The Federal Reserve has approved another quarter-percentage-point interest rate rise, the tenth consecutive increase aimed at battling inflation. This takes its benchmark federal funds rate to a range between 5% and 5.25%, a 16-year high.

As for the future of rate hikes, edits made to the post-meeting statement signal a pause may be imminent: Officials cut a phrase that said “some additional policy firming may be appropriate” in the pursuit of lower inflation.

It seems minor, we know. But within the dialect of “Fedspeak,” where every word is heavy with meaning, the deletion indicates that further interest rate increases aren’t inevitable.

That’s great and all – but here at LikeFolio, we’re especially tuned in to how rising rates influence consumer purchasing decisions, and our consumer insights suggest the Fed may have already taken rate hikes too far.

Today, we’re taking a look at the top investing trends to watch amid this consumer squeeze and the stocks either benefiting or suffering in this tough economic environment…

📰 Investing Trends We’re Watching after Another Fed Rate Hike:

- Discretionary Spending Is Only Getting Tighter

- Consumers Are Falling Behind on Payments

- Big Purchases Are Coming to a Standstill

Investing Trend No. 1: Discretionary Spending Is Only Getting Tighter

Bank of America credit and debit card spending per household moderated in March to 0.1% year-over-year for the slowest pace since February 2021.

This was attributed to a confluence of factors, including a slowdown in wages, lower tax refunds, and Supplemental Nutrition Assistance Program (SNAP) emergency allotments expiring.

A sustained deceleration in wages and a cooling labor market could further slow the rate of consumer spending going forward.

In fact, we’re already seeing the decline in discretionary spending hit three companies in particular whose products and services simply aren’t making the cut with consumers anymore.

Check out our consumer squeeze warning on three stocks seeing demand drop-offs.

Investing Trend No. 2: Consumers Falling Behind on Payments

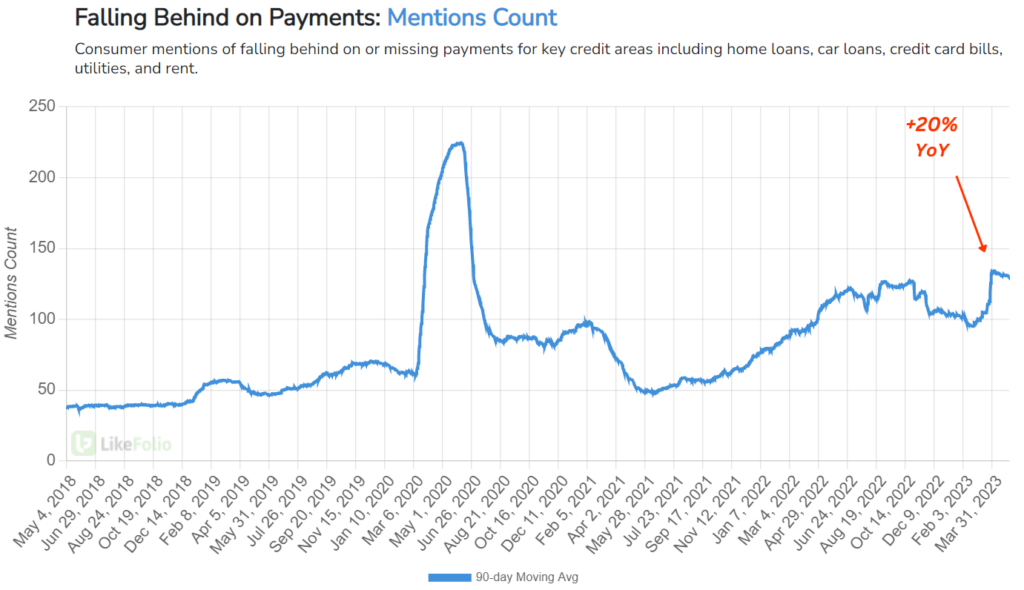

Consumer concerns over not being able to cover their bills each month have risen to multi-year highs, currently trending 20% higher from last year and 27% higher on a quarterly basis.

