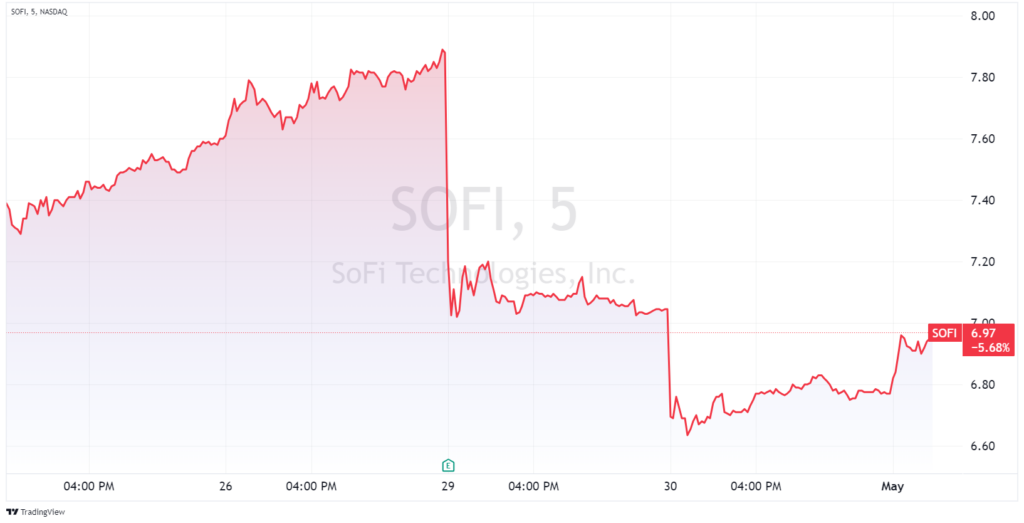

SoFi Technologies (SOFI) reported earnings before the bell Monday that beat expectations on nearly every level.

But the market didn’t like what it saw…

At first glance, it’s a headscratcher. SoFi reported:

- Its second consecutive quarter of profit (2 cents a share bested the consensus $0.01)

- Quarterly net revenue of $645 million, up 37% year over year and far exceeding the expected $555.3 million

- Adjusted EBITDA of $144 million, growing 91% year over year

- 622,000 new member additions, bringing its total count to 8.1 million members – a 44% year-over-year gain

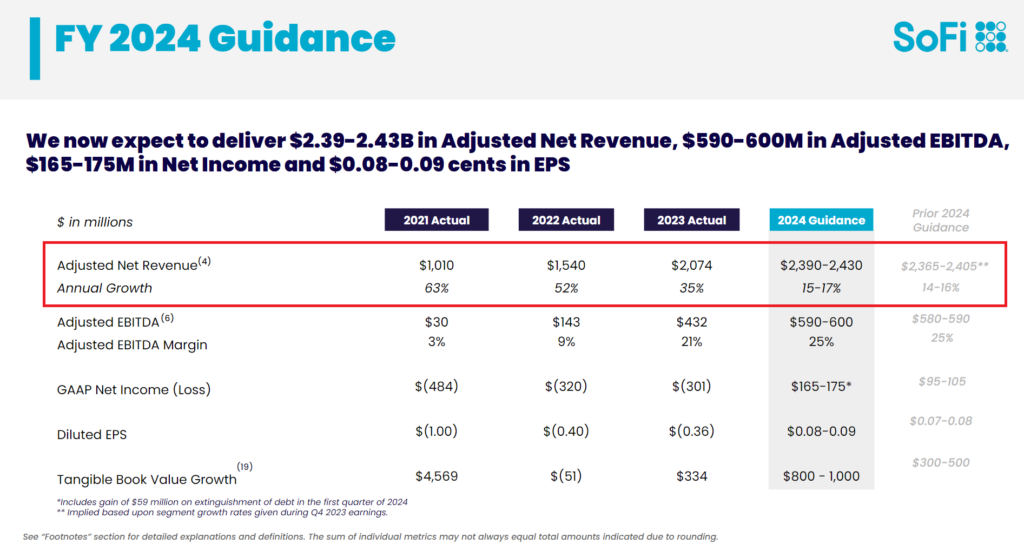

- Raised revenue guidance for the year, now expecting between $2.39 billion and $2.43 billion in FY’24

And yet… SOFI plunged more than 10%.

What gives?

We think the answer comes down to an even bigger question that investors are asking themselves right now:

Is SoFi just another bank, or is it an actual digital wallet play of the future?

Choose Your Side

Right now, SoFi’s growth deceleration has investors wondering if it should really be labeled a “bank” and be valued as such.

Raised guidance is typically a “best-case” earnings scenario, but in this case, it also sheds light on the stark slowdown in SoFi’s annual growth:

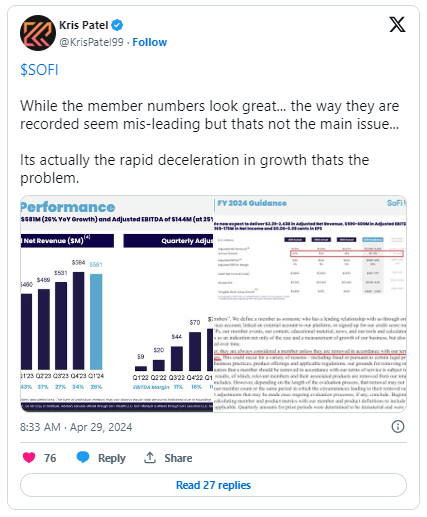

And as this X user points out, it’s this “rapid deceleration in growth” that’s raising red flags:

The company’s “uninspiring” call didn’t help to quell fears about its growth prospects.

Near term, it’s clear that even the “best quarter in the company’s history” couldn’t push its stock higher as Wall Street grows impatient.

On the flip side, there are plenty of investors still in SoFi’s bullish camp – folks who are betting on the transformation of the company’s target market expanding beyond student loans.

Folks like us who see SOFI as a winner in the future of banking.

The Verdict

Ultimately, only you can decide which side you stand on.

As for us, we’re still betting on SOFI becoming far more than just a bank and will treat these dips as opportunities to add shares. But we also acknowledge that the company needs to recover its user growth momentum and continue to execute on those users being more profitable than traditional banking customers.

Two “loyalty” tests are happening in parallel:

- Is the SoFi customer actually loyal enough to be highly profitable for the platform down the road?

- And are SOFI shareholders loyal enough to take that bumpy ride to find out?

Our consumer data remains strong for SOFI – mentions are surging as much as 81% year over year as I write this, while Consumer Happiness has gained four points to nearly 80%.

We’ll be keeping a close eye on growth and the company’s long-term vision from here.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

What the Market Is Still Getting Wrong About Tesla (Watch Now)

Don’t fall for the same mistake – because it could cost you a massive opportunity…

Here’s Proof NVDA Is Just Getting Started

Pay attention to NVDA – the stock price is down, but spending is up, making this a potentially rare window of opportunity…