All eyes were on Big Tech this week as Microsoft (MSFT), Alphabet (GOOGL), and Amazon.com (AMZN) reported first-quarter earnings results that will ultimately set the tone for the rest of 2023.

Microsoft and Alphabet were up first – posting strong earnings results on Tuesday that set the bar really high for Amazon’s Thursday announcement.

For the quarter ended March 31, 2023:

- Microsoft brought in $52.9 billion in revenue for a 7% increase.

- Alphabet saw revenue of $69.79 billion, a 3% increase.

- Amazon’s revenue came in at $127.4 billion in a 9% increase.

Three key themes drove momentum in the first quarter and will be critical for these companies to execute on for the remainder of 2023:

- Cloud Service Growth

- Artificial Intelligence Applications

- Cost Cutting Measures

Let’s break it down and see what LikeFolio data has to say about the cloud, AI, and cost-cutting…

Theme No. 1: Cloud Service Growth

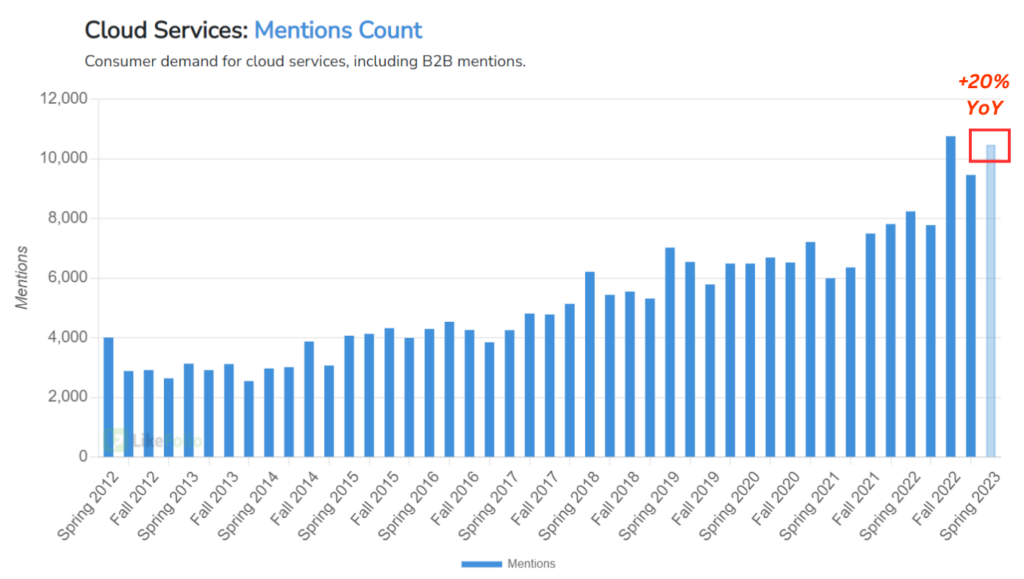

Consumer demand for cloud services remains strong in 2023, currently registering 20% higher for the Spring – and was a focal point for investors going into these big tech earnings reports:

- Microsoft’s cloud services powered the company’s growth, with segment revenue up 22% year-over-year to exceed $28 billion for the quarter.

- Alphabet’s cloud services turned profitable for the first time, generating $7.45 billion in revenue in the first quarter.

- And Amazon’s AWS (Amazon Web Services) segment saw a 16% year-over-year sales boost, bringing in $21.4 billion – reflecting a slowdown compared to the 37% growth in AWS sales from the prior quarter.

But despite the revenue beat, AMZN shares settled in around 3% lower on Friday. What gives?

