For many of us, Labor Day weekend was a final chance to fire up the grill, hit the pool before it closes for the season, snag those end-of-summer deals, or get one more long rest before the school year starts in earnest.

The fan of “taking it easy” inside me is sad to see it end… but the investor is excited about what comes next.

The truth is that Labor Day weekend actually serves as a major moneymaking catalyst with the power to shape consumer behavior and preferences for the rest of the year.

Whether it’s creating long-term customers through promotions, setting fashion trends, influencing travel plans, affecting food choices, or driving tech adoption…

The “Labor Day Effect” is very real.

And for savvy investors and businesses who understand this, the opportunities are endless.

Let me show you what I mean…

The Power of Promotions

Let’s start with the obvious: Labor Day sales.

Retailers like Walmart (WMT) and Target (TGT) go all out with discounts, luring customers into their stores and onto their websites to discover back-to-school deals and end-of-summer steals.

But here’s the kicker: These aren’t just one-off sales.

They’re an opportunity for companies to hook new customers just in time for the all-out spending rush of the holiday season.

Data shows that customers acquired during Labor Day promotions are more likely to become repeat buyers. The weekend serves as an entry point, hooking consumers on brands they might not have considered otherwise.

And once a consumer has made that all-important first purchase, their chances of selling to that consumer again are as high as 60 to 70%.

Setting the Trend for Fall Fashion

Labor Day weekend is a fashion watershed moment.

Brands like Lululemon (LULU) and Ralph Lauren (RL) release their fall collections, and consumers are eager to swap their summer attire for autumn’s latest trends.

The choices made during this weekend often set the tone for the entire season, influencing not just individual wardrobes but also broader fashion trends.

And after summer blockbuster “Barbie” helped reignite its iconic preppy look, Ralph Lauren is at the top of our fall investing watchlist.

The Vacation Effect

Travel platforms like Expedia (EXPE) and Airbnb (ABNB) tend to see a surge in bookings over the Labor Day weekend.

But it’s not just about the immediate revenue. The experiences people have during these getaways often shape their future travel plans.

A weekend in a cozy mountain cabin could lead to a ski trip in December, while a beachside retreat might inspire a tropical vacation come winter.

On the flip side, if bookings are lower than Labor Day weekends of the past – well, these companies could have a tough hill to climb over the next quarter or two.

Food for Thought

Labor Day BBQs and social gatherings have a more lasting impact than you might think.

Brands like Weber (WEBR) and Beyond Meat (BYND) use this opportunity to showcase their products, often leading to increased sales throughout the year.

The food and drinks enjoyed over the weekend can also influence consumer preferences, affecting grocery shopping habits and restaurant choices for months to come.

Tech Adoption Rates

Finally, let’s talk tech.

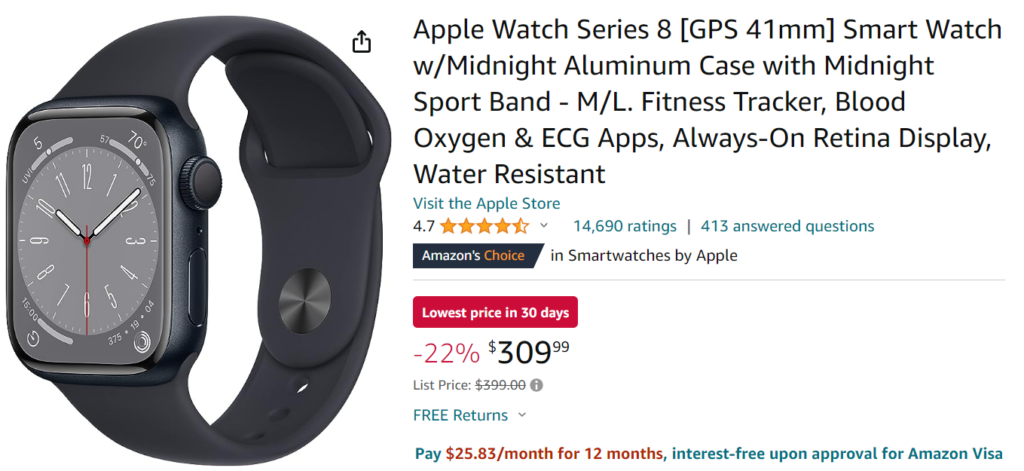

Labor Day sales often feature discounts on gadgets and appliances with companies like Apple (AAPL) using this weekend to clear out inventory before launching new products.

But these aren’t just quick sales; they’re opportunities for lifetime tech adoption.

That discounted smart home device or tablet can serve as a gateway to a whole ecosystem of products, locking consumers into a brand for the long haul.

For a company like Apple with industry-leading brand loyalty (92% of its customers make repeat purchases), a 22% Labor Day deal on an Apple Watch can get new customers in the door and keep them purchasing for life.

Bottom Line

Labor Day weekend is more than just a brief respite from work or a chance to snag a deal; it’s a pivotal moment that shapes consumer behavior for the rest of the year. We’ll be watching our Labor Day data closely to identify any standout winners in this consumer behavior shift.

It helped us identify several big winners for our MegaTrends subscribers last fall, with buy alerts triggering 37% profits on Lululemon, 70% on On Holding (ONON), and 58% on Booking Holdings (BKNG), just to name a few.

Now, the same system that spotted those breakouts before they happened has targeted five fresh MegaTrends opportunities in the high-octane AI sector with truly mega moneymaking potential.

We’re talking 1,000% growth potential or more on the horizon for each of these stocks, four of which were trading for under $3 per share as of today.

Landon has the full story for you here.

Until next time,

Andy Swan

Founder, LikeFolio

Trending Now: More Buzz-Worthy Stocks from Derby City Daily

How a Healthy Energy Drink Led to a 327% Profit Opportunity

This stock keeps bubbling to new highs – setting a new standard in the LikeFolio universe… Full story.

Record $41.5 Billion Back-to-School Spending Is a Goldmine for This One Stock

Here’s how to capitalize on the most robust back-to-school spending year ever… Check it out.

Less Than a Foot Tall but Worth $100 Million This Weekend

Find out how one classic toy became a cash cow – with a stock-price booster to match… Details here.