LikeFolio social media analysis also reveals that mentions of depleted savings accounts and maxed-out credit cards are up 7% and 40%, respectively, on a year-over-year basis.

Together, the data paint a clear picture that consumers are rapidly losing their spending power.

A few sectors that aren’t suffering, though? Beer… and pickleball.

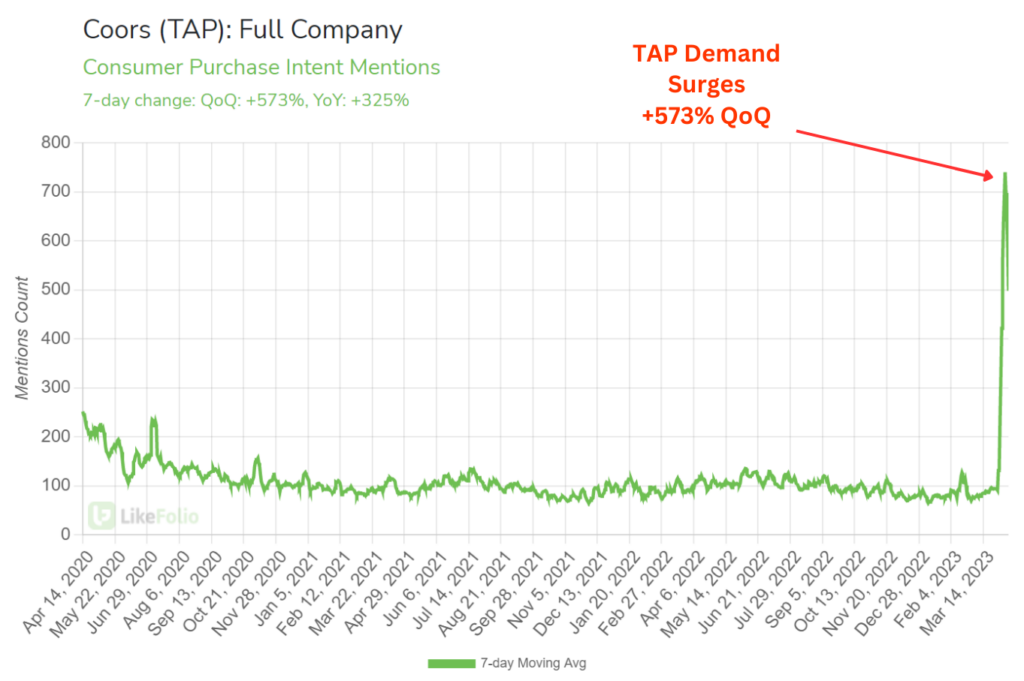

Molson Coors Beverage Co. (TAP) and Anheuser-Busch InBev (BUD) posted earnings beats this week – and we’re not exactly surprised.

We’ve been tracking the drama around BUD’s controversial partnership, and we watched in real time as Purchase Intent (PI) mentions for Coors subsequently skyrocketed:

Alcohol is one of those sectors that tends to outperform other areas of discretionary spending during tough economic times: People are willing to treat themselves to little indulgences and “affordable luxuries” when times get tough. There’s always a few bucks to spare for a beer to take the edge off.

And when it comes to pickleball… well, the popularity of the sport only continues to grow.

