Across the hundreds of macro trends tracked across the ever-growing LikeFolio universe, there are three that saw big “pops” in social media chatter this week.

“Popping” isn’t a scientific term, I grant you.

But it’s accurate. It’s backed by a method that’s simple, quantifiable, and increasingly predictive.

And that hands you opportunities to make money – and escape losses.

That’s what we’re bringing you today.

Two opportunities, one warning, all powered by LikeFolio’s real-time consumer insights.

And you’ll want to listen – because we can quantify trends that are “popping” by using the same methodology we use to formulate Earnings Scores for publicly-traded companies.

Similar to the Earnings Score, we use a –100 to +100 metric to determine positive (or negative) trend momentum. Higher scores indicate significant and unusual mention-volume surges for each trend observed.

Of the three on our radar this week, at least one stands to be a major headwind for the companies facing it. And that could spell trouble for unwitting investors. (Consider this an early warning.)

The other two trends we’ll cover today could serve as tailwinds for certain players ready to harness all that forward momentum and set sail.

These are three investable trends you can’t afford to miss…

📺 Trend No. 1: Struggles Mount for This Streamer

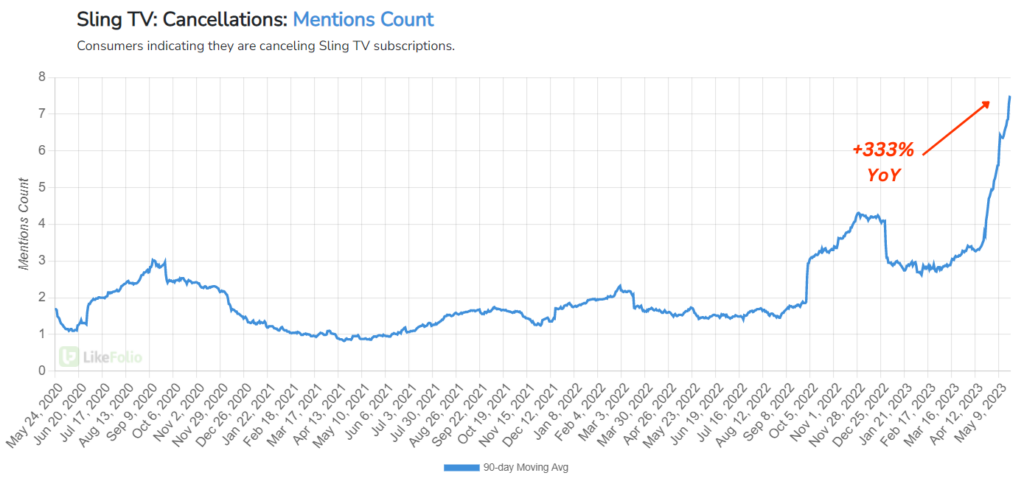

The strongest trend “pop” our system registered this week was around Sling TV cancellations, with a score of +99.

Consumer mentions of canceling their subscriptions with the DISH (DISH)-owned streaming service are currently surging by 333% year-over-year.

And no, that’s not a typo. Take a look for yourself:

There’s an underlying factor at play here that’s helping to send those mentions skyward: Sling TV appears to be the most popular streaming network for viewers seeking Fox News.

And with the removal of controversial (but beloved by many) host Tucker Carlson, Twitter is in an uproar.

More troublesome for investors though is that mentions of Sling TV streaming errors are also rising – and fast.

We’re in the middle of the NBA playoffs right now – the Nuggets shut out Lebron James’s Lakers in an unexpected Western Conference Finals 4-0 win on Monday.

And if you were watching on Sling TV, you might’ve missed a few things…

Passionate fans have been lamenting Sling TV’s slow streaming, constant buffering, and service crashes. More than a few “big moments” were missed.

Viewers of live sporting events – especially when watching their favorite teams – quite naturally have high expectations. So these folks react in a very strong way to any delays, lapses in coverage, and other programming errors.

