It’s hard to believe that the $9 billion company we know today as SoFi Technologies (SOFI) started in 2011 as a pilot loan program on a college campus.

Looking for a more affordable way to finance college educations, Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady recruited 40 Stanford University alumni to pool together a $2 million loan, which was then split between 100 students.

You guessed it: The pilot was a success.

By 2012, SoFi became the first company to refinance federal and private student loans…

By 2014, it launched a mortgage division.

By 2015, it was offering personal loans – and had become the first fintech company based in the United States to receive a $1 billion funding round…

And by 2020, it was celebrating 1 million members.

SoFi’s journey, while characterized by “firsts,” hasn’t been without its bumps.

The COVID-era freeze on student loan payments gutted a key segment of SoFi’s business. Quarterly revenue from its student loan unit tanked from $2.4 billion pre-pandemic to a meager $525 million in the first quarter of this year.

Its stock price was slashed by more than half.

But as history has shown, SoFi knows how to innovate… and how to evolve with the times.

And behind the scenes, LikeFolio consumer data is strengthening for this fintech app – creating a potential “double-your-money” opportunity for the folks who recognize it today…

Double-Your-Money Potential

Mobile banking apps are becoming a “must-have” money management tool for Millennials and Gen Z.

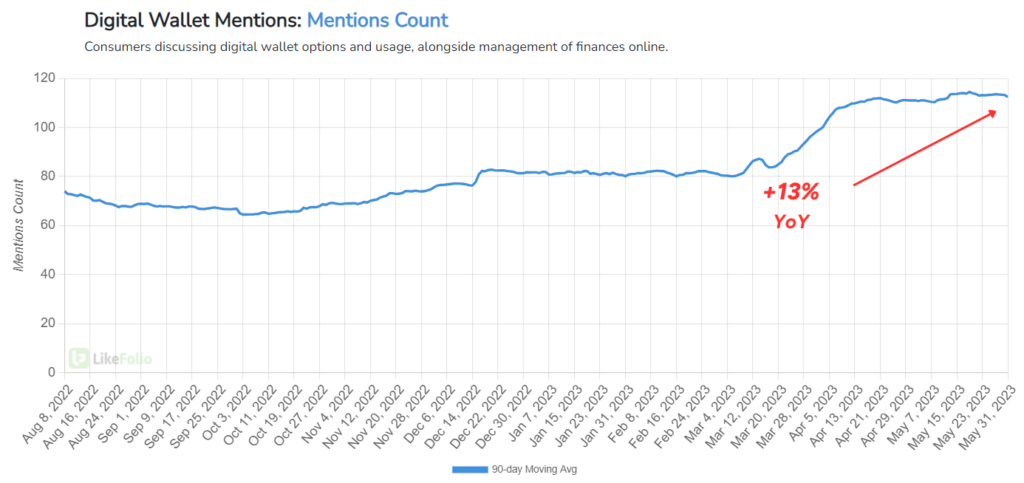

Consumer conversations around digital wallet options and usage and managing their finances online have spiked 13% year-over-year, according to LikeFolio trend data.

And SoFi is doing it better than most.

With a market cap of less than $9 billion, the company is relatively small compared to its fintech (“financial tech”) peers: PayPal (PYPL) at $70 billion, Block (SQ) at $38 billion…

Stack it up against a more traditional banking player like American Express (AXP) with its $121 billion market cap, and SoFi looks downright tiny.

