Today, April 20, may not be an official holiday marked on your calendars… But Americans will spend more money on legal cannabis products than they have on any other day of the year.

On this day commonly referred to as “4/20,” dispensaries in newly-legalized adult use markets like Arizona and Illinois saw sales increase by 134% on average in 2022.

And with this 4/20 falling on a Thursday, which is historically the better day for cannabis sales, according to data firm BDSA – and new adult-use markets like Connecticut and Missouri coming online…

Industry analysts expect April 20, 2023, to set a new record for the most cannabis sales seen in a single day.

For the companies raking in those sales, you’d typically think this would signal an investment opportunity: And by any other industry standard, stocks of billion-dollar cannabis behemoths like Trulieve (TCNNF) and Green Thumb Industries (GTBIF) would be obvious “buys.”

They sell a product that the vast majority of Americans WANT to buy. In fact, Americans spent more money on legal cannabis products in 2022 than they did on chocolate: an estimated $30 billion.

They run tight operations across dozens of states…

- Trulieve with 184 dispensaries across 11 U.S. markets; Green Thumb spans 77 retail locations across 15 states.

They post record revenues year after year…

- Trulieve grew revenue by 32% in 2022 at $1.24 billion; Green Thumb brought in $1 billion for a 14% year-over-year increase.

And better yet, they’re profitable…

- Trulieve banked $682 million in gross profits in 2022, with Q4 marking its 20th consecutive quarter of profitability; Green Thumb managed a gross margin of $504 million for the year.

Problem is, despite 88% of Americans favoring cannabis legalization, archaic federal cannabis laws and stubborn bureaucrats have kept these U.S.-based cannabis companies boxed out of major exchanges like the NYSE and Nasdaq.

Instead, these companies are forced to list on Canadian exchanges, where cannabis IS federally legal, and over-the-counter markets (OTCMKTs), which come with above-average trading fees, lower liquidity, and extra volatility.

That means investing in even the best-performing U.S. cannabis companies is an incredibly risky undertaking.

Without a clear path to federal legalization, these stocks are left with virtually no chance to live up to their full potential.

But in the LikeFolio universe, there’s another once-taboo substance gaining mainstream adoption with just as much (if not more) growth potential as the cannabis industry – where the major investable opportunities are Nasdaq-listed pharmaceutical companies.

Let me show you the better opportunity this 4/20…

The Investable Opportunity in Psychedelics

We introduced you to psychedelics earlier this month as one of the fastest-growing trends in the LikeFolio universe in 2023.

At the time, I told you I’d be back with an opportunity. And that’s exactly what I’m delivering today.

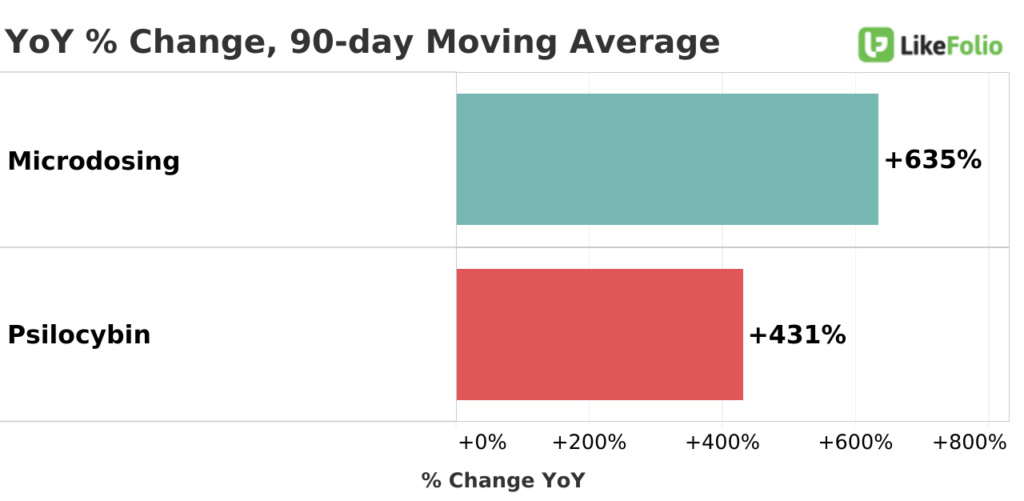

Consumer buzz around psychedelics as an alternative therapy for difficult-to-treat mental health conditions is soaring, with no signs of slowing down:

Microdosing and/or using psilocybin recreationally is illegal under U.S. federal law.

