This week ushered in the biggest IPO of the year with Arm Holdings (ARM).

The British chip designer supplying the tech for trillion-dollar giants like Nvidia (NVDA) and Apple (AAPL) made its public debut on the Nasdaq on Thursday at $51 a share.

With investors’ appetites whetted by Nvidia’s staggering 200%-plus rally this year, Arm’s $54 billion valuation is making waves in the market… while SoftBank’s positioning of Arm as a key player in the artificial intelligence (AI) realm adds fuel to the excitement.

Miss Out on the Nvidia Rally?

At under $5 a share, this tiny AI player is just getting started… and could turn into one of the biggest undercover AI opportunities of the decade.

➡️ More Here ⬅️

But while the limelight is firmly on Arm and its role in the AI-driven future, we’re looking beyond the dazzle of new IPOs and the established might of Nvidia…

Because another player that’s been quietly, yet steadily, making its mark in the high-powered AI chip arena has caught our eye.

This chipmaker is already a leader in gaming processors – much like Nvidia was before its monster breakout. A major product launch coming in the fourth quarter could soon propel it into an AI powerhouse.

And LikeFolio data shows it’s gaining significant momentum with consumers.

Let me show you the up-and-coming AI player displaying all the signs of a stock on the verge of a breakout…

The AI Underdog Poised for a Breakout

In the high-stakes world of semiconductor giants, Advanced Micro Devices (AMD) has long been the scrappy underdog, nipping at the heels of industry titans like Nvidia and Intel (INTC).

While Nvidia’s stock has soared to stratospheric heights with a nearly 90% gain over the last six months, and Intel has enjoyed a robust 38% uptick, AMD has been the quiet contender – posting a more modest 23% rise in the same period.

It’s like the tortoise in the classic fable, steadily making its way while the flashy hare grabs the headlines.

But as any seasoned investor knows, underdogs have their day.

And AMD’s story is shaping up to be a compelling one for those with a long-term vision.

AMD’s Financial Rollercoaster

Last quarter, AMD defied expectations, posting impressive earnings results even as it faced macroeconomic headwinds.

Diluted earnings per share (EPS) came in at 58 cents, just barely edging out Wall Street’s estimate of 57 cents, while posting better-than-expected quarterly revenue of $5.4 billion.

But it wasn’t all rosy.

Combined with its first-quarter pull, $10.7 billion in revenue for the first half of 2023 meant AMD revenue dipped nearly 14% year-over-year.

A slump in personal computer sales significantly impacted AMD’s ledger. We’re talking $1.7 billion in revenue for that segment for the six months ended July 1, 2023, compared to $4.3 billion for the same period in 2022.

But every cloud has a silver lining.

Projections for AMD’s full-year revenue paint a brighter picture, hinting at a robust performance comeback in the latter half of 2023.

Industry pundits forecast a 14% year-over-year revenue spike in the fourth quarter as AMD rolls out its much-anticipated foray into AI chips with its MI300 accelerators.

The chips are designed to be the heartbeat of revolutionary AI applications, like ChatGPT, and could make AMD a serious contender for Nvidia.

AMD Chair and CEO Dr. Lisa Su put a fine point on those efforts, saying: “Our AI engagements increased by more than seven times in the quarter… We made strong progress meeting key hardware and software milestones to address the growing customer pull for our data center AI solutions…”

LikeFolio Data Reveals: AMD Is Gaining an Edge

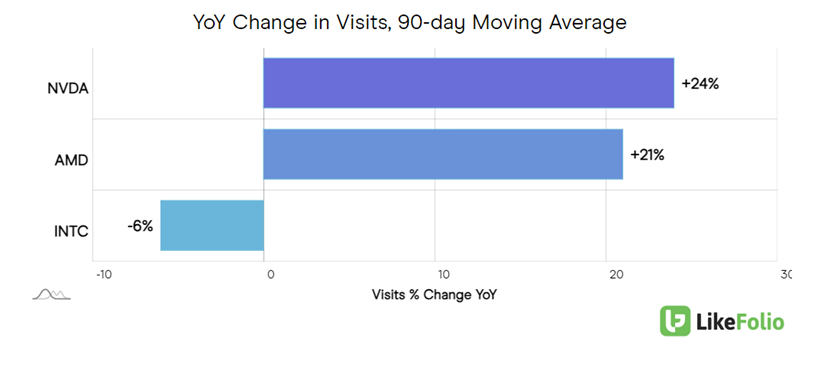

While AMD might not be the most-traveled site compared to stalwarts like Nvidia and Intel, LikeFolio web data indicates it’s catching up – and fast.

