Last week, Walmart (WMT) proved it knows what consumers really want.

The retailer delivered $169 billion in quarterly revenue propelled by a wider-than-typical demographic of shoppers finding value in its services. The market ate it up.

We can learn a few things from the retail giant – and use those lessons to make money over the next few weeks of earnings season…

Consumers Really Want Four Things

On Thursday’s earnings call, Walmart hit the nail on the head:

“Around the world, our customers and members continue to want four things. They want value; they want a broad assortment of items and services; they want a convenient and enjoyable experience buying them; and they want to do business with a company they trust.”

As every dollar is increasingly stretched, even high-income households are open to trading down to accomplish these four goals.

- Value

- Variety

- Convenience

- Trust

And Walmart isn’t the only company set to benefit.

Here are three other names on our watchlist that check all of those boxes…

3 Stocks Consumers Love

No. 1: Casey’s General Stores (CASY)

Casey’s General Stores (CASY) offers a warm, small-town feel with a focus on convenience, known for its made-from-scratch pizza, friendly service, and quick access to essentials. Popular across the Midwest, it’s a go-to spot for locals seeking a reliable, welcoming place to fuel up, grab a bite, and pick up everyday items.

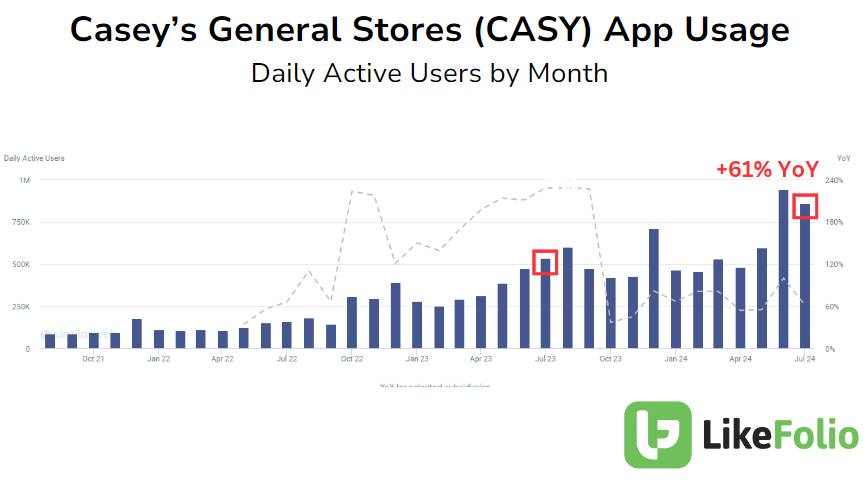

LikeFolio picked up a surge in Casey’s app usage this summer, with daily active users growing more than 60% year over year in July alone.

Key Takeaway: CASY has significant room for expansion. If the Midwest King can bring its empire (really good pizza, apparently) to other regions, its stock has plenty of room for upside.

Next Earnings Release: Thursday, September 5

No. 2: Chewy (CHWY)

Chewy (CHWY) is an e-commerce pet supply go-to – and a beloved one at that – offering convenience and a unique customer experience. The company has earned high consumer trust with its exceptional customer support, often going above and beyond with gestures like sending pet birthday cards. Chewy’s auto-ship program also fosters strong customer loyalty, making it a top choice for pet owners who value the ease of shopping online and personalized care.

After struggling to sustain high growth levels from a pandemic boom, it looks like Chewy is back in action. Web visits have now pushed higher for five consecutive months, aided by the expansion of affordable health services for man’s best friend(s).

Key Takeaway: It looks like Chewy is winning back some customers who may have missed its convenience and superior service.

Next Earnings Release: Wednesday, August 28

No. 3: Ulta Beauty (ULTA)

Ulta Beauty (ULTA) is a one-stop beauty destination, offering both drugstore and prestige brands that cater to customers across all income ranges. With its wide selection and welcoming atmosphere, it’s a favorite spot for everyone from budget-conscious shoppers to luxury beauty enthusiasts.

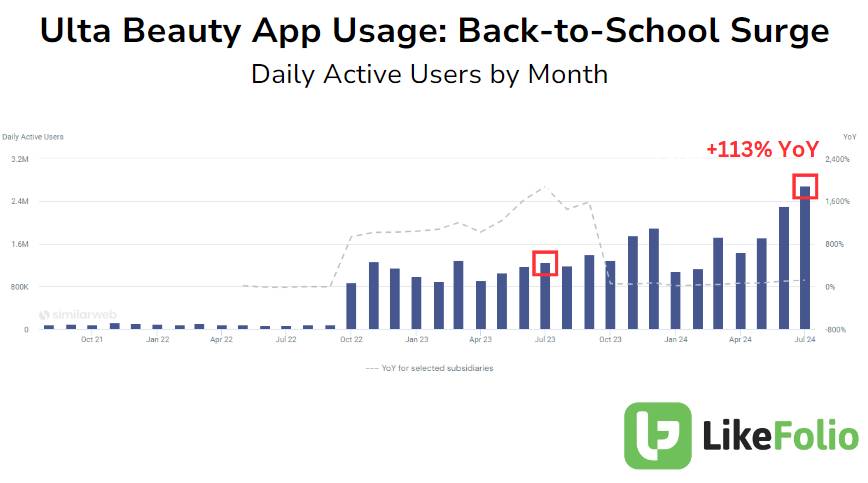

Ulta Beauty app usage hit all-time high levels the last week of July as back-to-school shoppers clamored for beauty items that fit their budgets.

(It’s no wonder Warren Buffett wanted this name in his portfolio.)

Key Takeaway: ULTA shares are still trading lower than they were this time last year. And data suggests it’s about to post a nice quarter. No FOMO to be had, it’s not too late for a play to the upside on strong guidance when it reports earnings in a few weeks.

Next Earnings Release: Thursday, August 29

How You Can Play CASY, ULTA, and CHWY Along with Us

When you trade earnings alongside Landon and me, you can make the double and triple-digit gains investors are lucky to make in a couple years in five days or less. And you have the chance to do that nearly 600 times over the course of a year.

In the past five weeks alone, Earnings Season Pass members have had a shot at gains like:

- 113% on United Airlines (UAL) in 3 days

- 115% on Whirlpool (WHR) in 4 days

- 39% on Wix.com (WIX) in 11 days

- 104% on On Holding (ONON) in 4 days (that was last week’s top pick)

Earnings trading is incredibly lucrative. (Check out our track record here.) It’s also just plain fun.

Current members can look forward to exclusive earnings predictions and trade recommendations for CASY, ULTA, and CHWY in their Earnings Scorecards over the next few weeks (CASY in Week 8 and ULTA and Chewy in Week 7).

If you’re not yet a member, now is a perfect time to get started.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

How Walmart Achieves $169 Billion in Sales in a Single Quarter

This retailer is undergoing a full-fledged brand renaissance. What’s next?

Massive Executive Shakeup: Where SBUX and CMG Go from Here

The surprising CEO move gives Starbucks a much-needed lifeline. Here’s what we’re watching…