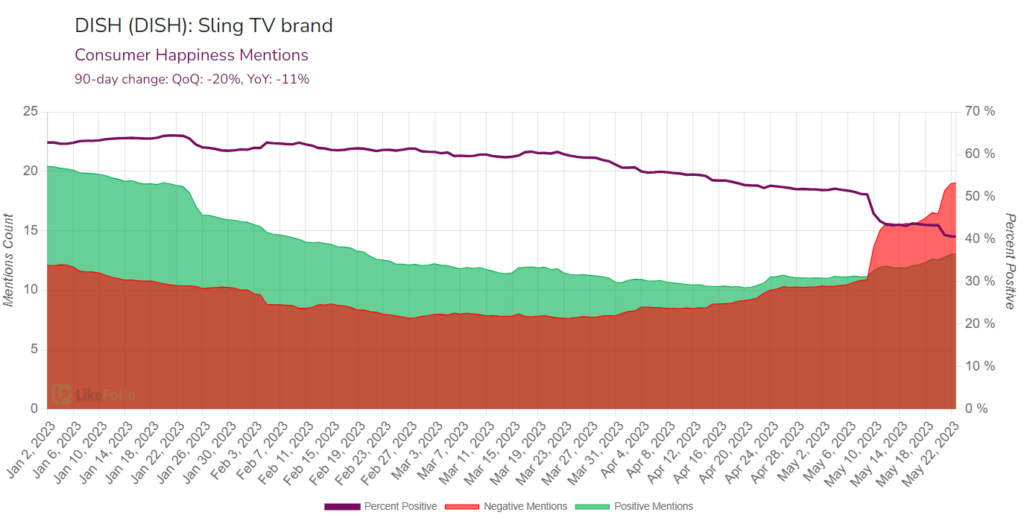

As a result, Consumer Happiness mentions around the Sling TV brand are slipping by 11% year-over-year and 20% quarter-over-quarter:

That’s taking a toll on DISH’s overall Consumer Happiness score too, which has tanked 14 points year-over-year to an abysmal 38%.

But there may be a beneficiary here: Disney (DIS)-owned Hulu.

LikeFolio trend data shows Hulu cancellation mentions are actually down 2% on a year-over-year basis while many other streamers struggle with influxes of negative sentiment and cancellation threats.

Now, let me show you these next two trends – both of which present opportunities for investors in the here and now…

💊 Trend No. 2: Weight-loss Drugs in the Limelight

It’s human nature to search for the easy way out of any problem. If you’re looking to lose weight, a “magic pill” is a whole lot more alluring than the “real work” of diet and exercise.

So when drugs that were originally designed to treat diabetes turned out to be effective weight-loss treatments, social media was quick to catch on.

The drug I’m talking about is called Semaglutide – a prescription injection meant to regulate blood sugar levels by acting on GLP-1 receptors in patients. In layman’s terms: The drug also regulates hunger, which makes it easier to lose weight.

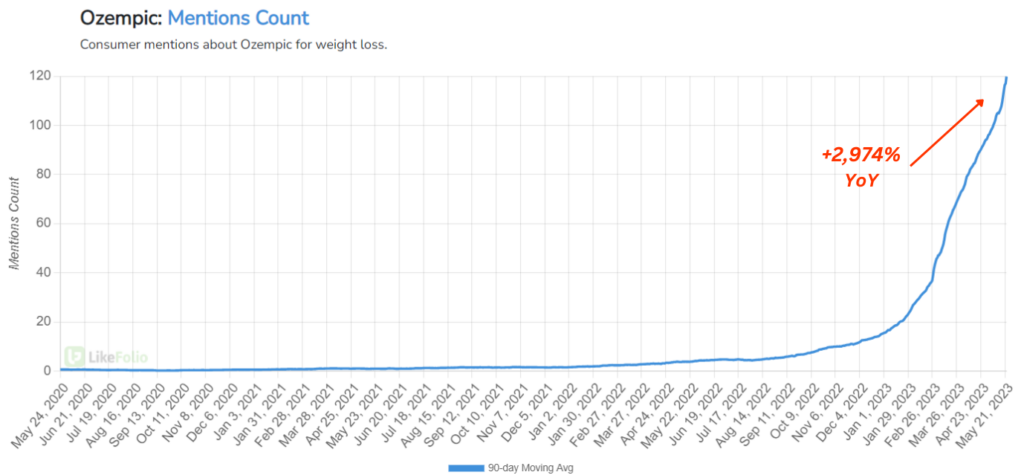

Consumer mentions of Semaglutide’s name-brand counterparts, Ozempic and Wegovy – both owned by pharmaceutical maker Novo Nordisk (NVO) – have skyrocketed here in 2023.

But it was Ozempic mentions that surged enough to receive a significant +86 score from our system.

What caused such a spike?

Phase 2 clinical trial results from competing drugmaker Pfizer (PFE) are what happened – revealing that its own oral weight loss drug (Danuglipron) may be just as effective as an Ozempic injection.

Novo Nordisk-owned Ozempic still holds a massive brand recognition lead when it comes to mention volume over other established brand names.