AMD website visits have surged 21% year-over-year. That growth is on par with Nvidia – and leaves Intel traffic seriously trailing.

What investors need to know is that this isn’t a mere blip for AMD.

Just a quarter ago, AMD’s traffic was only growing 12% year-over-year.

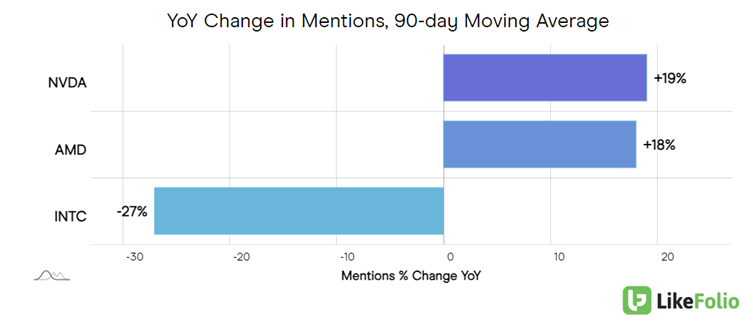

And buzz is gaining traction, too.

AMD mentions have shot up by 18% year-over-year, once again neck-and-neck with NVDA and leaving Intel in the dust.

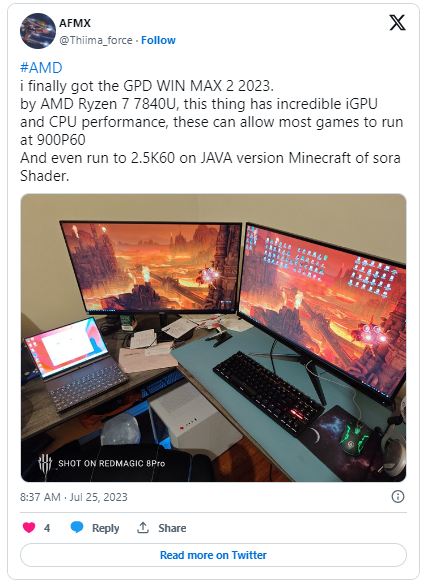

Consumers are raving about AMD’s Ryzen processors – especially the newly minted Ryzen 7000 Series. Think of these chips as the brains that make computers go.

Gamers love them because they render graphics with lightning-fast speed. And with the upgraded 7000 now available, the marked-down predecessor Ryzen 5000 Series is flying off the shelves.

That’s a true testament to the prowess of these processors. And it’s helped AMD gain a three-point edge over Nvidia in Consumer Happiness.

But as we gaze into the future, our radar is set on AMD’s potential expansion in data centers and embedded sectors – where Nvidia found its own blockbuster success this year as it transitioned from gaming to full-blown enterprise applications.

As one of the few torchbearers crafting chips powerful enough for AI supercomputers, the company’s leadership envisions AI as a pivotal growth propeller.

So, while AMD grapples with immediate challenges like tepid PC sales and a gaming sector hitting the brakes, it’s not all doom and gloom.

High consumer satisfaction and a noticeable uptick in web traffic are positive long-term indicators. Factor in the macro tailwinds of AI and big data, and AMD emerges as an increasingly attractive long-term investment.

With its stock price back below $120, we’re all systems go on AMD.

But there’s always room in our portfolio for a “moonshot,” too. And this $2 AI stock could make your year if it goes the way we think it might. Check it out.

Until next time,

Andy Swan

Founder, LikeFolio

New in Derby City Daily: Trends and Insights for September (and Beyond)

GM Is at a Crossroads. And This Next Move Is Make or Break.

September 13, 2023

Amid worker strikes, we explore whether GM is an emerging “EV play” that deserves a spot in your portfolio…

DocuSign Bets Big on AI: Will It Work?

September 12, 2023

DocuSign was a $300 stock in 2021. Now it’s barely reaching $50. Could impressive AI initiatives be enough to bring shares back to life?

4 Stocks to Soar as the NFL Season Starts

September 8, 2023

The NFL isn’t just about touchdowns and Super Bowl rings. This season will see more sports betting than ever before…