If Celsius Holdings (CELH) has taught us one thing, it’s that oftentimes, it pays to bet on a winning horse.

We highlighted this rising star in November: Even after delivering a 300% win to our subscribers, we believed this better-for-you energy drink brand could be due for a fresh surge.

We were we right. CELH is trading 50% higher since that November 7 issue went out.

For LikeFolio Investor subscribers holding shares from our January 2022 bullish alert, that translated to a 390% windfall. And our more recent bullish alert just over a year ago: +194%.

But believe it or not, we think this quadruple-your-money winner has even more gas in the tank. Here’s why…

A Trifecta of Winning

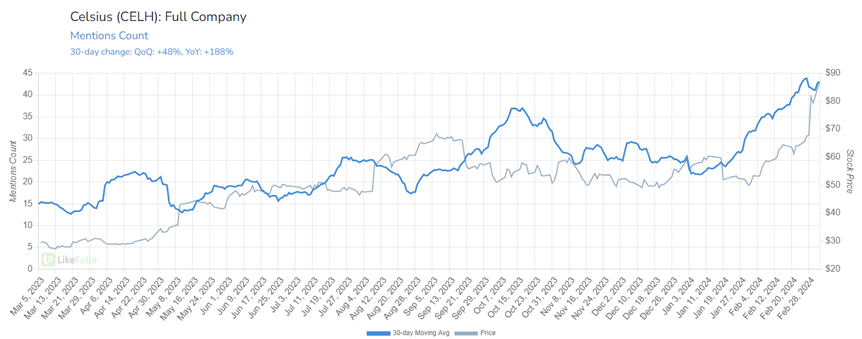

LikeFolio data reveals that CELH is still gaining steam when it comes to brand buzz. Consumer mentions are up an incredible 188% year over year here in March 2024 – continuing to outpace stock gains.

The company best known for its high-quality ingredients and trendy packaging is resonating with consumers more than ever.

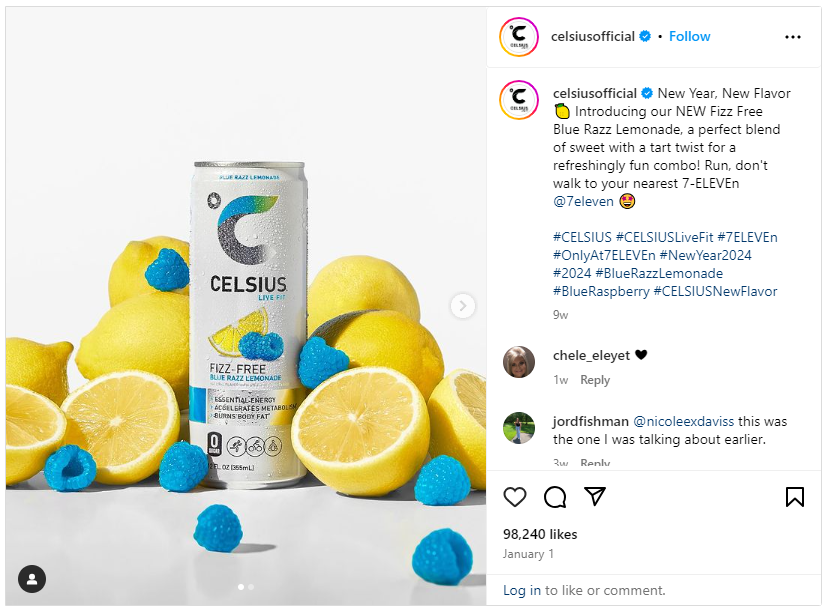

In response to overwhelming demand from its enthusiastic following, Celsius revealed a new line of “fizz free” flavors to kick off 2024…

And this expanded lineup seems to be paying off.

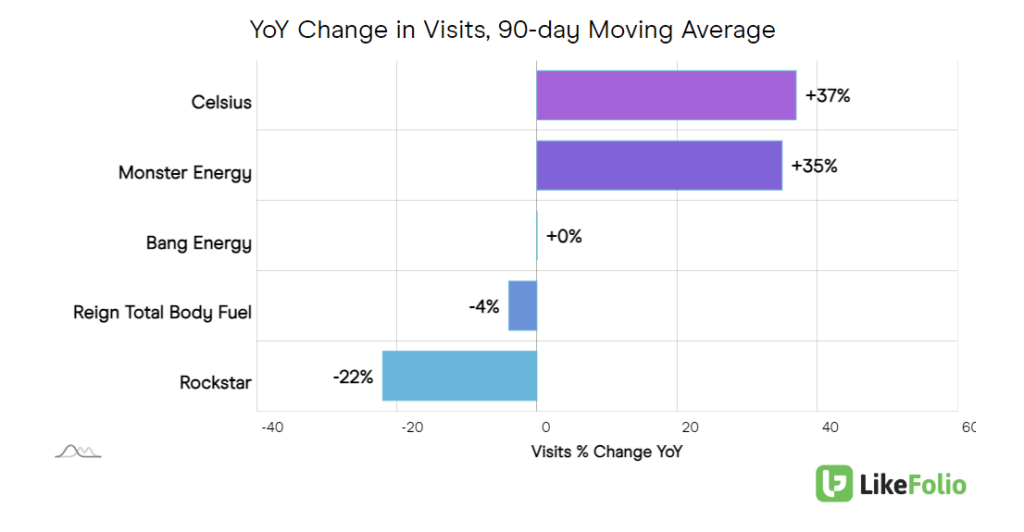

Celsius currently leads other major energy drink brand names when it comes to web visits – a critical metric that’s predictive of future demand.

