Competition is mounting in the streaming space – and some stocks are feeling the pressure more than others…

It’s a relatable scene.

You’re curled up on the couch, scrolling through endless streaming options, trying to find that one show you’ve been eager to watch.

But between Netflix (NFLX), Amazon Prime Video (AMZN), Disney+ (DIS), Hulu, Peacock, Max… You quickly get lost – maybe even panic. (Why pay for all these streaming services if you can’t even find this one show?)

Until it hits you: The beauty of Roku’s (ROKU) platform is that it makes this search seamless, aggregating shows across services with its global search feature.

In the crowded streaming landscape, Roku’s unique offering stands out.

It goes beyond streaming subscriptions – offering the largest streaming operating system (OS) in the U.S. and a full suite of smart TVs, speakers, and home devices.

But the competition is mounting. Fast.

Earlier this month, ESPN (DIS), Fox (FOX), and Warner Bros. Discovery (WBD) teamed up to launch a joint live sports streaming service that promises to shake up the entire industry.

Just this week, Walmart (WMT) made its entry into the TV business via a $2.3 billion Vizio (VZIO) acquisition that stands to challenge Roku’s dominance.

And ROKU is feeling the pressure.

Shares have tumbled more than 33% in the last week.

We made our bullish case for ROKU in the November 14, 2023 issue of Derby City Daily. But a lot can change in a short period of time.

Has ROKU been left for dead? Or is this a flashing “buy-the-dip” opportunity?

Here’s where the ROKU opportunity stands now…

Short-Term Pain

For Roku, it’s not just the convenience of streaming under the microscope anymore, but its pivotal role in a massive industry shift.

The company delivered an impressive Q3 earnings performance in November, featuring a 20% year-over-year surge in net revenue, a surprise core profit, and over 100 billion in streaming hours for the quarter.

Wall Street had high expectations going into Roku’s Q4 and full-year 2023 earnings release last Thursday. And those proved difficult to surpass.

Despite reaching a new milestone of 80 million active global accounts, logging over 100 billion streaming hours again, and growing revenue by 11% year over year in 2023, Roku shares nosedived more than 20% in the hours following that February 15 report.

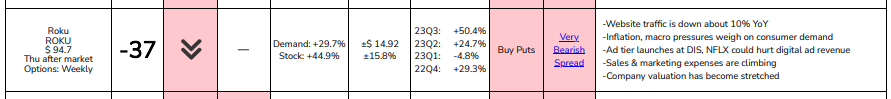

We saw this near-term stumble coming a mile away, thanks to our predictive earnings algorithm, and Earnings Season Pass members went into last week’s report armed with a bearish trade that paid off massively.

(You can learn more about our “cheat code” to earnings season here.)

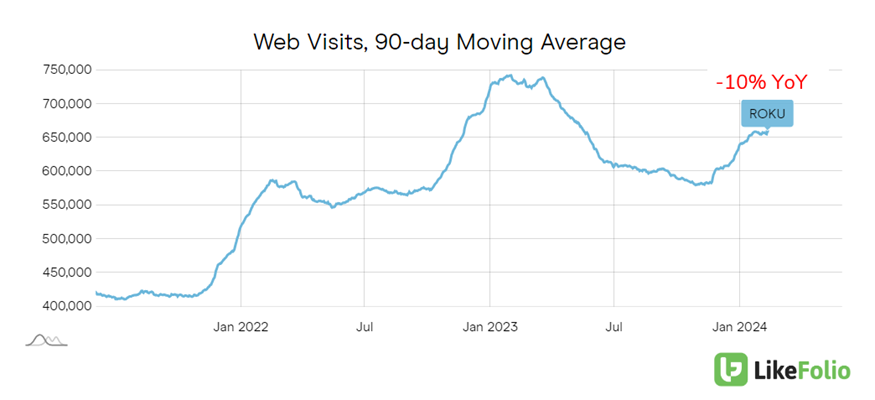

LikeFolio web traffic data showed a 10% year-over-year slowdown in visits, signaling caution in the short term:

Increasing competition from platforms like Apple TV (AAPL), which boasts higher user satisfaction, poses a notable threat.

And this most recent Walmart-Vizio deal has created a formidable new competitor in the streaming wars – one that takes direct aim at Roku’s smart TV niche.

Roku faces short-term challenges.

