During the early 2000s recession, then-Estee Lauder Chairman Leonard Lauder famously discovered a contrarian trend that he coined “The Lipstick Index.”

He found that lipstick sales actually rose during that time – indicating that women facing economic uncertainty were turning to beauty products as an affordable luxury.

As economic conditions worsen, beauty product sales got better.

This theory rang true once again in late 2007 and into 2008 when the Great Recession began and nail polish sales took off.

In fact, earlier iterations of “The Lipstick Index” can be traced all the way back to the 1930s, when cosmetic sales rose during the Great Depression, even as industrial production was cut in half.

The theory is that when consumers can’t splurge large amounts on vacations, new cars, or high-end clothes… a tube of a new lipstick or a bottle of perfume can substitute in as a more affordable luxury.

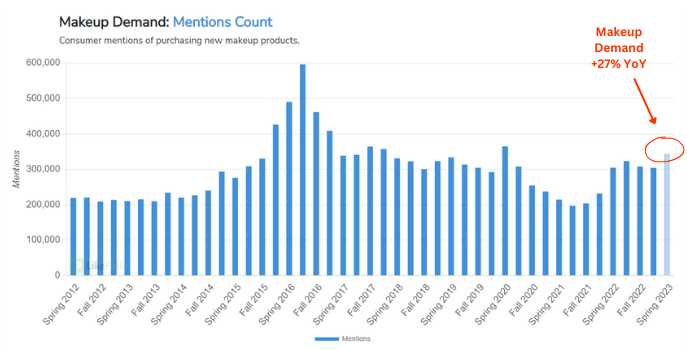

Now, facing economic uncertainty once again, LikeFolio data is adding more evidence to “The Lipstick Index” with consumer mentions of purchasing new makeup products pacing 27% higher for the Spring of 2023:

There are two main competitors in the beauty retail space that have us excited about this uptick: Ulta (ULTA) and Sephora, which is owned by LVMH (the parent company of Louis Vuitton).

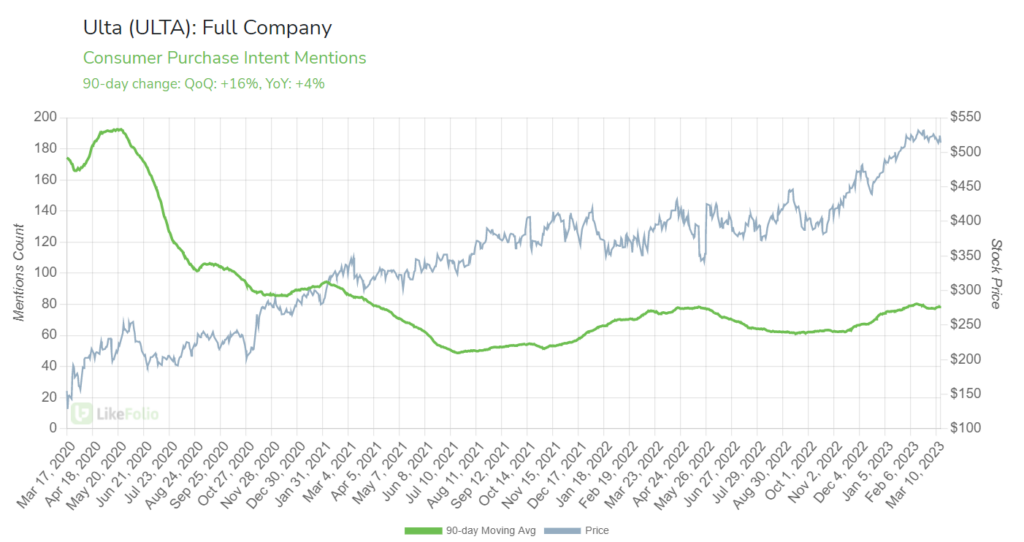

This seasonal surge is right in line with Ulta’s 21 Days of Beauty campaign, a highly-anticipated annual event where customers get 50% off products both in-store and online…

Which begs the question: Is Ulta doing a better job than Sephora capitalizing on strong beauty product demand?

Let’s just say we were surprised when analyzing the data…

Beauty Faceoff: Sephora v. Ulta

Ulta’s 21 Days of Beauty campaign is clearly garnering buzz online – ULTA mentions are up 7% this quarter alone while Purchase Intent (PI) Mentions, measuring real consumer purchases, are up 16% during the same period:

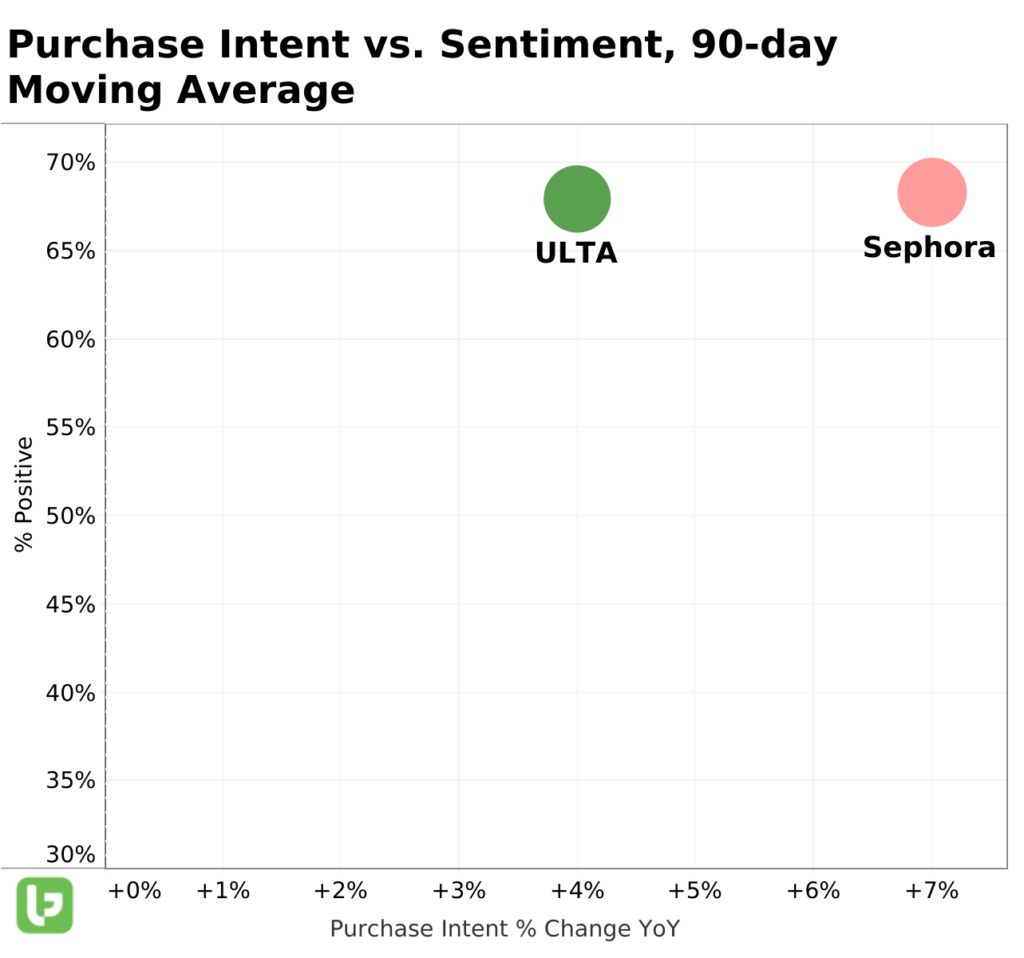

Sephora mentions are pacing higher too, though – increasing 9% quarter-over-quarter (QoQ) as consumers reach for more cosmetics.

And both retailers have comparably high levels of Consumer Happiness: 66% for Sephora and 67% for Ulta.

That’s why we took this beauty faceoff to the Outlier Grid: the most powerful tool in our investing arsenal for sorting the winners from the losers.

(You can learn more about how the Outlier Grid works right here, but the key is that the most bullish opportunities show up in the upper-right quadrant – where demand growth and happiness levels are the highest.)

Our Outlier Grid reveals that Sephora is experiencing more demand growth than Ulta right now, a critical metric to monitor because this translates to consumers actually making purchases:

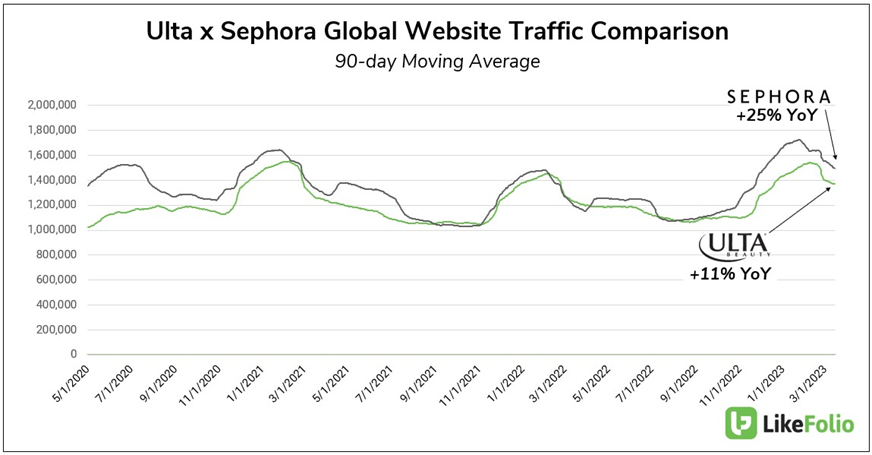

And a closer look into e-commerce data tells a similar story:

Not only is Sephora recording higher online traffic (and potential online transactions), but that traffic is growing at a faster clip too – increasing 25% YoY compared to Ulta at 11% YoY.

And the gap is widening…

High-End Wins Another Round

On the surface, these beauty retailers offer the same products: It’s the average ticket size that differentiates them.

- Sephora specializes in cosmetic and beauty products considered to be high-end or luxury, aka “prestige.” The brand is owned by Louis Vuitton (LVMH), after all.

- Ulta carries some prestige products but also caters to consumers looking to save by offering drugstore-level options.

To put this in perspective, a tube of lipstick will cost you $15 at Ulta (on average). At Sephora, it’ll set you back $27.

In fact, across the board, makeup at Sephora is 65% more expensive than at Ulta.

So, for high-end luxury, Sephora wins the battle.

But both beauty retailers are still winners at the end of the day with “The Lipstick Index” in full effect. And while you can’t invest directly in Sephora (you could invest indirectly through LVMH)…

You can pick up ULTA shares on a publicly-traded exchange.

Until next time,

Andy Swan

Co-Founder