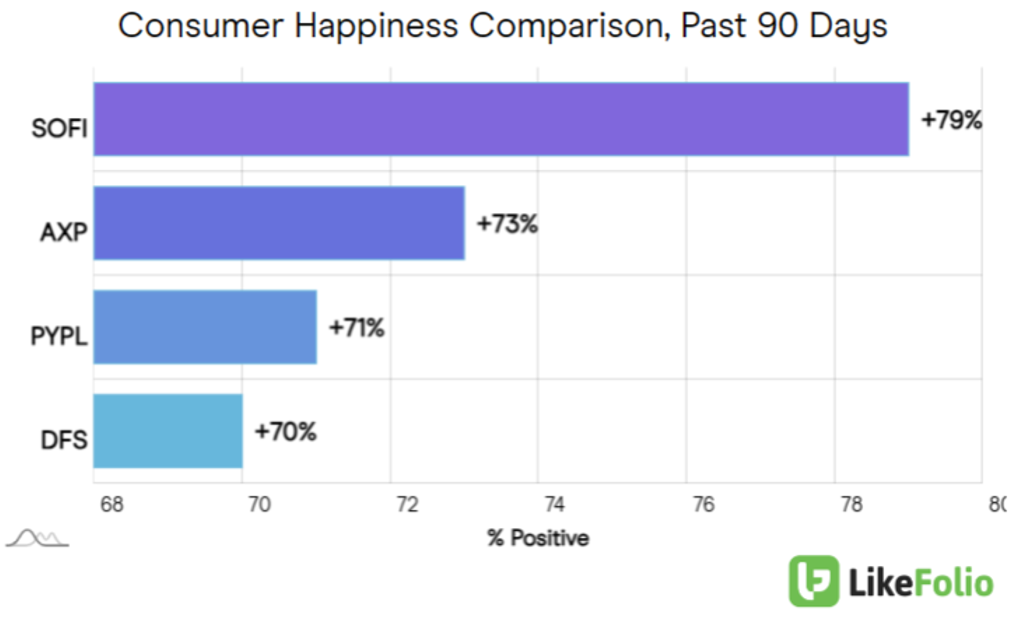

But that hasn’t stopped SoFi from garnering one of the most enthusiastic customer bases in the LikeFolio universe, with a Consumer Happiness level nearing 80%.

The company found a unique niche that sets it apart from those competitors – a true “one-stop” financial services “Super App” where customers can manage multiple accounts, including loans, credit cards, mortgages, and more.

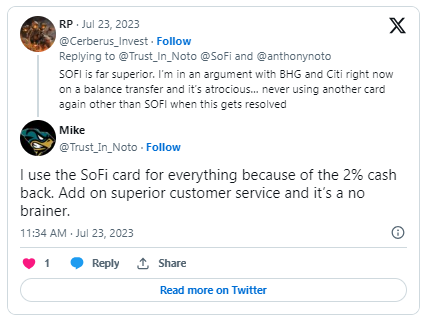

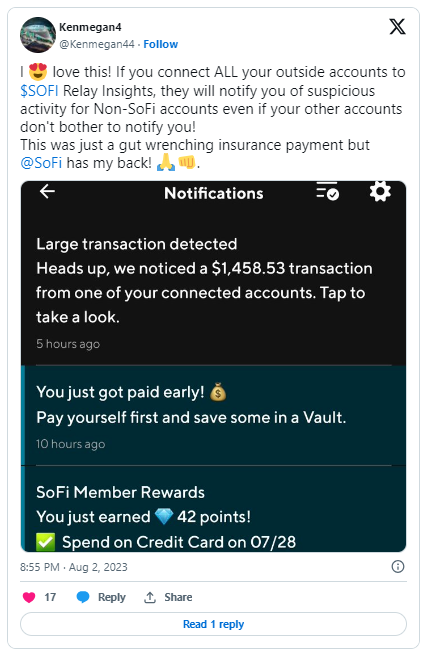

The SoFi Relay mobile dashboard gives members a convenient way to view everything going on with their finances in one spot. And competitive interest rates, strong customer service, and highly accessible CEO Anthony Noto are attracting a large, loyal following.

