Last week, I realized I needed to buy a birthday gift – and I’d already run out of time to get an online order delivered. (My typical go-to.)

So I went “old school” and stopped at the mall on my way home from work.

“Twist my arm, I’ll stop in at Lululemon,” I laughed to myself.

My brick-and-mortar sojourn was enjoyable – and surprising.

Not only did Lululemon (LULU) have the item in the size and color I wanted but the store was relatively quiet. It was easy to find an associate to help. And there was zero waiting in a checkout line that once needed velvet ropes to guide eager (and impatient) customers.

This was a nice experience for me. But it was a troubling observation too.

I mean, we’re talking about a retail storefront – one that comes with costs for real estate, utilities, inventory, and employees to serve its in-store shopping customers.

Where did those shoppers go?

Bad Omens for High-End Retail

Over the last few months, LikeFolio research has helped investors rake in big wins on some of the retail sector’s best-of-breed players.

In many cases, we’re talking about quality brands that consumers are happy to pay up to buy.

Just check out the peak performance of our high-end retail MegaTrends report from October:

- On Holding (ONON) – Max Gain: +103%

- Canada Goose (GOOS) – Max Gain: +49%

- Revolve (RVLV) – Max Gain: +47%

- Lululemon (LULU) – Max Gain: +32%

- Williams-Sonoma (WSM) – Max Gain: +20%

The problem?

We’re starting to see that even luxury brands aren’t impervious to the challenges hammering the broader economy.

The underlying data we’re viewing today tell a story that’s far less rosy than the narrative those numbers told back in October. Even customers who are better insulated from the impacts of inflation are ratcheting back on spending.

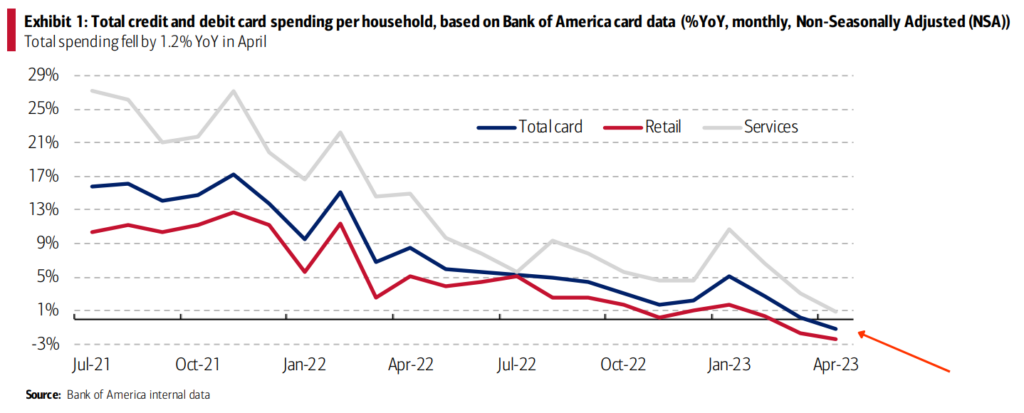

Bank of America’s latest monthly consumer checkpoint serves as proof: Household spending in April declined 1.2% on a year-over-year basis.

It was the first negative monthly growth reading since February 2021.

The same report from Bank of America revealed that discretionary spending by higher-income consumers is now growing at a slower rate than lower and middle-income households.

Wealthier folks are no longer “immune” to the consumer squeeze – they’re feeling the effects of interest rate hikes and inflation just like everyone else.

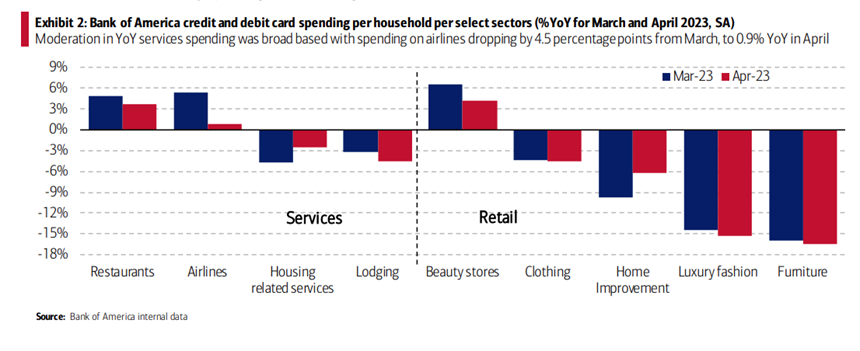

Among the sectors hardest hit by this pullback, says Bank of America data? Luxury fashion.

