Late 2018 through the end of 2022 was a dark time for WW International (WW), the company formerly known as WeightWatchers.

Even with a list of celebrities from Oprah to James Corden touting the benefits of the WeightWatchers’ program, the stock was in the tank – thrown out by Wall Street as a has-been.

But here at LikeFolio, we saw something unfolding on Main Street that Wall Street hadn’t noticed yet.

Real-time consumer insights revealed that WW International was gaining momentum with consumers under new leadership – outperforming other weight management services and home fitness companies in demand while maintaining high levels of Consumer Happiness.

That’s why we issued a bullish report on the stock in December, when it was trading near $3.70, and predicted that WW shares could climb by more than 100% within the next two years.

It was a bold prediction but we stood by it, knowing the power of consumer sentiment data in predicting future moves in the stock market.

And we were right.

Since the report was issued, the price of WW stock has increased significantly, rising from $3.73 per share on the day the report was sent to $8.32 per share as of April 18.

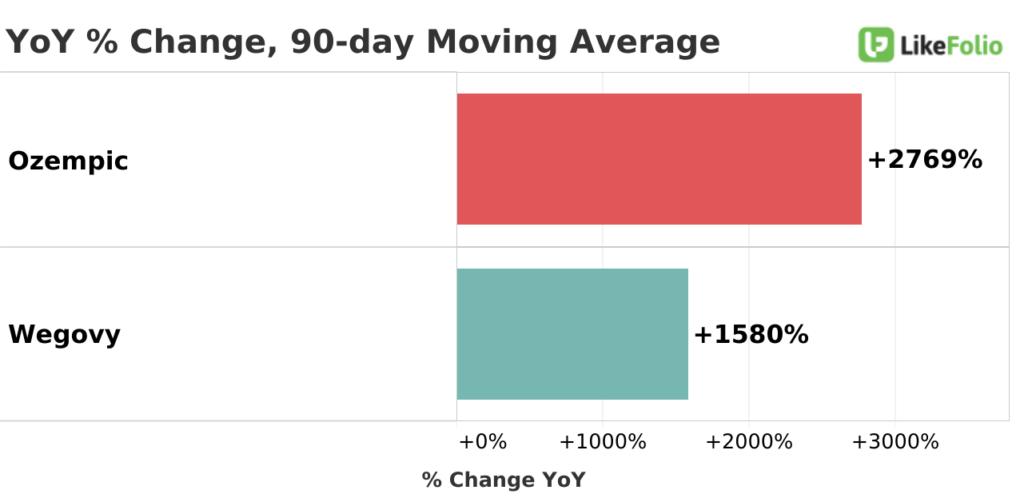

One of the positive impacts for WW is its acquisition of Sequence, which will allow WW to tap into the rapidly rising trend of consumers seeking prescription weight loss drugs like Ozempic, Wegovy, and Mounjaro.

Of course, the stock market is a forward-looking beast.

So, the key question is: Where does WW go from here after such a massive price climb?

Is there still time to invest or has the opportunity passed?

Here’s what’s next…

The Trends That Could Send the WW Stock Price Even Higher

From here, we’ll be watching for these key signs that WW could run higher:

- Improvements in WW consumer demand, measured by Purchase Intent (PI) Mentions of folks signing up or using a WW service…

- And key macro trend tailwinds to continue – namely, demand for weight loss drugs like the three we mentioned earlier.

Early signs do show momentum…

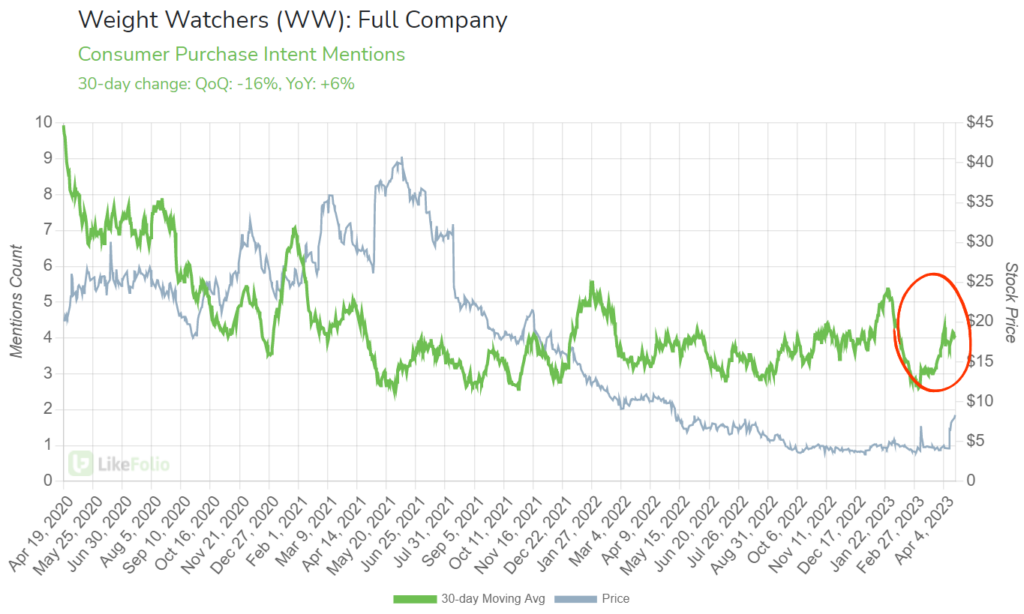

WW demand is pacing 6% higher year-over-year in the current quarter, which kicked off in April:

Macro trend tailwinds remain hot:

And WW stock is still rolling.

LikeFolio Opportunity Alert subscribers had a head start in making that triple-digit gain.

And those of you who’ve been following Derby City Daily closely have been in the know since March 8, when the news broke about WW’s Sequence acquisition.

Shares have gained 40% just in the month and some change since then.

Bottom line: Between more people talking about using WeightWatchers, and the company’s strategic move into prescription weight loss drugs, WW International is in the driver’s seat – ready to capitalize on an emerging trend that isn’t going to stop any time soon.

If you were able to invest in WW thanks to one of our earlier calls and have made money, I’d love to hear from you.

Let me know how the trade worked out here.

Until next time,

Andy Swan

Co-Founder

💡 Ready to uncover more opportunities? Check out this company that’s taking a page out of Apple’s book by enabling high-value experiences that are winning over consumers amid economic uncertainty. Full story here.