Welcome to Week 2 of earnings season…

More than 70 publicly-traded companies tracked in the LikeFolio database are slated to report earnings over the next five days and send the stock market into an all-out frenzy.

Wall Street is preoccupied with big tech headliners like Microsoft (MSFT), Amazon (AMZN), Meta (META), and Google (GOOGL).

But here in Derby City Daily, we’re zeroing in on small-to-mid-cap stocks and companies not receiving as much attention to give you the biggest investing edge, along with a couple of LikeFolio favorites that could be in for some short-term volatility.

Here’s what you need to know…

📅 Earnings Headliners This Week (April 24 – 28, 2023)

- Hawaiian Holdings (HA): Reports Tuesday, April 25

- General Motors (GM): Reports Tuesday, April 25

- Crocs (CROX): Reports Thursday, April 27

- Snapchat (SNAP): Reports Thursday, April 27

- Pinterest (PINS): Reports Thursday, April 27

Hawaiian Holdings (HA): Reports Tuesday, April 25

Outlook: Cautiously Bearish

Those of you who’ve been following Derby City Daily know U.S. airlines are facing their fair share of headwinds in 2023 as post-COVID demand stabilizes.

And this week, we’ll be watching Hawaii’s flagship commercial airline, Hawaiian Holdings (HA), to see if it adds to its four-quarter losing streak.

HA shares have cratered over 55% in the past year, with losses seen after the last four consecutive quarterly reports:

- 22Q4: –5.8%

- 22Q3: –6.5%

- 22Q2: –1.1%

- 22Q1: –13.5%

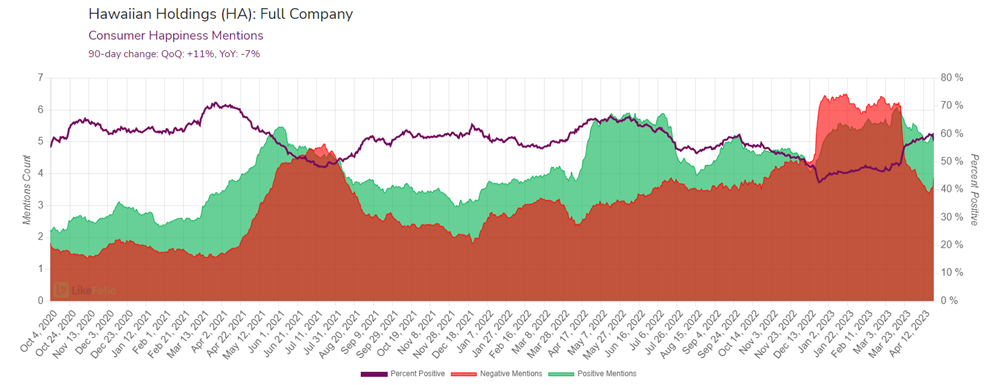

LikeFolio continues to see sluggish consumer demand and dissatisfied customers complaining about flight delays, lost baggage, and poor customer service:

With an Earnings Score of –26, we’re cautiously bearish going into the report and will use a risk-defined strategy to cap potential losses at a manageable level… should the company finally offer a ray of hope.

💡 The LikeFolio Earnings Score is a simple -100 to +100 metric that lets us know if we should be bullish, bearish, or neutral heading into a company’s earnings event. Higher scores indicate a more bullish outlook while lower scores indicate a more bearish outlook. You can learn more about how we use this metric here.

General Motors (GM): Reports Tuesday, April 25

Outlook: Bearish

Several bearish indicators are looming over General Motors (GM) ahead of Tuesday morning’s earnings announcement.