But from a long-term view, we still see massive opportunity…

Long-Term Gains

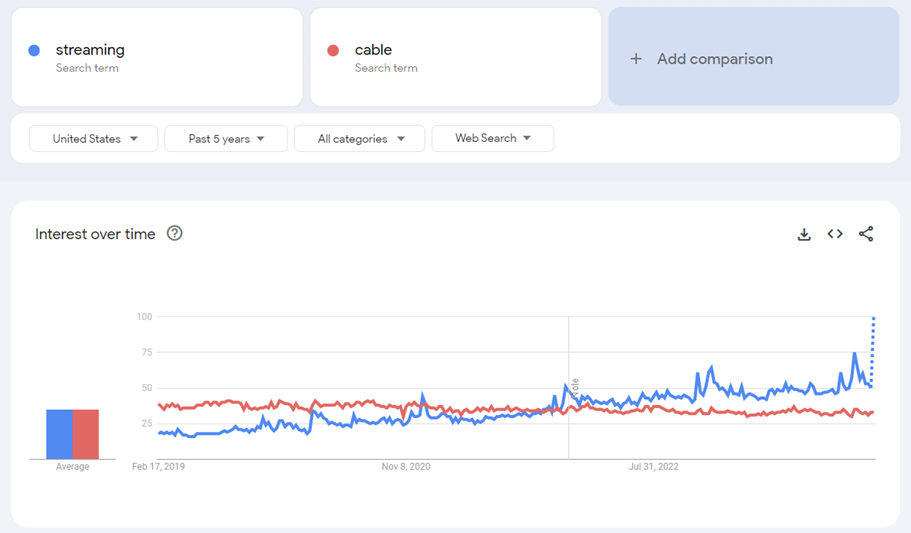

In November, Roku CEO Anthony Wood noted, “Traditional TV ads in the U.S., as everyone probably knows, is a $60 billion a year business. It’s all going to move to streaming and there’s going to be multiple winners.”

Let that sink in – the shift in ad dollars underway.

Consumer searches confirm the movement of eyeballs on screens:

And ROKU stands to gain, especially as a key player even in broadband households.

“Our platform, obviously, has significant scale engagement, first-party data, unique ad products. And like we said before, in the U.S., our scale is approaching half of broadband households, that makes us a tremendously important platform to be involved in for everyone in the ecosystem.”

With over 80 million active accounts, Roku not only leads the U.S. streaming distribution market, but also stands at the forefront of the advertising revolution in streaming.

The platform’s emphasis on user experience, demonstrated by features like global search, positions it uniquely in the streaming wars, especially as streaming service fatigue sets in among viewers.

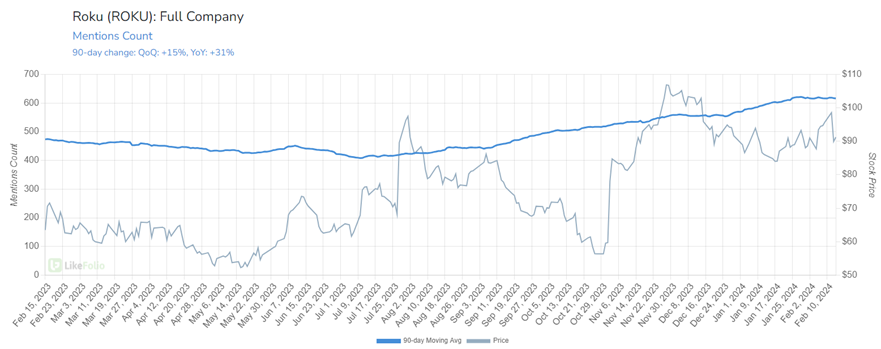

LikeFolio’s mention buzz shows a notable uptick, indicating robust platform engagement and growing market interest.

This engagement, along with its unique advertising products, positions Roku to win big as TV advertising dollars flow into streaming.

From here, we’ll be tracking smart TV demand for any significant changes in Roku usage mentions on the back of the new Walmart-Vizio news.

But for now, our long-term bullish conviction remains – and ROKU stock looks like one heck of a steal at just $63.

Translation: We’re buying this dip.

And we’ve already got another “bargain” lined up for you right here. This hidden AI gem is trading at just $2 a share right now, but it won’t be much longer… considering it’s riding the hottest investing trend of 2024. Check it out.

Until next time,

Andy Swan

Founder, LikeFolio

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

NVDA Earnings Preview: Here’s What to Expect Tonight – and Beyond

It’s been a tough road if you’ve bet against this tech titan over the past few years…

This Stock Won the $17.3 Billion Super Bowl Spending Spree

Kansas City won the Super Bowl, but one stock dominated the big-game snacking frenzy…