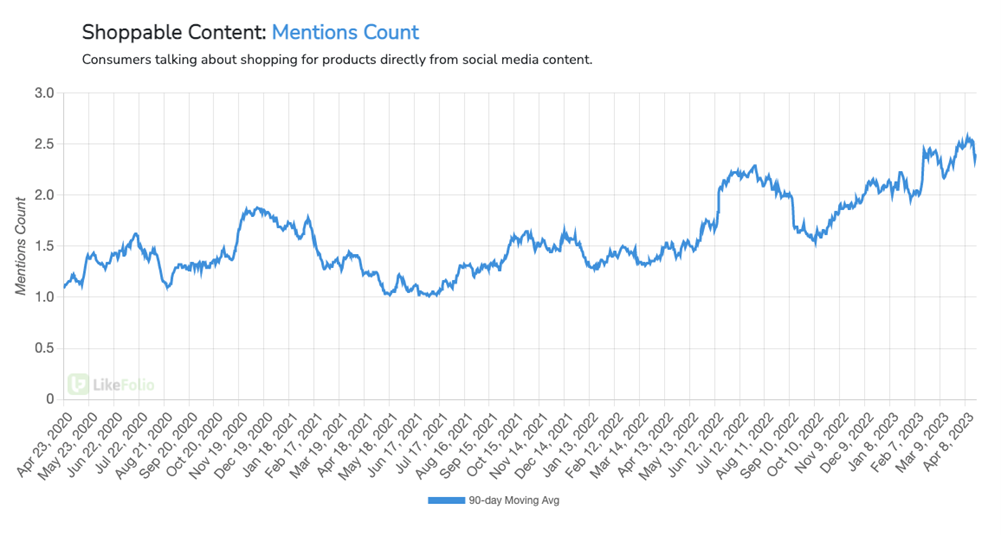

In the retail sector, shoppable content is trending through the roof, where consumers are talking about shopping for products directly from social media content:

On a quarter-over-quarter basis, shoppable content mentions are up 18%; and on a yearly basis, they’re up an eye-popping 71%.

One company, in particular, has become really great with seamlessly connecting its users with relevant ads that don’t even seem like marketing ploys.

People are flocking to this site for art, recipes, fashion, and home décor, and the users are then able to take things one step further, as the company aggregates shoppable items of interest connected to their searches.

Everything you need to know about this company is available in the free April 22 issue of Derby City Daily.

Until next time,

Andy Swan

Co-Founder