Earlier this week, Nvidia (NVDA) upped its quarterly revenue guidance by a full 50%.

That’s revenue – the “top line” – not profits.

The catalyst?

Artificial intelligence.

That’s right: AI.

And the AI Revolution is unfolding faster than anyone expected.

Even Nvidia.

“The computer industry is going through two simultaneous transitions—accelerated computing and generative AI,” Nvidia CEO Jensen Huang said in a company statement.

“Our entire data center family of products—H100, Grace CPU, Grace Hopper Superchip, NVLink, Quantum 400 InfiniBand and BlueField-3 DPU—is in production. We are significantly increasing our supply to meet surging demand for them.”

Despite its already-rich valuation, investors had a field day with Nvidia’s earnings beat.

The stock price is pushing toward the $400 level as I write this.

That’s a steep climb from where it was trading at $310 on the day before the announcement.

Fortunately for you, LikeFolio has been pounding the table on NVDA since it fell under $200 almost a year ago.

In June of 2022, we issued a special “Buy-of-the-Century” report on Nvidia, saying “We’re buying NVDA below $200 per share” because “we believe NVDA will be a $500 stock within five years.”

As of market open Thursday, that position was up 143%.

In September 2022, we doubled down with a buy alert on NVDA under $130 per share, citing exploding incoming demand in AI, self-driving cars, and data-center use cases.

That position has gained 198%.

In January 2023, we tripled down on NVDA with a buy alert at $173, calling it an “oversold” stock ready to soar.

Another 122% in a matter of months.

Heck, since we first brought you NVDA here in Derby City Daily on February 27, it’s surged 63%; since our March 2 feature issue, it’s up an even bigger 71%.

Like I said – we’ve been pounding clobbering the table on Nvidia.

That’s because we could see what Wall Street hadn’t figured out yet: Nvidia already had a massive claim to the AI boom, well before ChatGPT brought it mainstream.

The company has been tinkering with artificial intelligence applications for decades. Its chips and graphics cards can be found behind some of the world’s most profound AI tech.

And now that the world is catching onto the incredible potential of AI, Nvidia is fulfilling its “destiny” as one of the leading moneymakers in the industry.

But there are a lot more AI stocks out there for investors.

So, as Nvidia barrels toward a trillion-dollar market cap, we’re spotlighting a few… “non-traditional” AI stocks.

Not the tech giants that everyone already knows about.

The smaller players… the “undercover” AI investments… the companies you otherwise wouldn’t have guessed were “AI plays.”

Some of these names have found unique ways to leverage AI with promising profit potential.

While others… we’re not so convinced. Yet.

Check out these AI successes and failures (so far)…

AI-Powered Shopping 🛍️

Pinterest (PINS) might look like a social media stock on the surface – but it’s really an “AI” stock hiding in disguise.

The company realized the importance of seamlessly blending content and ads where people weren’t even really able to tell where one began and the other ended. Way back in 2015.

For an undisclosed figure, Pinterest bought the recommendation engine tech startup Kosei, which could recognize “400 million relationships between 30 million products.”

With Kosei’s tech, Pinterest can help match content recommendations people want to see while also connecting what people are searching for with relevant advertisements.

More recently, in June 2022, Pinterest signed a definitive agreement to acquire The Yes, an AI-powered shopping platform. The platform enables people to shop a personalized content feed of styles, sizes, and brands.

These AI-powered recommendations are doing such a good job that it doesn’t even feel like people are bombarded with ads or feel like they are being hit over the face to buy something.

PINS is down 13% since that April 22 issue. This is a long-term horizon type of play.

AI-Powered Live Sports ⚽

This next stock is a “shoot-for-the-moon” kind of opportunity: Fubo (FUBO).

The company offers live streaming at a time when more consumers than ever are bypassing traditional media platforms for online content.

Its specialty: live sports.

Fubo’s positioning in the live sports market initially helped to attract new users to the platform – and the company is now executing creatively.

The company tapped into artificial intelligence with its 2021 acquisition of Edisn.ai, which gave Fubo access to computer vision technology that can track and identify specific athletes.

According to CEO David Gandler, “With Edisn.ai, [Fubo] will be able to create new experiences that integrate interactivity and data directly within our live TV feeds, pushing the boundaries of innovation even further.”

The company reiterated its intent to use Edisn.ai to “build the future of live TV with AI as its centerpiece” in its recent first-quarter earnings release.

But Fubo still has a lot to prove for a moonshot wager to pay off.

FUBO is up 18% since that May 6 issue, with peak gains of 50% on May 23.

AI-Powered Drive-Thru 🍟

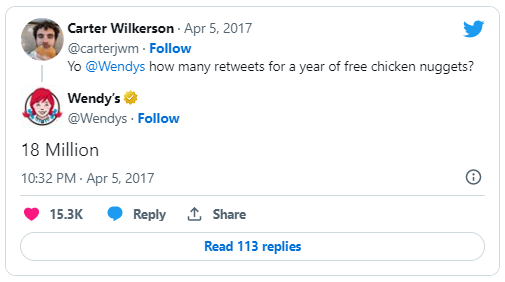

Iconic fast-food joint Wendy’s (WEN) has come a long way from its Clara Peller “Where’s the Beef?” ad campaign, from its sunroom dining areas – and even from its fun joyride at the top of the Twitter charts for its infamous roasts and customer engagement.

The company grabbed some headlines recently with its food delivery automation plan. Wendy’s wants to use an old-school underground banking tube to send your order from the restaurant to your car, no human needed.

This streamlined future includes an AI integration partnership with Google (GOOGL), where an efficient chatbot would process your drive-thru order.

It’s a tech-embracing storyline that’s helped drive Wendy’s shares higher. The stock was trading 41% above its year-ago price, as of earlier this week.

Unfortunately for Wendy’s, at the same time its stock price has run up, it’s found itself in last place behind other major fast-food players when it comes to LikeFolio consumer mention data – as well as market share.

Could this hot new AI strategy be the secret ingredient Wendy’s needs for a comeback special?

WEN hasn’t moved much since we covered it May 24. We’ll be keeping an eye on this one.

AI-Powered Playlists 🎧

Last but not least, check out what Spotify (SPOT) is doing with AI.

The music streaming service rolled out a personalized AI-powered DJ named Xavier (or “X” for short) and set the internet ablaze. You can see the surge in “spotify dj” searches mapped on the Google Trends chart below:

The new feature queues up personalized tracks alongside real-sounding voice commentary from a digital DJ Xavier. Imagine your “Discover Weekly” and “Spotify Wrapped” playlists melded into an on-demand music lineup, just for you, whenever you want it.

Between the ultra-curated sets and raspy-cool DJ voice, listeners aren’t just buzzing about the AI-powered DJ – they’re loving it.

Spotify Consumer Happiness mentions saw a significant boost on the feature’s release.

Spotify’s DJ Xavier is an awesome application of AI.

But for investors, it’s more than just cool – it has serious implications for an AI space with seemingly limitless profit potential and creates a promising investment opportunity for you.

SPOT is up 13% since that March 31 issue.

Until next time,

Andy Swan

Co-Founder