But we wonder if these new developments are a case of rising tides lifting all boats?

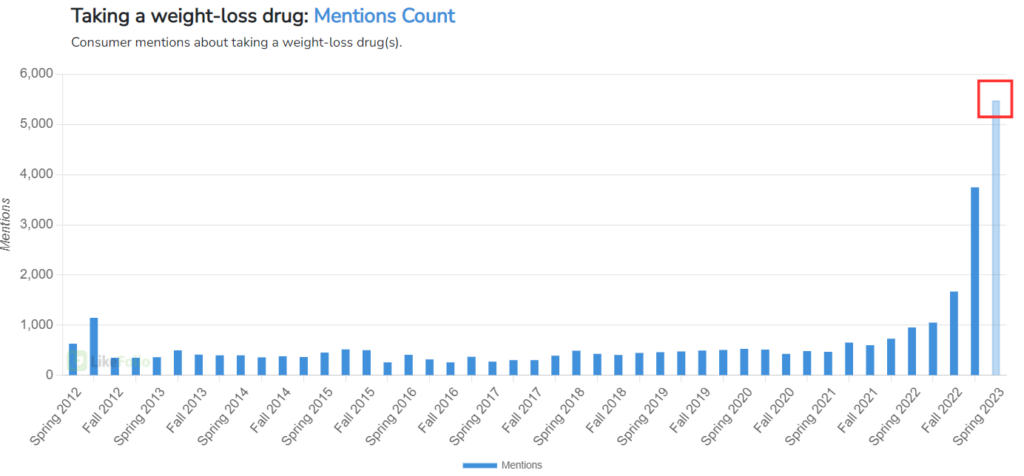

Overall consumer mentions of weight-loss-drug use are accelerating in the current quarter, pacing 491% higher year-over-year.

Pharma players Novo Nordisk, Pfizer, and Eli Lilly (LLY) – the maker of fellow trendy weight loss drug, Mounjaro – are all vying for a piece of the weight-loss pie.

We’ll be tracking mentions of Pfizer’s new weight loss drug to see if it can catch up.

In the meantime, check out WW International (WW).

The company, better known as WeightWatchers, made a savvy move this year with its acquisition of Sequence – a telehealth company that gives WW access to a niche digital market of overweight consumers.

And more importantly, the ability to connect its users via medical doctors to prescription drugs Ozempic, Wegovy, and Mounjaro.

₿ Trend No. 3: Near-Term Bitcoin Weakness = Opportunity for Investors?

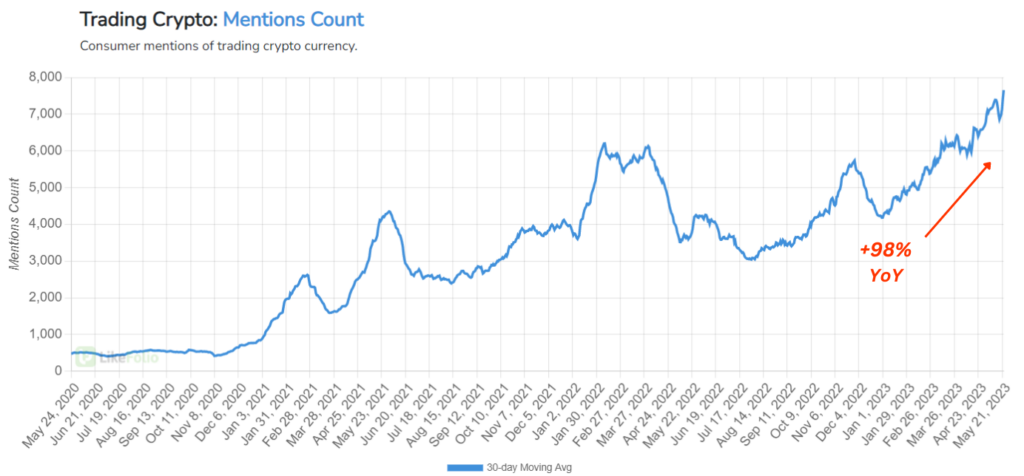

And last but not least, consumer mentions of trading cryptocurrency continue to rise – now up 98% year-over-year – and triggering a trend score of +46.

The price of Bitcoin (BTC) is down slightly on the month after reaching $30,000. But LikeFolio data reveals signs of mentions and sentiment improvement over the last week.

Is this near-term weakness an opportunity for long-term investors?

We certainly think so.

Until next time,

Andy Swan

Co-Founder