U.S. stocks stumbled this week amid concerns over First Republic Bank’s failure (and subsequent rescue by JP Morgan) and the tenth-consecutive interest rate hike from the Federal Reserve, which raised the benchmark to a 16-year high of 5%.

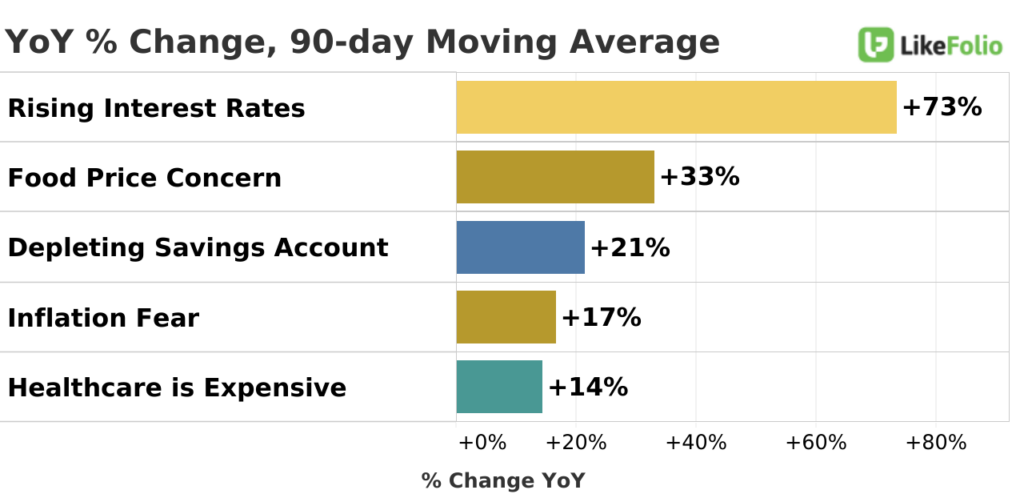

Market uncertainty and persistently high rates aren’t just affecting investors – they’re hitting the consumer psyche too.

LikeFolio social media analysis shows concerns over rising interest rates are front and center on Main Street.

Meanwhile, a perfect storm of macro trends has been brewing:

- COVID-related government stimulus has now run dry…

- Tax refunds came in significantly lower this year, dropping nearly 9%…

- And inflation (remaining 5% higher for the month of March) continues to erode consumer buying power.

Discretionary spending is declining – fast.

And in analyzing LikeFolio’s vast database of consumer data, a clear pattern has emerged where fewer companies are in the bullish camp while more and more discretionary-focused retailers are entering bearish territory.

Leveraging these insights, we’ve been able to identify which companies are facing significant drop-offs in demand – well before they’re due to report their numbers to Wall Street.

Consumers are squeezed for cash. And the products and services these names offer simply aren’t making the cut anymore…

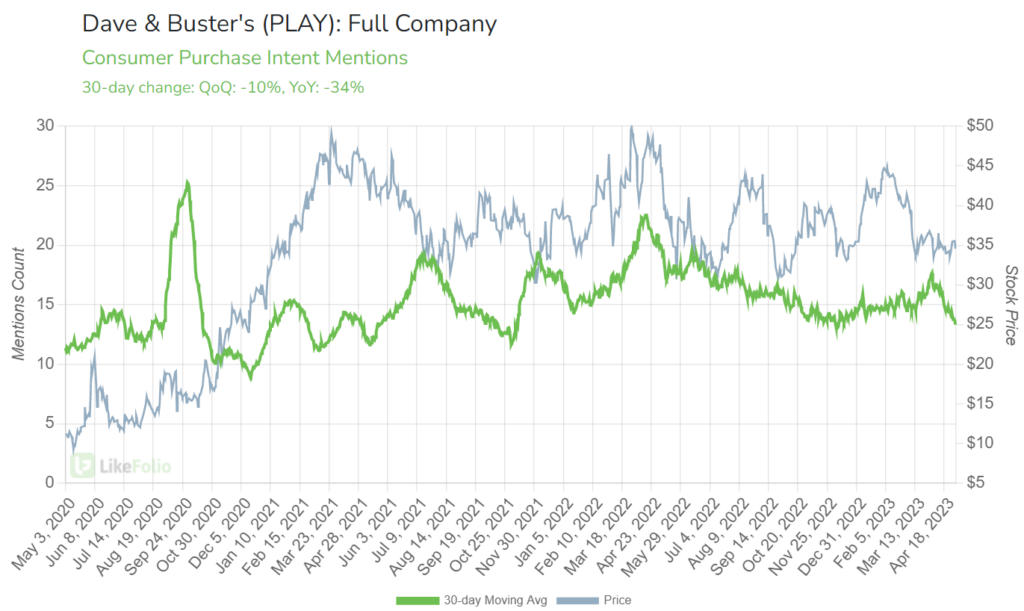

📉 Stock No. 1: Dave & Buster’s (PLAY)

Dave & Buster’s (PLAY), the entertainment and dining venue, just received a bearish LikeFolio Earnings Score of -38.

