The U.S. housing market is on shaky ground.

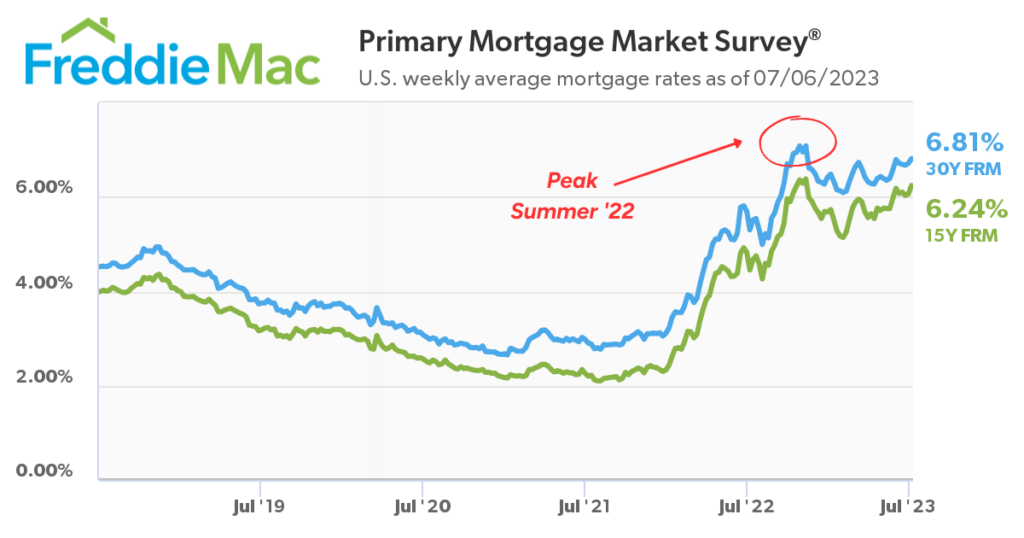

Last week, the average 30-year fixed mortgage rate climbed to 6.81%… Indicating that if Federal Reserve rate hikes continue, we could be on our way back to peak summer 2022 levels – when inflation reached a boiling point.

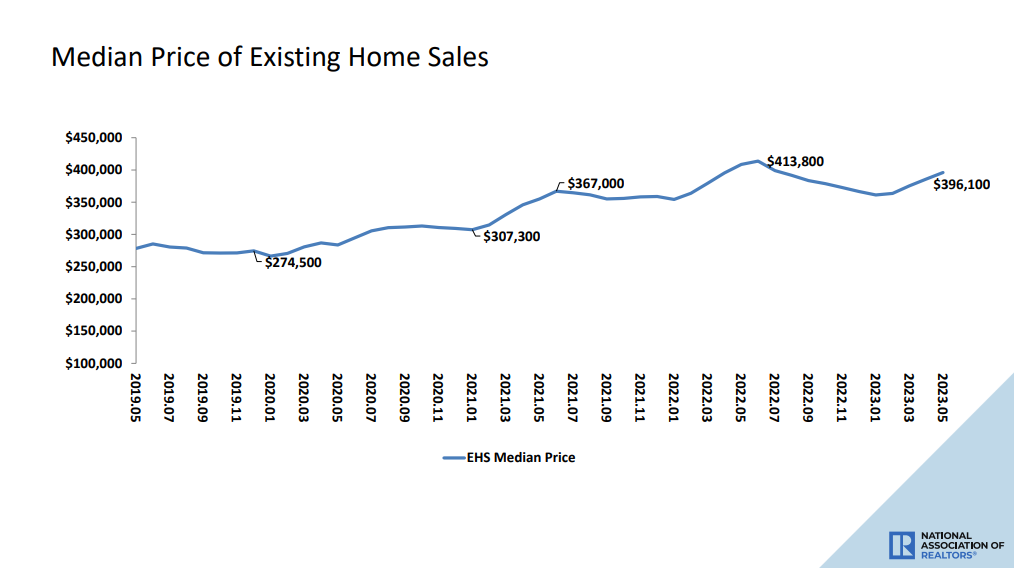

As mortgage rates rise, home prices tend to follow. The median sales price for an existing home climbed toward $400,000 in May, offering little relief for prospective homebuyers:

And mortgage applications are way down, dropping 31.8% year-over-year in June, according to data from the Mortgage Bankers Association.

