“Bitcoin is property rights… It’s technology to deliver property rights to eight billion people for the first time in the history of the human race and that’s life, liberty, and property.”

– Michael Saylor, 2021

When Michael Saylor famously declared Bitcoin (BTC) “the apex property of the human race” in 2021, the world wasn’t ready.

The media was calling Bitcoin “a Ponzi scheme…” “a delusion…” “worthless…” “a scam…” and worse.

But Saylor was a man with a vision. Under his leadership, MicroStrategy (MSTR) went on to accumulate the most Bitcoin of any corporation or country in the world.

His bold Bitcoin bet is now worth an astonishing $25.8 billion.

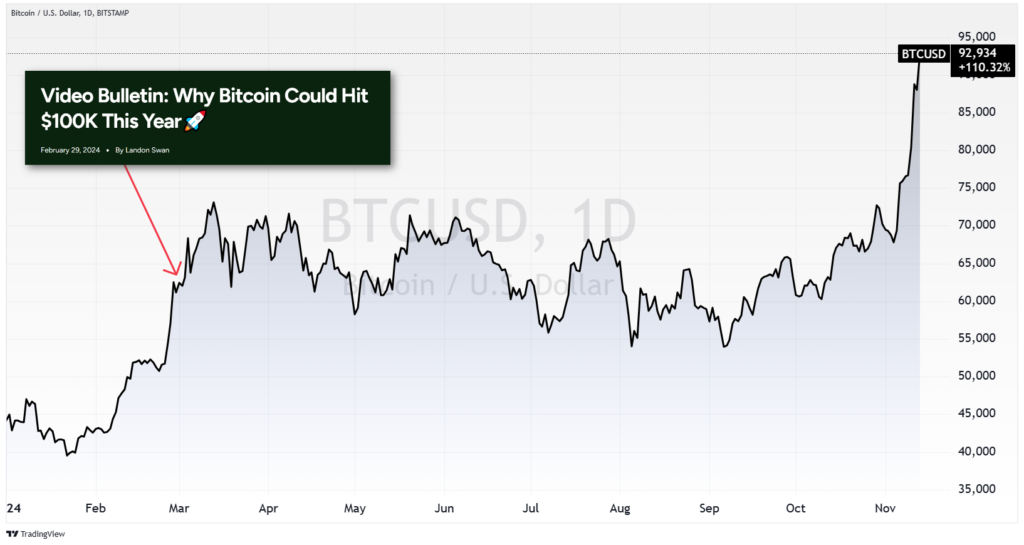

When LikeFolio predicted Bitcoin could hit $100,000 in 2024 earlier this year, the naysayers piled into our inbox, claiming it could never happen.

Bitcoin is now as close to $100k as it’s ever been, racing to all-time highs near $93,000 as I write this.

With a monumental rally underway and a penchant for calling Bitcoin’s next moves, we’re thrilled to see the flood of messages coming in from LikeFolio followers:

- Is it time to take profits?

- Can it go higher in 2025?

- Is it too late to buy?

If you’re reading this now, I’ll bet you’re wondering the same, so I’ll answer those questions (and more) for you in today’s issue.

That way, you can have the information you need to make the best of the historic opportunity in front of you…

Bitcoin Q&A: Risk, Reward, and the Rally of a Lifetime

Question No. 1: You’ve been bullish on Bitcoin for a long time… does the recent run to $90,000 and beyond make you think about “taking some off the table”?

That’s a question I get a lot. The answer is easy: Absolutely not.

This move is CONFIRMING our thesis that Bitcoin is THE digital and decentralized store of value of the future. Besides, what would I receive for selling Bitcoin? Dollars?

Question No. 2: LikeFolio drew skepticism (even just a couple months ago) for Landon’s bold prediction that Bitcoin could reach $100k in 2024. What’s your 2025 price target for Bitcoin?

We haven’t established one yet. It’s too early. We could be anywhere from $60,000 to $160,000 at the end of 2024. That said, I see no reason why 2025 would be a worse year for Bitcoin than 2024.

FOMO (aka fear of missing out) is starting to kick in – people want to know if they’ve already missed the boat on Bitcoin… what would you tell them?

I tell them that if you’re thinking about “timing” Bitcoin, you don’t understand Bitcoin. Volatility will be high, and that’s a GOOD thing. Volatility is vitality.

On a 10-day or 10-month timeframe, I don’t know when the best entry will be. On a 10-year timeframe, I believe that “right now” is always the best answer.

Question No. 3: Does that mean you think Bitcoin can go substantially higher than $100k over the long haul?

I think people will look back on buying Bitcoin below $100k the way we look in awe at the guy that bought Miami beachfront property for $1,000 per acre.

Question No. 4: What are the key drivers of Bitcoin’s appreciation so far, and what will be the drivers in 2025 and beyond?

First and foremost is the debt and money-printing of governments around the world. That’s the foundational driver of demand for Bitcoin as a store of value with limited supply.

The secondary driver that is acting like an accelerating flywheel on top of that foundation is the recognition and embrace of Bitcoin as a store of value (digital gold) by institutions.

The exchange-traded funds (ETFs) were just a spark… the flame comes from S&P 500 companies adding Bitcoin to their balance sheet, and the explosion comes from sovereign nations adding Bitcoin to their reserves.

A race to acquire Bitcoin has begun, and the largest players in the history of the world are starting to get involved.

Question No. 5: Is there still risk with Bitcoin?

Of course. The risk is still very high. This is what allows for asymmetric upside. Once the risk is out of Bitcoin, it will trade much more like gold.

Question No. 6: What would you say to someone who says “Should I buy Bitcoin here”?

If you’re asking that, you don’t understand it. You haven’t done your homework. I can tell you this though – I bought Bitcoin yesterday. I bought Bitcoin this morning. I will buy Bitcoin tomorrow.

Everyone buys Bitcoin at the price they deserve.

The Bottom Line

Being a Bitcoin bull comes with a territory.

The “offbeat” digital asset has been declared “dead” 477 times, according to 99 Bitcoins’ Bitcoin Obituaries tracker. Yet Bitcoin has proven its resilience, time and time again.

And the stalwart Bitcoin investors? Well, they’re the ones reaping the profits. Not the detractors.

I want to make sure you’re on the right side of this opportunity.

Stick with LikeFolio…

Follow Michael Saylor on X (formerly Twitter) and YouTube…

Learn as much as you can.

This is potentially the only chance in our lifetimes to actually front-run the institutions – and get in on the future before they go all in.

It’s an exciting time to be an investor… enjoy!

Until next time,

Andy Swan

Founder, LikeFolio

P.S. If you’re interested in the Bitcoin opportunity but not ready to own the cryptocurrency outright, you have options. MicroStrategy, for one, is like the ultimate leveraged Bitcoin bet. I explain why here. You can also learn more about crypto-adjacent opportunities that could benefit under a Trump administration in this October 25 issue of Derby City Daily. And if you have any questions I didn’t cover here today, don’t be shy! Send them to [email protected], and we may cover them in a future issue.

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Win the Deregulation Trade with One Pick

Deregulation is trending as investors brace for Trump policies. Here’s how you can get in on the trade with one surefire winner…

3 Must-See TTD Charts for 2025 and Beyond

These charts are extremely telling for The Trade Desk’s future moneymaking potential…