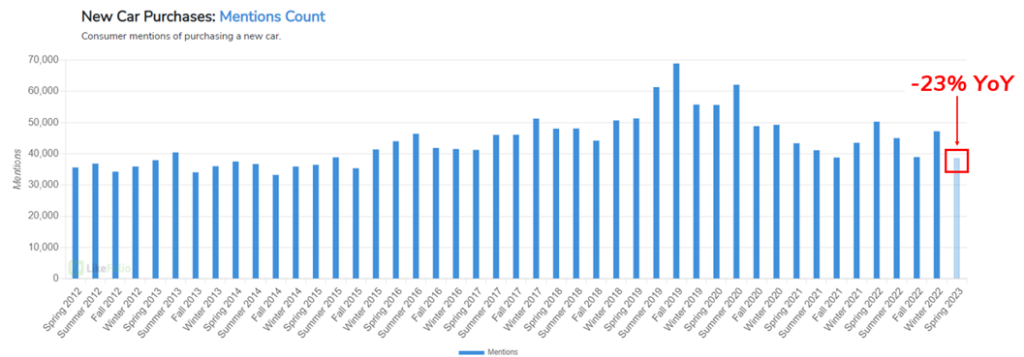

LikeFolio’s predictive consumer demand has dropped 6% year-over-year for the auto manufacturer with overall mentions of new car purchases slipping by 23%:

Rising auto loan rates are playing a big role here, as higher all-in prices have consumers reconsidering big ticket items like new cars.

Concerns over GM Financial’s weaker 2023 contribution have also raised doubts about the upcoming results.

All signs point to a bearish outcome for GM this week with an Earnings Score of –57.

Crocs (CROX): Reports Thursday, April 27

Outlook: Cautiously Bearish

We’ve been pounding the table on Crocs (CROX) since way back in 2018 when it was trading for under $13 per share.

We could see the ironically ugly shoes gaining significant traction on social media and have made several bullish plays on CROX in the years since, with some resulting in quadruple-digit gains.

But today, we’re flipping the script and heading into Thursday’s earnings report with a bearish outlook.

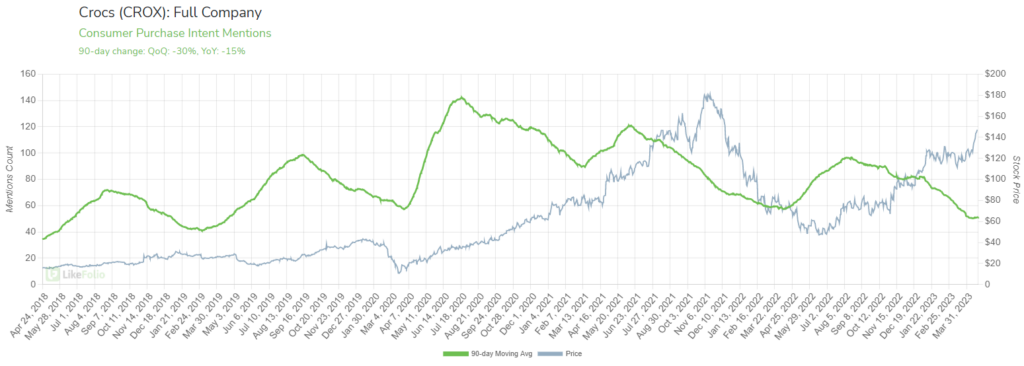

In less than a year, the CROX stock price has more than tripled from $46 in July 2022 to nearly $150 as of market open today.

We’ve also seen Purchase Intent Mentions slip (currently pacing 15% lower year-over-year) to create a divergence between stock price performance and consumer demand metrics:

When that gap forms, it means a reversal could be in the making.

LikeFolio macroeconomic trends show consumer demand for waterproof shoes starting to slow, with mentions sinking 6% lower on a yearly basis.

In the long run, Crocs’ acquisition of Hey Dude Shoes was a promising move that could help keep the “King of Comfy Shoes” in a leading position.

But like we saw with Netflix (NFLX) and Tesla (TSLA) last week, even the best players can have a bad game.

Our outlook for CROX is cautiously bearish with an Earnings Score of –35.

Snapchat (SNAP): Reports Thursday, April 27

Outlook: Bearish

Snapchat (SNAP) gets the dubious honor of receiving our lowest Earnings Score of the week at –72, which is very bearish.