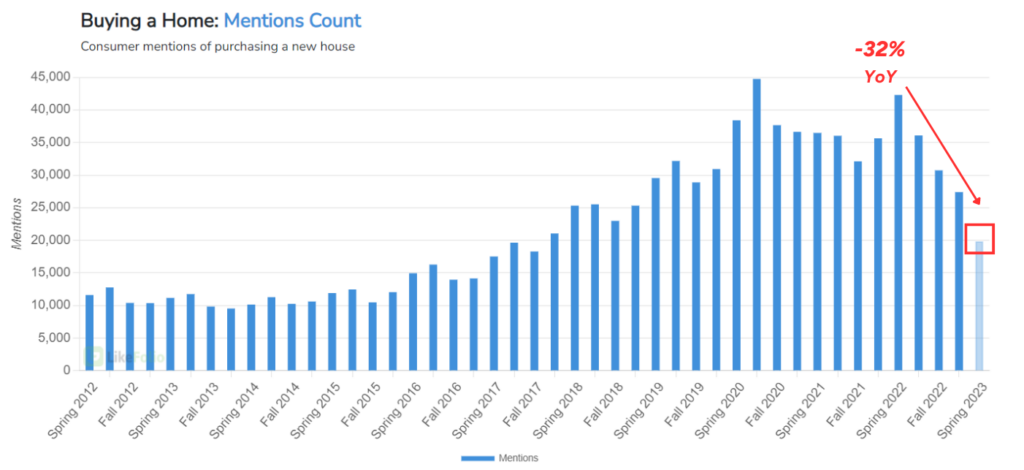

Many folks simply can’t afford to buy a new home right now.

LikeFolio trend data reflects this reality, with consumer mentions of purchasing a new house falling off significantly:

This confluence of macroeconomic factors could put many companies relying on the housing market at risk… like a certain home improvement store we covered last week.

Yet many stocks operating in the sector are on the rise.

Home buying sites like Zillow (Z) have seen their stock prices skyrocket in 2023, with Redfin (RDFN) and Opendoor Technologies (OPEN) more than tripling.

- Z: +55% YTD

- RDFN: +250% YTD

- OPEN: +300% YTD

Surely waning home affordability – combined with the digital ad spending slowdown – could put a damper on all that momentum.

And that might be the case for two out of three.

But one of these players has an ace up its sleeve that has us feeling optimistic about its future prospects.

Take a look at how Zillow, Redfin, and Opendoor stack up with consumers to find out which emerges a potential winner in this Derby City Stock Showdown…

The Good and Bad News for Real Estate Techies

Elevated home inventories plus soft demand are no doubt a disastrous recipe for these companies, especially with large and small players alike crowding the space.

A supply-demand imbalance and increased consumer choices are reflected in recent real estate website activity. Fewer visitors are knocking on the door. And those that are, seem to be just kicking the tires:

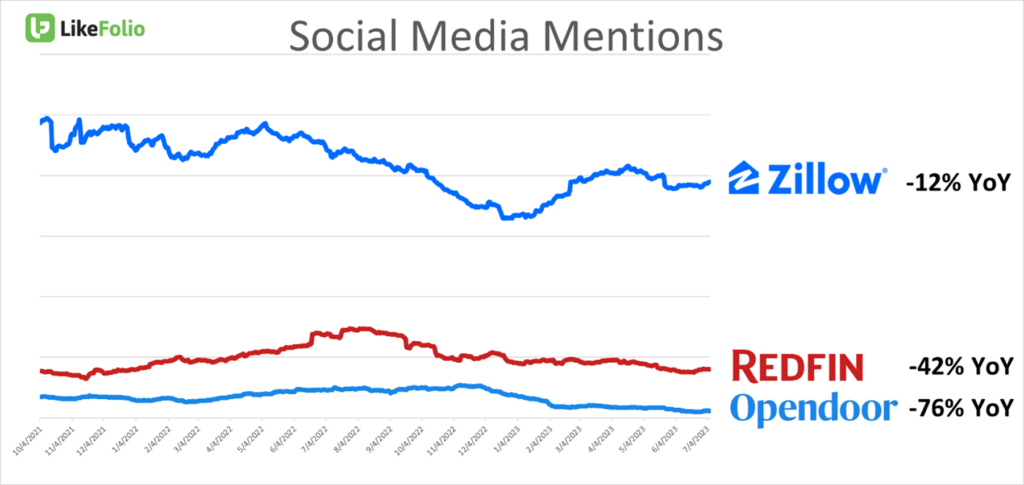

And consumers aren’t exactly buzzing about these names… our database shows social media mentions slipping for Zillow, Redfin, and Opendoor:

With homebuyers on the sidelines and real estate agents purchasing fewer products and services, financial results have been poor for real estate techies, too.

Take Zillow. First quarter revenue fell 14% year-over-year led by weakness in the core residential business. That’s a double whammy when you also operate a small mortgage business. With higher operating costs thrown into the mix, Zillow has posted a net loss in six straight quarters.