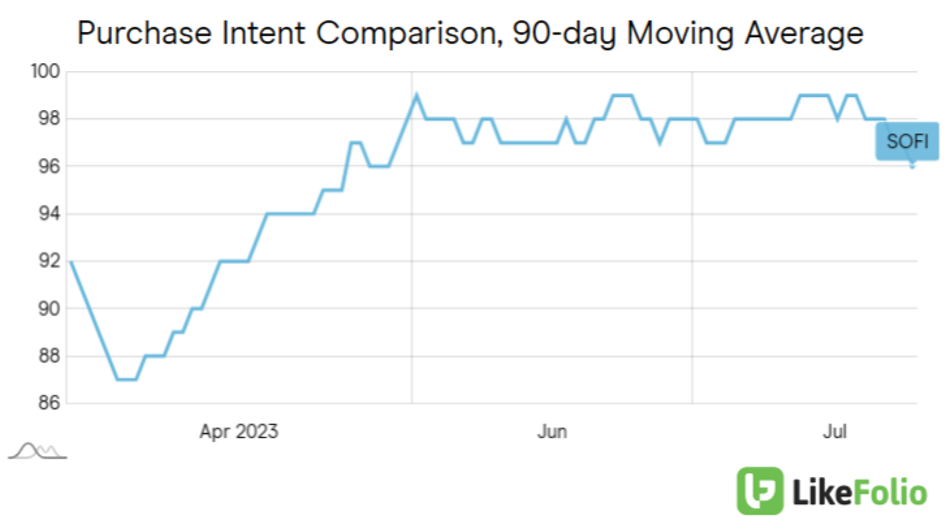

Even as demand for competing services like PayPal (-13%), Block (-21%), and AmEx (-29%) has declined, thanks to our social media machine, we know SoFi demand stayed consistently high throughout the summer.

Purchase Intent mentions – consumers talking about opening a SoFi banking, lending, credit card, insurance, or investment account – remain elevated by 4% on a quarter-over-quarter basis…

And that demand translated to real growth for SoFi during its most recent quarter:

- Quarterly revenue soared 37% year-over-year to $488.8 million…

- Membership grew 44% year-over-year, bringing its total tally to 6.2 million…

- Total deposits to its SoFi Bank subsidiary increased 26% sequentially to $12.7 billion…

- And adjusted EBITDA – which stands for earnings before interest, taxes, depreciation, and amortization, and is a great “big picture” indicator of a company’s financial health and future performance – saw a 278% boost from the year prior to $77 million.

Now that the debt ceiling deal in Washington has ended the three-years-and-counting freeze on student loan payments, SoFi has a clear runway to ramp up its bottom line even further.

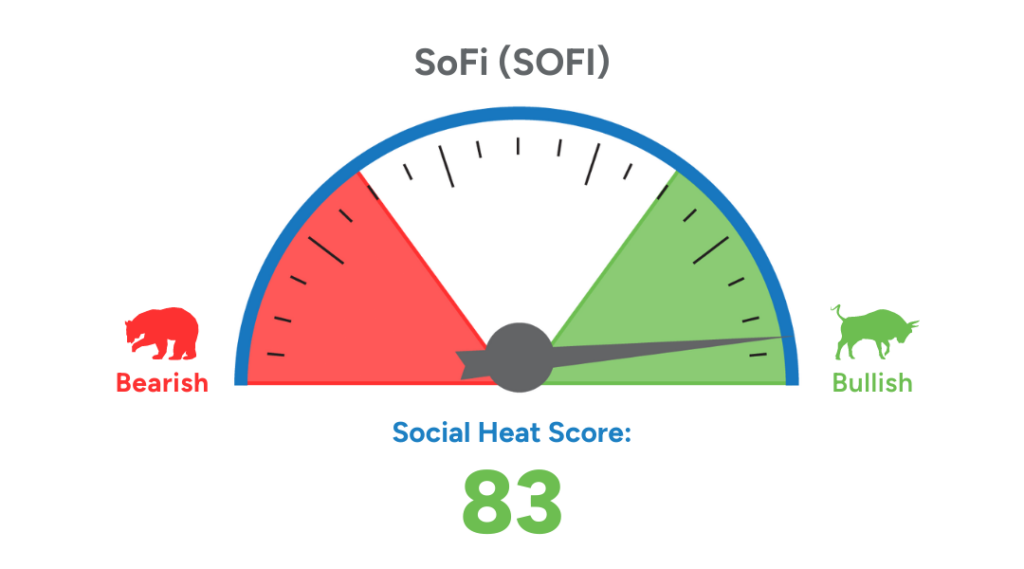

Our system flagged SOFI as a buy in May when it registered a Social Heat Score of 74… and shares were trading for just $4.79.

The stock has already doubled since then, giving our paid-up members an early lead.

But strengthening LikeFolio data has sent SoFi’s Social Heat Score zooming nearly 10 points in the months since to 83…

Leading us to believe this stock could double in price again over the next two years.

And better yet? The same system that flagged SOFI as a buy before it doubled is now targeting five lesser-known AI stocks with – get this – 1,000% growth potential.

Like SOFI, all five of these stocks are registering Social Heat Scores well above 70… and four of them are still trading for less than $5 per share.

Go here now, and Landon will give you the details.

Until next time,

Andy Swan

Founder, LikeFolio