To better understand how this could be impacting our high-end retail stocks, we compared these findings with our own real-time consumer data. And we zeroed in on a couple of brands that investors should watch – and even be worried about.

In fact, here are two companies we were bullish on and brought your way. You’ve even made money on them.

But the data has flipped from bullish to bearish…

Meaning: This may be a good time to take profits.

Otherwise, get ready to embrace a longer-term holding strategy, understanding you could be in for a bumpy ride with stock price volatility…

🚩 Red Flag No. 1: Lululemon (LULU)

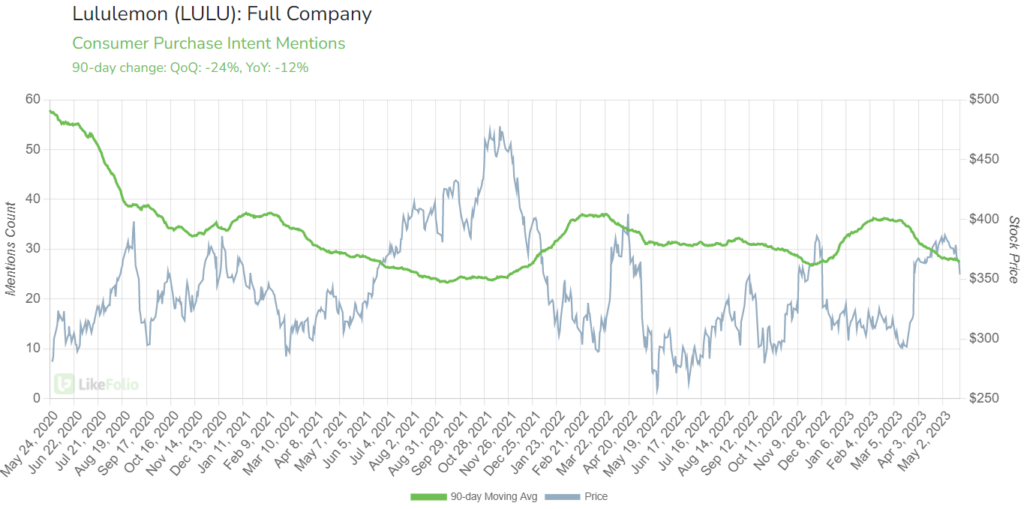

Turns out, my Lululemon experience wasn’t an outlier event.

Consumer mentions of shopping with Lululemon have slipped 12% year-over-year when measured on a 90-day moving average.

And they’re down 17% from last year on a 30-day moving average.

What does this mean?

Well, when we zoom in on those shorter-term timeframes and see an even greater decline in mentions, it means one thing…

Demand is eroding at an accelerating rate: The slide is steepening.

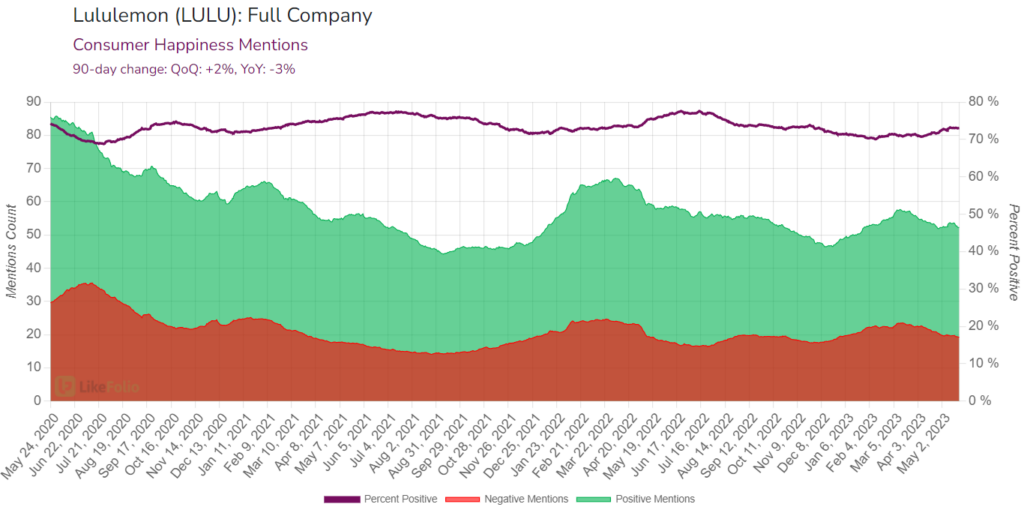

Long-term, Lululemon still holds one of the highest Consumer Happiness ratings compared to other retailers at 73%.

In short, this is a good company.

But investors who stick around should buckle up for a bumpy ride in the second half of the year.