The good news — the secular digital trend is still on. Instead of getting real estate information from local newspapers and real estate offices, consumers are most definitely shifting to websites and mobile phones.

During the home buying process, a whopping 90% of folks search online, says a recent NAR study.

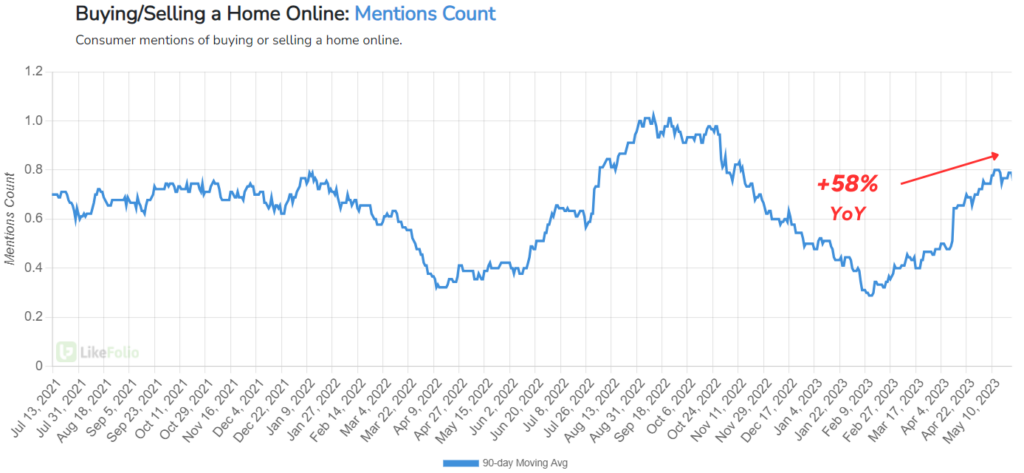

And although overall mentions of buying a home are waning, mentions of buying or selling a home online are showing strength, trending 58% higher year-over-year:

Among Zillow, Redfin, and Opendoor, one name has put itself in a stronger position on the other side of the housing downturn with a secret weapon…

Artificial intelligence.

Winning with AI

In January 2023, Zillow rolled out an AI-powered natural language search tool, the first of its kind in real estate. Home shoppers can enter a specific phrase about what they are seeking instead of having to sift through multiple filters.

Then, last month, it launched an enhanced software package called Appointment Center by ShowTime+.

Sounds like another streaming TV product, I know. But the upgrade is meant to eliminate the monotony of appointment setting for real estate agents with a whole suite of tech products. With data, reporting tools, and 24/7 access to live appointment specialists, users may find the $15-a-month investment well worth it.

This could be helping Zillow outperform its competitors in website traffic and social media mentions, as you saw earlier.

In addition, Zillow is benefiting from its rentals business, which saw 21% revenue growth in the first quarter. Consumers awaiting cooler home prices may be turning to apartment rentals.

But upcoming financial results are expected to remain well below 2021 levels.

Zillow forecasts second-quarter revenue to be in the $451 to $479 million range. That’s half of what it brought in this time last year ($1 billion).

Still, we believe Z may warrant the most optimism because:

- Website and social media activity is holding up relatively well

- It has beaten consensus EPS estimates in each of the last six quarters (including a big first-quarter beat)

- A growing Zillow Rentals business could be a difference maker

Much of Zillow’s 2023 gains came in the weeks that followed its AI search launch. Whether the stock rebounded simply because it’s been deemed an AI winner – or whether the market truly sees a return to sustainable profit growth – remains to be seen.

And the macro landscape needs to see improvement for these companies to sustain recent gains in their stock prices.

But for now… Zillow appears to be the strongest of a weak group.

Even with overall buzz trending lower, LikeFolio data shows Zillow Purchase Intent mentions soaring as much as 87% year-over-year – signaling growing demand with consumers.

Zillow is definitely a stock to keep on your radar – especially heading into its August earnings report. If there’s a winning trade to be made, Earnings Season Pass members will be the first to know.

🏆 The Verdict: Zillow wins this Derby City Stock Showdown. 🏆

Until next time,

Andy Swan

Founder, LikeFolio

3 Stocks That Could Triple This Year

Andy, Landon, and Megan have identified three companies that hit the mark on their “Trifecta” stock-picking strategy, each with triple-digit moneymaking potential.

The Pepsi Effect: How Celsius Shares Keep Bubbling to New Highs

LikeFolio has been pounding the table on this energy drink stock for years, and its stock price just… keeps… climbing.

The Great $2 AI Moonshot

The same system that pinpointed Nvidia before its meteoric rise – and led LikeFolio followers to 228%-plus gains – has unlocked an even bigger AI opportunity in one tiny sub-$5 stock.