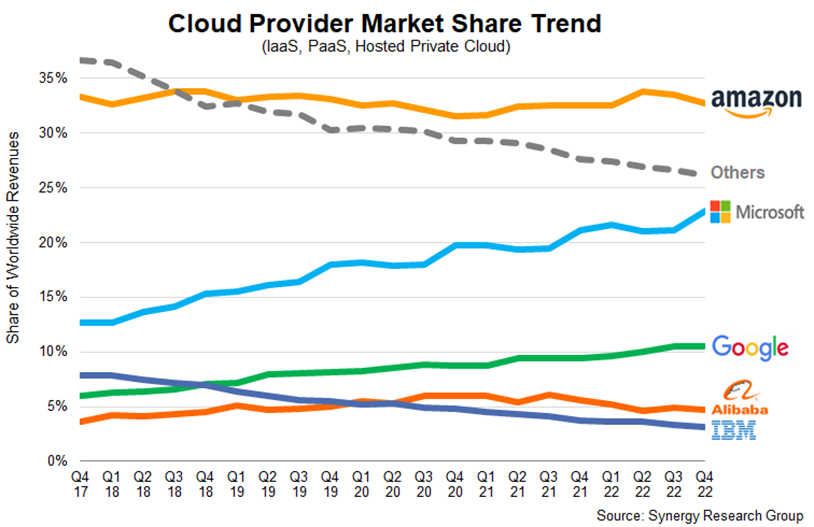

Last quarter Amazon was the market share leader in cloud services, commanding about a third of dollars spent.

But the company is losing ground.

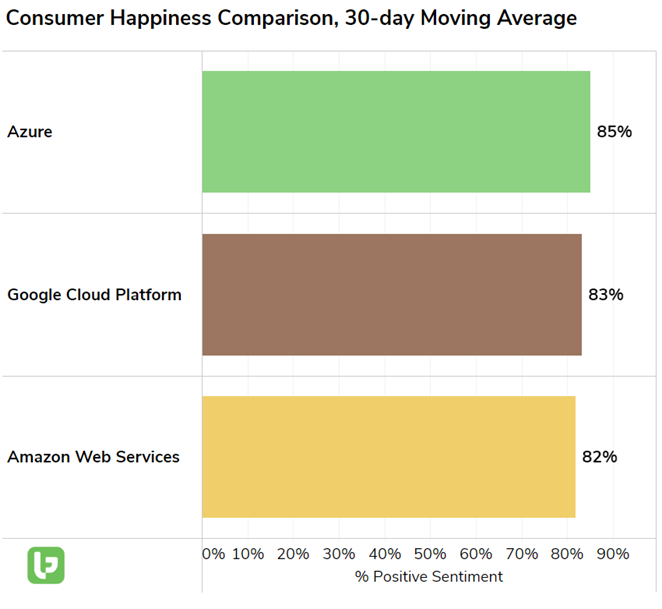

Not only are Microsoft (Azure) and Alphabet (Google Cloud) users reporting a more positive experience, measured by Consumer Happiness:

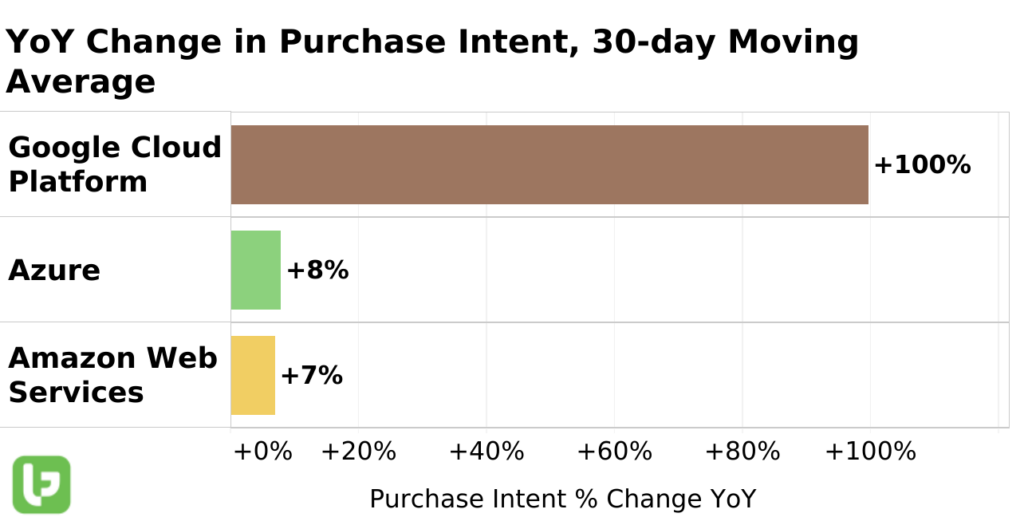

But both are beginning to outpace Amazon on the demand front in critical signs of market share steal:

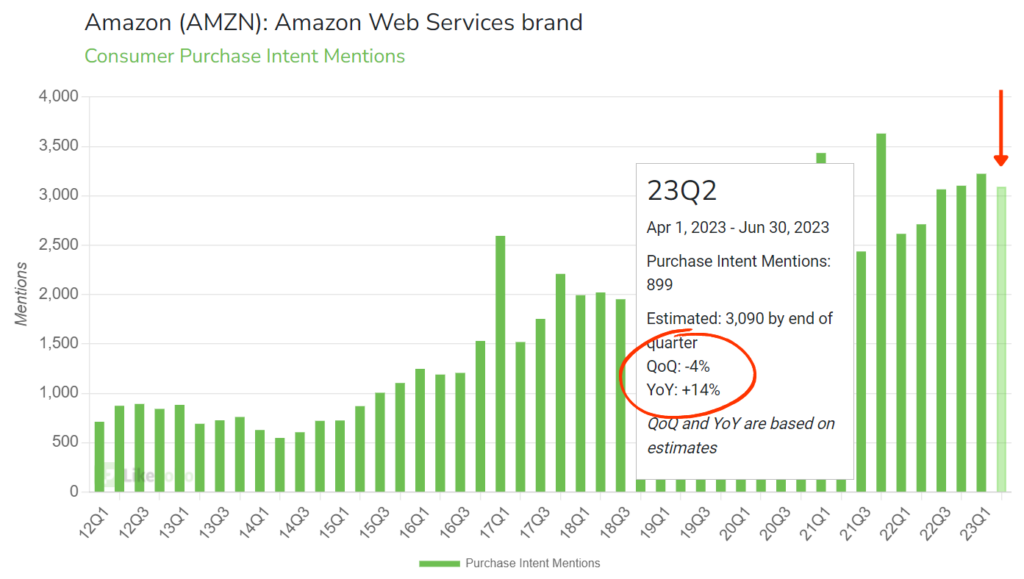

Consumer Purchase Intent (PI) Mentions for Amazon Web Services rose by 23% year-over-year in the first quarter but we’re seeing signs of a slowdown in April, as AWS demand in Q2 paces for 14% year-over-year growth:

Amazon’s earnings release, while positive, ultimately did nothing to quell investor fears – suggesting that margins are shrinking in its cloud unit.

The AWS operating margin of 24% was the narrowest it’s been since 2017.

Data supports reason for caution as competitors encroach on its dominant positioning and Microsoft gains momentum.

Theme No. 2: Artificial Intelligence Applications

Microsoft and Alphabet collectively mentioned artificial intelligence (AI) 100 times on their earnings call – and for good reason.

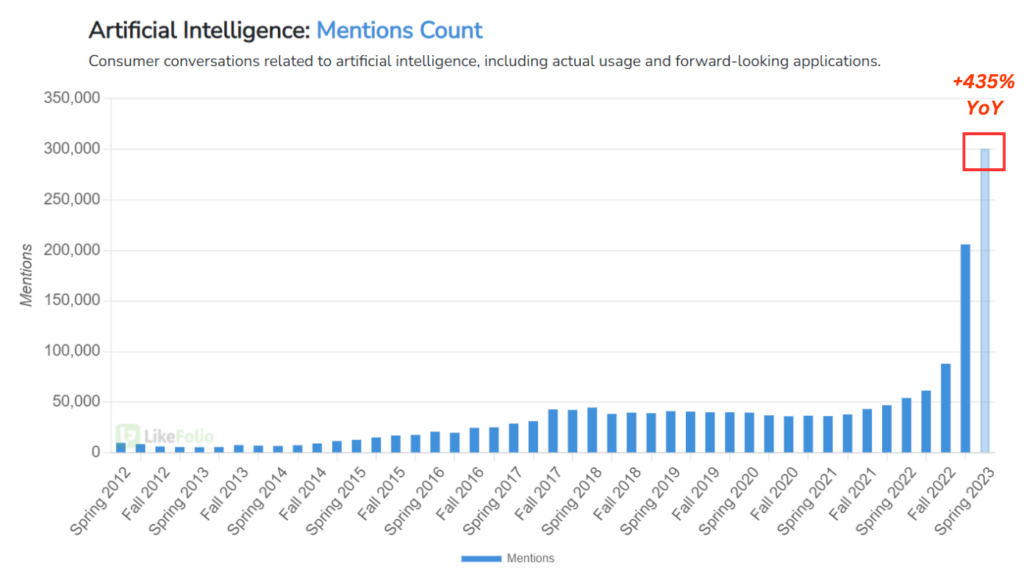

Demand for AI is booming. LikeFolio consumer data shows AI buzz currently trending 435% higher on a year-over-year basis:

Microsoft is leveraging AI to connect advanced models (like ChatGPT) with its cloud enterprise capabilities. The company’s AI-powered Bing and Edge search tools are also recording significant usage and engagement upticks thanks to improved consumer experiences and new features.

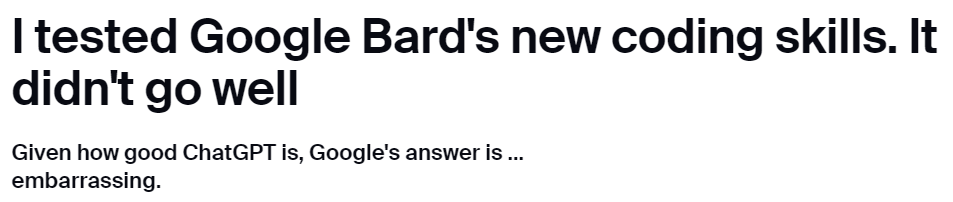

Alphabet boasted AI large language model client adoption and search improvements and outlined programming and software development progress on its AI chatbot, Bard… though consumer sentiment suggests Bard is seriously trailing the user experience of ChatGPT.

Amazon has leveraged AI for years now, from product recommendations to enabling Alexa to play a song based on a user voice request. But the future of AI at Amazon goes deeper…

- Amazon’s generative AI application (as opposed to conversational), Bedrock, allows users to build and scale applications that can generate text, images, audio, and synthetic data in response to prompts.

- Bedrock is Amazon’s direct response to OpenAI (controlled by Microsoft). The Bedrock service includes access to Amazon Titan foundational models, which are pre-trained on large datasets to democratize access for builders.

- Amazon is also trying to get ahead of software development applications by making CodeWhisperer (a coding companion for Amazon services) available to any user for free. On average, developers who tested CodeWhisperer were able to complete tasks 57% faster than those without the AI companion.

It’s still too early to gauge the success of Amazon’s AI application but so far, it has some serious catching up to do.

We’ll be closely monitoring consumer adoption in the coming months.

For now, MSFT holds a significant edge on the AI front.

Theme No. 3: Cost-Cutting Measures

Tech companies notoriously got a bit ahead of themselves during COVID to meet extreme demand growth, especially when it came to employee headcount.

Amazon, Alphabet, and Microsoft have all participated in significant workforce reductions in 2023 – which were a major theme in each of their earnings reports.

Workforce reductions should help improve operational efficiency and are typically viewed as a positive move.

But Amazon’s mass layoffs announced in March officially kicked off this week and included its AWS sector, spooking some investors.

We were officially neutral ahead of AMZN earnings: Aside from growing competition, Amazon’s retail demand appears to be weakening.

And of the three tech leaders, we believe Microsoft is garnering the most significant bullish momentum in the long term.

Until next time,

Andy Swan

Co-Founder

P.S. Did you catch how Crocs (CROX), Snapchat (SNAP), and Pinterest (PINS) performed on earnings this week?

Hint: They all did exactly what we told you they would…

- CROX shares fell off a cliff, plummeting from $147.78 as of close on April 26 to a low of $116.61 on April 27 for a steep 21% loss…

- SNAP tumbled from $10.50 as of close on April 27 to a low of $8.41 as of this writing for a fast 19% drop…

- And PINS shares lost 18%, falling from $27.27 to around $22 between April 27 and April 28.

Hawaiian Holdings (HA) and General Motors (GM) stocks also slid on earnings – just not in quite such a dramatic fashion.

We issued bearish outlooks on all five of these stocks in our Derby City Daily Earnings Sneak Peek on Monday – and there will be more where that came from hitting your inbox tomorrow.

In the meantime, enjoy another round of earnings season wins powered by LikeFolio’s predictive consumer insights machine.