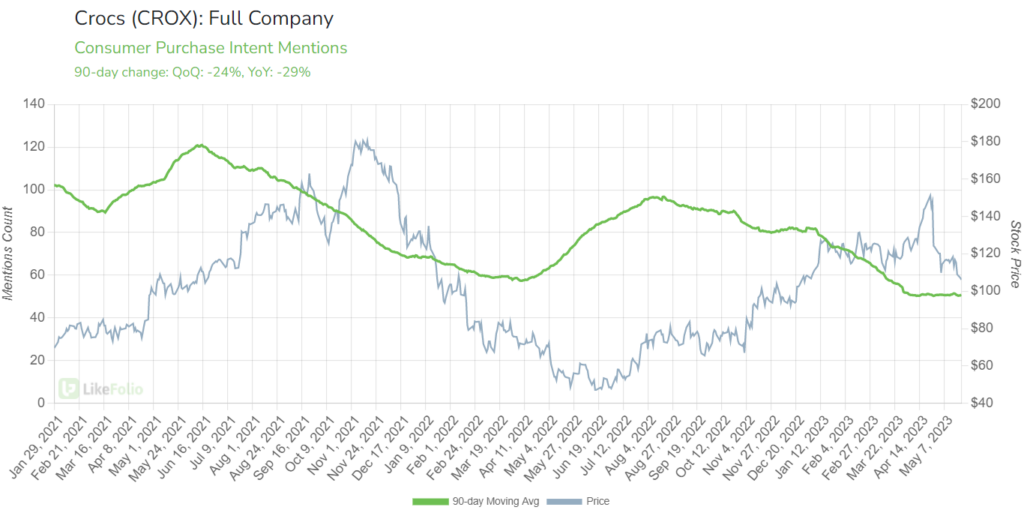

🚩 Red Flag No. 2: Crocs (CROX)

LikeFolio issued a bullish alert for Crocs (CROX) late last August.

We’re currently up 37% on that call (with peak gains of 94%).

But just like with Lululemon, demand is weakening for the “King of Comfy Shoes.”

Just like with LULU, consumer mentions of purchasing a pair of Crocs (including its owned-brand Hey Dude Shoes) have slipped by 29% from this time last year.

And if we look at that shorter 30-day moving average, with a drop of 44%, we know this rate of decline is even steeper over the last month.

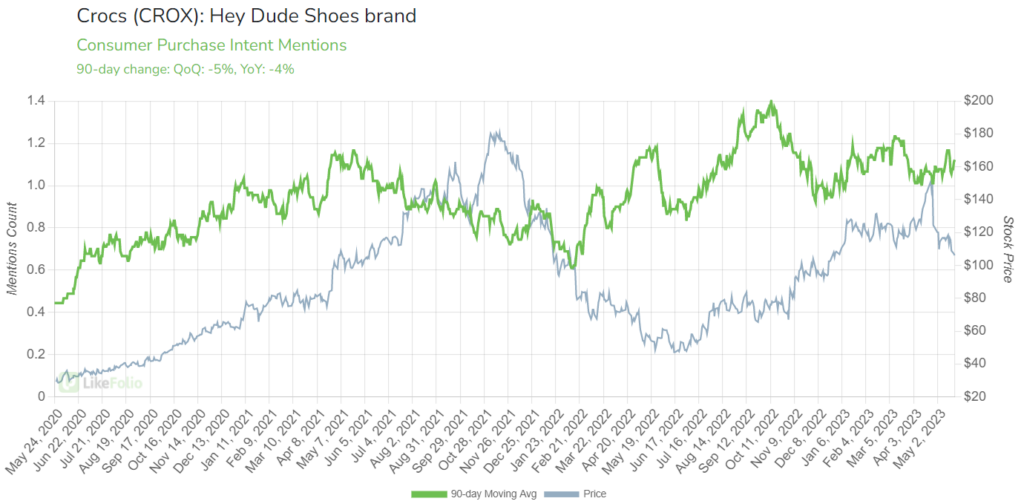

The demand drop-off for Hey Dude Shoes is especially troubling.

Crocs dropped a cool $2 billion-plus for the brand at the end of 2021. And Hey Dudes was once a booming business and a major generator of new revenue for the company.

While demand for Hey Dude Shoes is looking better than the company’s flagship Crocs brand, Purchase Intent mentions are still down 5% from the same point last year.

So that Crocs growth engine is throttling down.

We don’t see a reversal of these troubling trends here in the near term.

Take those profits while you can.

Bottom line: It’s a good time for investors to play defense, and use LikeFolio data to spot red flags before they hit your portfolio.

All the best,

Megan Brantley

VP of Research