The company has endured four consecutive post-earnings drops, two of which were larger than 25%:

- 22Q4: –0.8%

- 22Q3: –26.7%

- 22Q2: –28.4%

- 22Q1: –8.8%

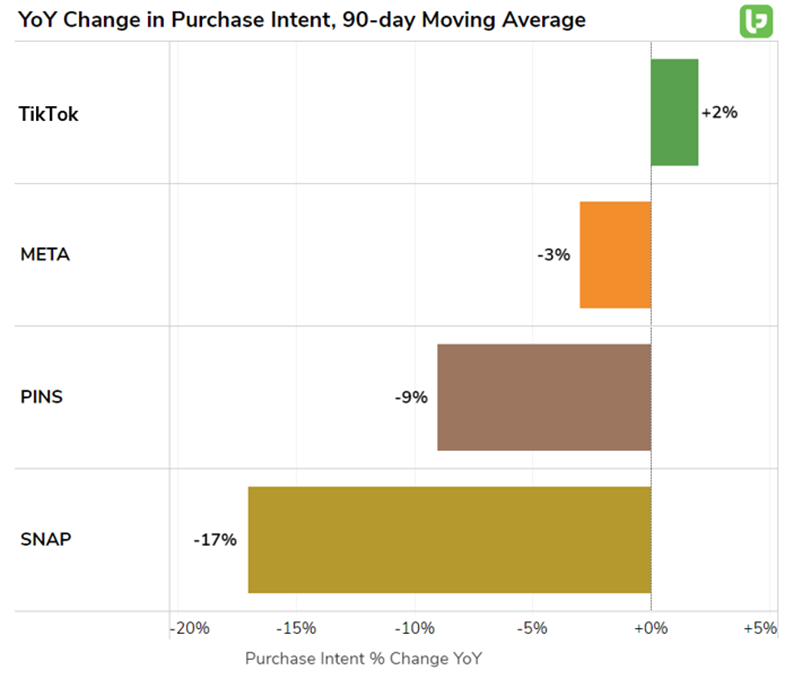

LikeFolio consumer demand data shows Snapchat trailing other social media peers, with Purchase Intent levels down 17% year-over-year:

Snapchat Consumer Happiness levels have dipped below 60%, too, currently sitting at just 58% positive.

On top of that, the advertising market Snapchat revenue depends on has been particularly weak in recent quarters.

SNAP shareholders would be wise to hedge their position into this report.

Pinterest (PINS): Reports Thursday, April 27

Outlook: Bearish

Pinterest (PINS) is yet another stock we’re fans of here at LikeFolio – but that looks like it could move to the downside on earnings this week.

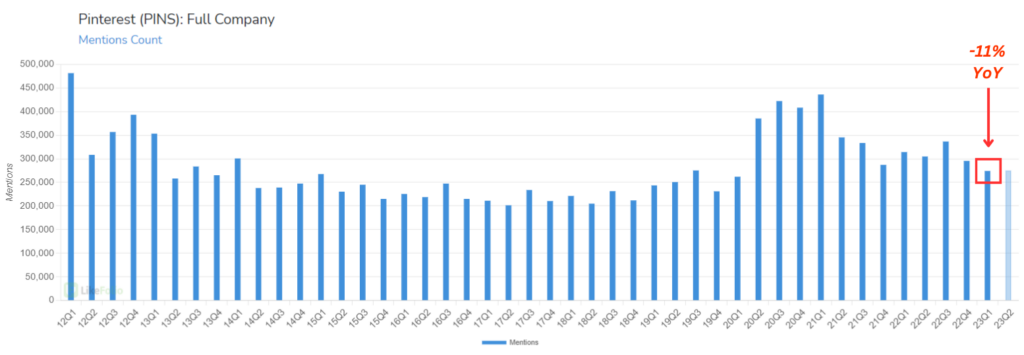

Comprehensive consumer demand fell 11% year-over-year for the quarter being reported (Q1) as folks spend less time at home exploring the app:

Our Earnings Score for PINS this week is –51, so watch out for a near-term slide in share price.

(Investors with a longer-term horizon may even consider a move to the downside as a discounted entry point on this AI stock in disguise.)

Until next time,

Andy Swan

Co-Founder