But early studies have shown signs that psilocybin could be a safe and effective medicine for patients with depression, anxiety, addiction, and other mental illnesses when administered with psychological support from specially trained therapists.

So when Oregon voters legalized the use of psilocybin under the supervision of a licensed, state-sanctioned facilitator last January, it opened up a massive opportunity for healthcare companies to enable this therapy in a regulated way.

Then, Colorado joined in legalizing access to psilocybin during the last election cycle – and nearly a dozen more states are looking to do the same this year.

Meaning there’s a clear runway for growth.

So, who are the players to know?

Last year, we initiated coverage on three major drug companies developing psychedelic compounds for use as therapeutic treatments, all of which are stocks listed on the Nasdaq…

Psychedelic Stock to Watch No. 1: COMPASS Pathways (CMPS)

📈 CMPS Consumer Buzz +252% YoY

Treatment-resistant depression costs insurance payers and employers an estimated $29 billion to $48 billion annually in the U.S., and COMPASS Pathways (CMPS) is attempting to solve that costly problem with psilocybin.

Its proprietary formulation of synthetic psilocybin, COMP360 (which is administered in conjunction with psychological support), has been designated a Breakthrough Therapy by the U.S. Food and Drug Administration (FDA) and received Innovative Licensing and Access Pathway (ILAP) designation in the U.K. for treatment-resistant depression.

After a successful Phase 2 trial, COMP360 entered the first-ever Phase 3 trial of a psilocybin therapy.

As regulators across the globe become more receptive to alternative treatment, CMPS opportunity grows… especially if trials continue to perform successfully.

Psychedelic Stock to Watch No. 2: MindMed (MNMD)

📉 MNMD Consumer Buzz –49% YoY

MindMed (MNMD) is working to develop psychedelic-inspired medicines to treat underlying causes of distress in the brain.

Its basic premise: Serotonergic psychedelics like LSD, psilocybin, and DMT promote connections between neurons in the brain – and increased connectivity could help reverse some degree of changes resulting from negative experiences, depression, anxiety, PTSD, and substance misuse.

Earlier this month, the company announced positive topline data from its Phase 2 clinical trial evaluating LSD-assisted psychotherapy in treating Major Depressive Disorder (MDD).

However, LikeFolio data shows a drop-off in consumer buzz around MindMed while CMPS and this next stock are trending higher.

Psychedelic Stock to Watch No. 3: Atai Life Sciences (ATAI)

📈 ATAI Consumer Buzz +136% YoY

Atai Life Sciences (ATAI) seeks to address unmet needs in depression, anxiety, schizophrenia, substance use disorder, and traumatic brain injury (TBI), with its pipeline of treatments leveraging various psychedelics from MDMA derivatives to DMT.

Worth noting: Cathie Wood’s ARK Investment continues to add to its Atai Life Sciences position.

The company manages 12 active programs, including eight drug and discovery programs and four enabling technologies, focusing on differentiated, potentially disease-modifying therapies.

Its RL-007 compound is the furthest along in clinical trials, currently in Phase 2 trials as a therapy for cognitive impairment associated with schizophrenia.

ATAI also works closely with COMPASS Pathways and holds a minority stake in the company, meaning that when CMPS does well – ATAI should too.

The Bottom Line

These psychedelics stocks carry their fair share of risk, as the world of psychedelic treatments is still in the very early phases.

But we’re here to keep you informed about potential opportunities before Wall Street catches wind. And there’s no question that consumers are buzzing about the psychedelics trend.

At the very least, you now know which companies are generating the most buzz – and which to add to your moneymaking watchlist.

Until next time,

Andy Swan

Co-Founder

💡 Up Next: WW International, Our 120%-Plus Profit Play, and What’s Next for the Stock. WeightWatchers stock has gained significantly since we first issued a bullish report. Question now is… After such a steep climb, where does WW go from here? Find out.