Web visits have grown an impressive 37% year over year. While Monster Energy (MNST) is keeping a close pace at 35%, Monster’s other brands, Bang Energy and Reign Total Body Fuel, are falling behind… while Rockstar (PEP) suffers a steep 22% decline.

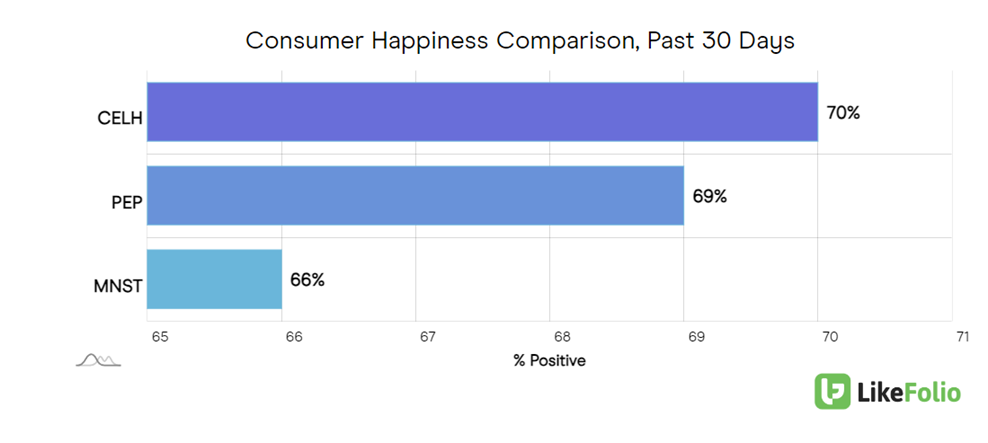

If that all wasn’t enough, check out how CELH stacks up in Consumer Happiness:

At 70% positive, CELH once again leads the pack – several points ahead of other beverage giants PEP and MNST.

That’s brand buzz, web visits, and sentiment where CELH is logging gains: A trifecta of winning.

And its last quarter certainly impressed the market…

Crushing Expectations at Every Opportunity

Celsius’s annual revenue surpassed $1.3 billion in 2023, representing a 102% boost from the year prior. That outperformance was bolstered by 95% growth in the fourth quarter alone. The company also achieved a record operating income of $266 million, translating to an impressive operating margin of 20%.

Much of this is driven by expanded availability thanks to its distribution partnership with PepsiCo. (“The Pepsi Effect” in action.)

Strong word-of-mouth recommendations and robust product placement also meant the company was able to achieve greater market share while spending less on marketing expenses, which were down 11% year over year in Q4.

And this market is still heating up as energy drinks become popular with a wider audience of consumers.

As CEO John Fieldly puts it, “They consume Celsius… but they don’t consider themselves an energy drink consumer.”

The Unexpected Ozempic Effect

Oh – and you know those weight-loss drugs that are all the rage? We’ve talked about the Ozempic craze here before. But what you may not know is that GLP-1 drug users are 72% more likely to consume an energy drink at least once a month compared to the general population.

This probably relates to the need for an energy boost absent significant calorie consumption. If more people take weight-loss drugs as expected, this could increase U.S. energy drink consumption by about 2%.

The Bottom Line

The energy drink market should continue its robust growth, with forecasts suggesting it could reach approximately $110 billion this year, growing at an 8% to 9% annual rate.

Celsius is capturing a larger market share, even as it faces competition from established giants like Monster and Red Bull. Yet despite its rapid growth, Celsius still only represents a small fraction of the revenues of these market leaders, indicating substantial room for expansion, especially in international markets.

We’re maintaining our bullish outlook on Celsius until we see reversals or slowdown in consumer sentiment.

Don’t miss out on another quadruple-your-money winner like CELH. Get access to real-time trade alerts from yours truly, and we’ll deliver the next one straight to your inbox. Here’s how.

Until next time,

Andy Swan

Founder, LikeFolio

P.S. If you own CELH, we’d love to hear how this pick is working out for you. Drop us a line at [email protected].

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

NVDA Who? This AI Chip Maker Could Surge in 2024

Wall Street is still underestimating this name, but we see a massive opportunity…

You Don’t Need to Buy Bitcoin to Ride This Rally

This publicly-traded stock could be your ticket to DeFi profits…