The 150th Kentucky Derby was a milestone year – and not just because the iconic horse race hit a century-and-a-half.

Viewership exploded 33% year over year: An average of 16.7 million viewers tuned in for “The Most Exciting Two Minutes in Sports” on Saturday, May 4, 2024, breaking a 35-year record. The race outperformed the Masters, World Series, and the NCAA Basketball Championship.

Total money wagered hit a record $320 million: That’s a significant 11% increase from 2023’s previous record. Prize winnings also hit a new high of $5 million, topping last year’s pot by $2 million.

I’m no stranger to The Derby myself. I’ve been celebrating Derby Week at Churchill Downs, the namesake track of Churchill Downs Inc. (CHDN), since the ‘90s (seriously).

The historic venue has undergone significant upgrades, with renovations to suites, dining, and most recently, the Paddock horse viewing area, which I’ve had the pleasure of experiencing first-hand.

Today, Churchill Downs is much more than just a legendary horse-racing track.

It’s a formidable competitor in the lucrative sports betting arena.

CHDN’s Growth Strategies On and Offline

The Kentucky Derby is still the defining event for Churchill Downs. You saw how much money is up for grabs with this one event.

And the horse betting market is growing at an impressive clip. Allied Market Research projects the global market value to reach $91.2 billion by 2032 at a compound annual growth rate (CAGR) of 7.6%.

CHDN keeps those profits rolling all year round through TwinSpires, its online horse wagering platform, where players can place wagers on local and international races straight from their mobile devices.

Its 2023 acquisition of Exacta Systems, a provider of historical horse racing technologies, boosted vertical integration across state markets. TwinSpires also has agreements with fellow online betting platforms FanDuel (FLUT) and DraftKings (DKNG) to tap into their large consumer bases.

TwinSpires brought in $458 million in revenue for Churchill Downs in 2023 and is off to a strong start in 2024. In the first quarter, revenues were up 18% year over year to $114 million, while adjusted EBITDA surged an impressive 35% year over year to $40 million for this segment.

CHDN’s avenues for growth extend into traditional casino gaming, too, giving it a more diverse revenue stream than the online-only betting players like DKNG.

The company owns 43 properties throughout the U.S., 29 of which are commercial casinos.

Its newest location, The Rose Gaming Resort, opens later this year in Northern Virginia.

Could This Be CHDN’s Best Year Yet?

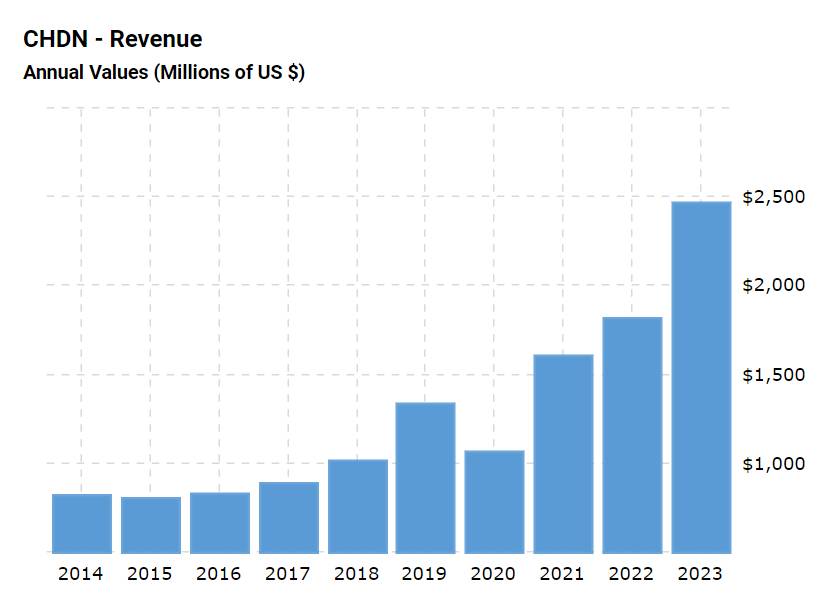

Churchill Downs is seeing the benefits of its growth strategy on paper: Annual earnings grew an exceptional 36% from 2022 to 2023, thanks to its hand in horse racing and casino gaming.

With the Kentucky Derby occurring in the month of May, CHDN’s biggest earnings come in during Q2, making up over 30% of annual earnings in recent years.

But it came out of the gate strong in 2024, with first-quarter earnings gaining a solid 5.5% from last year’s Q1.

CHDN’s continued projects, investments, and dividends signal that the company is confident in its position.

U.S. gross gaming revenue (GGR) is expected to rise. This market grew 10% in 2023, setting an all-time high for the third year in a row – and will serve as a tailwind for CHDN going forward.

Bottom line: With a large stake in commercial casinos, ownership of the irreplaceable asset that is the Kentucky Derby and access to online consumers through the TwinSpires platform, CHDN is well positioned to ride these growing industries.

We see no signs of slowing down.

🚨 NEW DEVELOPMENT IN THE 2024 PRESIDENTIAL PLOT TWIST 🚨

How Trump’s Guilty Verdict Could Play to Our Advantage

Earlier this week, I let you in on a stranger-than-fiction election story playing out in real time: Tension between the Biden administration and Elon Musk is reaching a fever pitch, and I believe Elon could wield his platform and influence to cost current President Joe Biden (D) re-election. I lay out the proof in this bombshell video.

To be clear, I did not think that former President Donald Trump (R) would be found guilty in the “hush money” show trial. But now that he has been found guilty by the Manhattan jury, I believe Trump will become a sympathetic figure and near-martyr to a huge portion of the population who believe the prosecution itself was clearly politically motivated.

This shift in popular perception will likely allow powerful people such as Elon Musk, Bill Ackman, and many others to shift from “concerned about Biden” to now being vocal and passionate in their support for Trump.

No matter where you stand, LikeFolio’s social media machine puts us in an incredibly unique position to stay ahead of the election fallout. Go here now and I’ll show you the five steps you can take right now to come out on top, no matter how this situation plays out.

You’ll want to hurry, too. Because this story is developing faster than I can even type this message to you…

Exclusive: Hedge fund billionaire Bill Ackman is leaning towards backing Donald Trump in the US election https://t.co/YC3DvTatBF

— Financial Times (@FT) May 31, 2024

There is now only one issue in this election: whether the American people will stand for the USA becoming a Banana Republic.

— David Sacks (@DavidSacks) May 30, 2024

Indeed, great damage was done today to the public’s faith in the American legal system.

— Elon Musk (@elonmusk) May 31, 2024

If a former President can be criminally convicted over such a trivial matter – motivated by politics, rather than justice – then anyone is at risk of a similar fate. https://t.co/zrHCyIZazh

This will be interesting https://t.co/UbcehLj9V2

— Elon Musk (@elonmusk) May 31, 2024

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

The Man Who Sent NVDA to $1,100 Could Sway the Election

Elon Musk’s next power play? Costing Biden re-election…

Could Wingstop Be the Next Victim of Fast-Casual’s Fall?

Fast-casual dining is in trouble, and WING could be an unexpected victim…