💡 The LikeFolio Earnings Score is a simple -100 to +100 metric that lets us know if we should be bullish, bearish, or neutral heading into a company’s earnings event. Higher scores indicate a more bullish outlook while lower scores indicate a more bearish outlook. You can learn more about how we use this metric here.

With consumers facing financial pressures, they’re being more cautious about spending on discretionary activities like dining out and entertainment – and that’s taking a toll on Dave & Buster’s consumer demand, which has slid 34% year-over-year on a 30-day moving average:

Dave & Buster’s won’t report its next earnings numbers until June, but thanks to LikeFolio’s predictive consumer data, we already know how demand looks for the quarter it’ll report on (Jan. 30 – April 30).

And that puts you ahead of the investing curve.

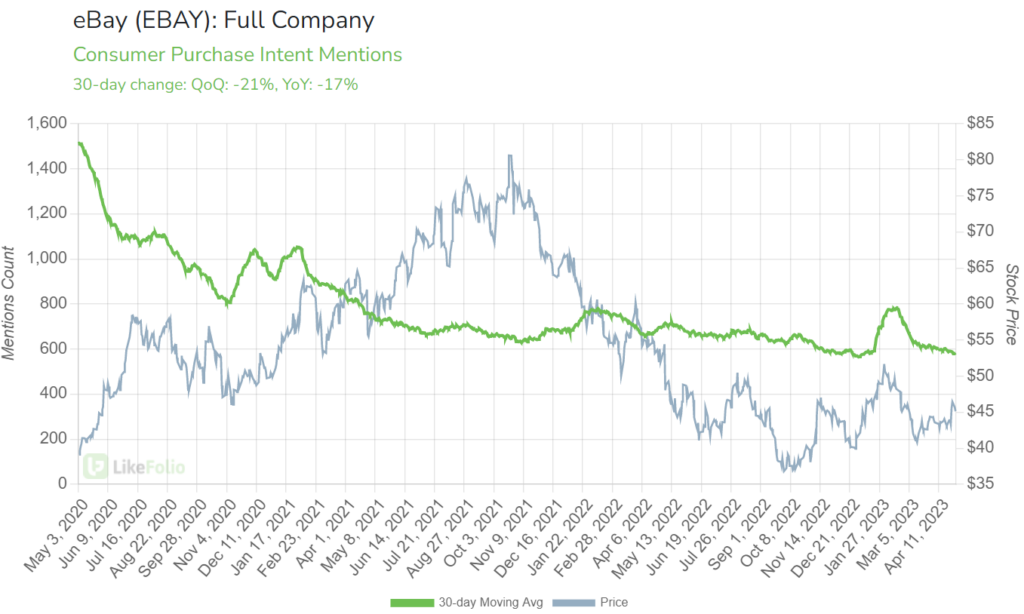

📉 Stock No. 2: eBay (EBAY)

Online sales platform eBay (EBAY) has a LikeFolio Earnings Score of -40, indicating a bearish trend in consumer sentiment.

Fierce competition from e-commerce giants like Amazon.com (AMZN) and Walmart (WMT), along with unfavorable changes to policies that made selling more expensive, are negatively affecting eBay’s market share and user satisfaction.

Demand has slipped by 17% on a year-over-year basis and notably degraded over the last month – which was not reflected in its first-quarter earnings results:

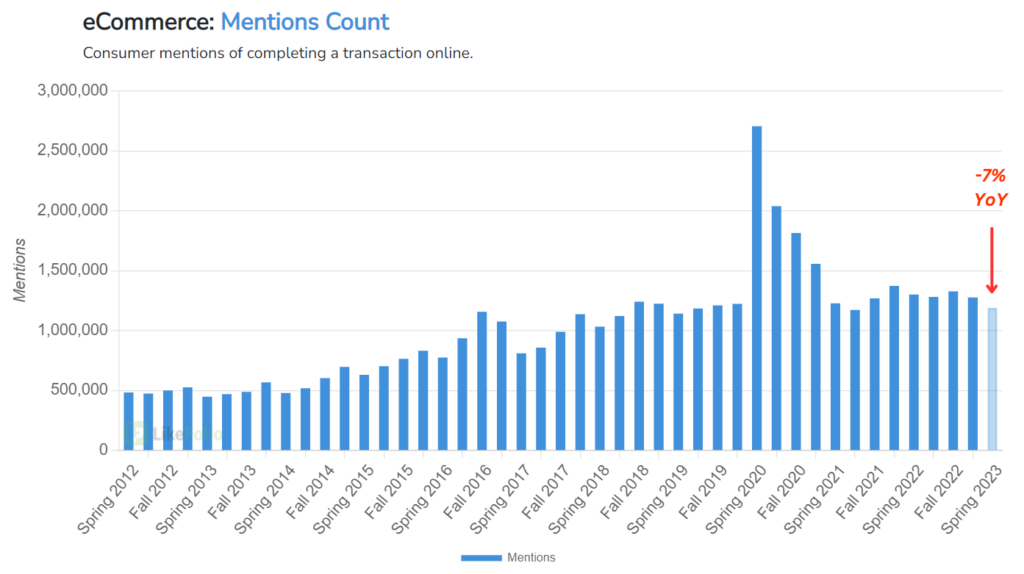

eBay Consumer Happiness is slipping, too, down 4% year-over-year – and overall e-commerce mentions aren’t looking much better:

📉 Stock No. 3: Wix (WIX)

The popular website-building platform Wix (WIX) has seen its LikeFolio Earnings Score drop to -59, putting it squarely in bearish territory.

The company faces increasing competition in the website builder market from companies like Squarespace (SQSP).

While its easy-to-use web builder is great for beginners, who can get started for free, limited functionality may be causing paid business and enterprise users to look elsewhere for more sophisticated web design solutions.

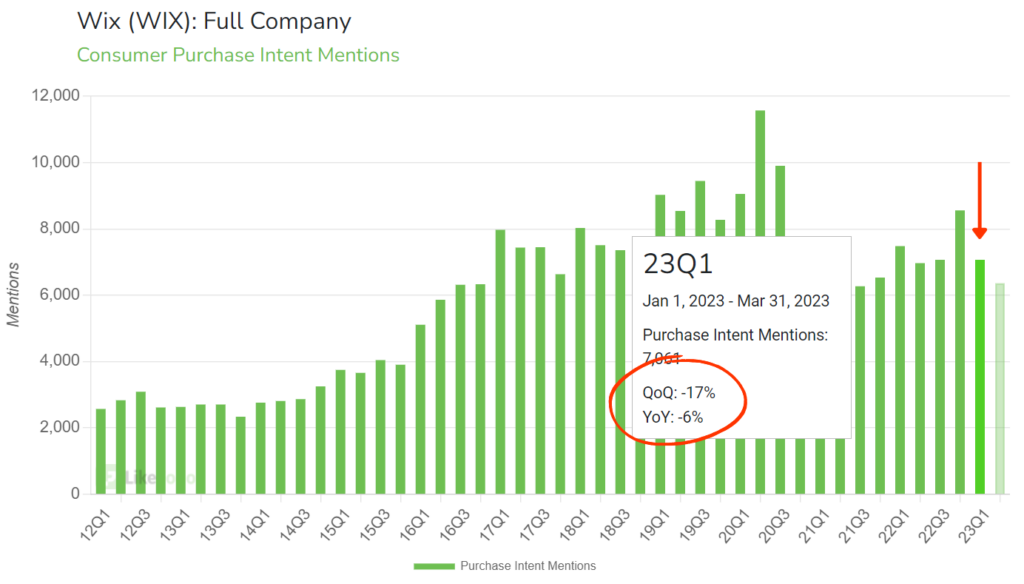

After recording some improvements in 2022, Wix demand in Q1 came in 6% lower year-over-year, reflecting a 17% quarterly decline:

Wix is set to report its first-quarter earnings on May 17, and this data suggests disappointment on the horizon.

Until next time,

Andy Swan

Co-Founder

Up Next: Budgets are tight but one thing consumers ARE willing to spend on right now? Pickleball. 🎾

That’s right: Demand for the retro sport is surging (+185%) – and its rapid adoption feels eerily familiar to another opportunity that was a moneymaker for investors… You’ll want to see this.