Investing Trend No. 3: Big Purchases Are Coming to a Standstill

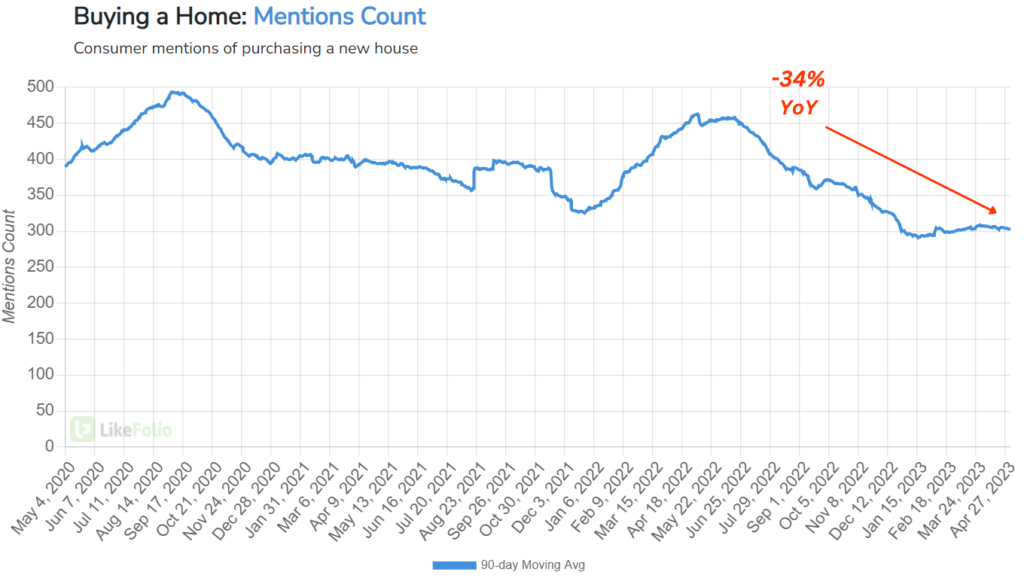

Consumer mentions of purchasing a new house continue to weaken, currently pacing 34% lower year-over-year.

This could be bad news for automakers struggling to achieve profitability on EV investments, like Ford (F).

But it could be good news for auto parts retailers, like AutoZone (AZO), Advanced Auto Parts (AAP), and O’Reilly Automotive (ORLY), as consumers are forced to repair the vehicles they already own.

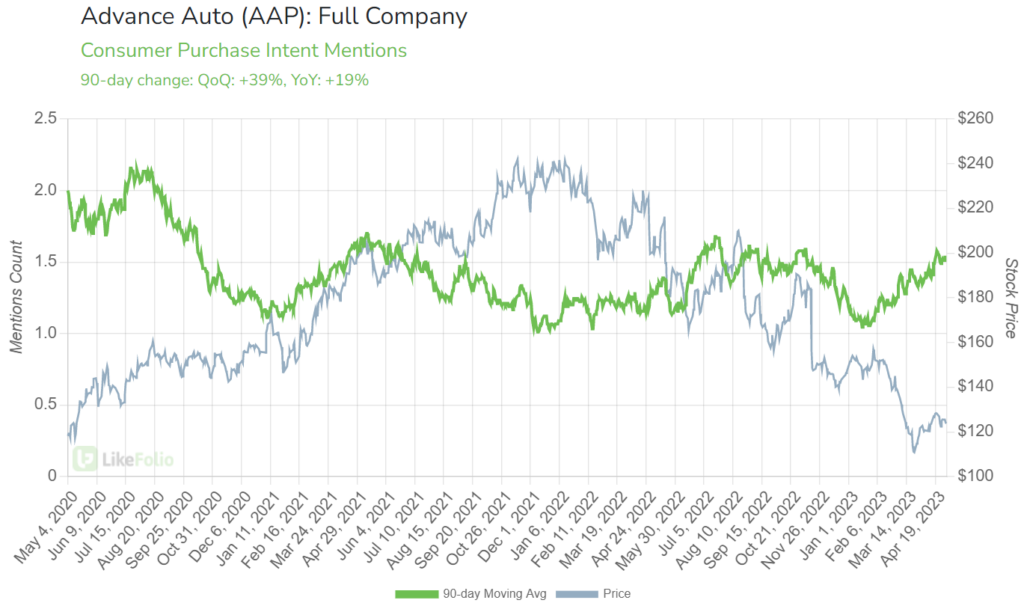

Of the three companies, our database is picking up the most significant demand surge for AAP right now – with Purchase Intent (PI) mentions pacing 39% higher quarter-over-quarter:

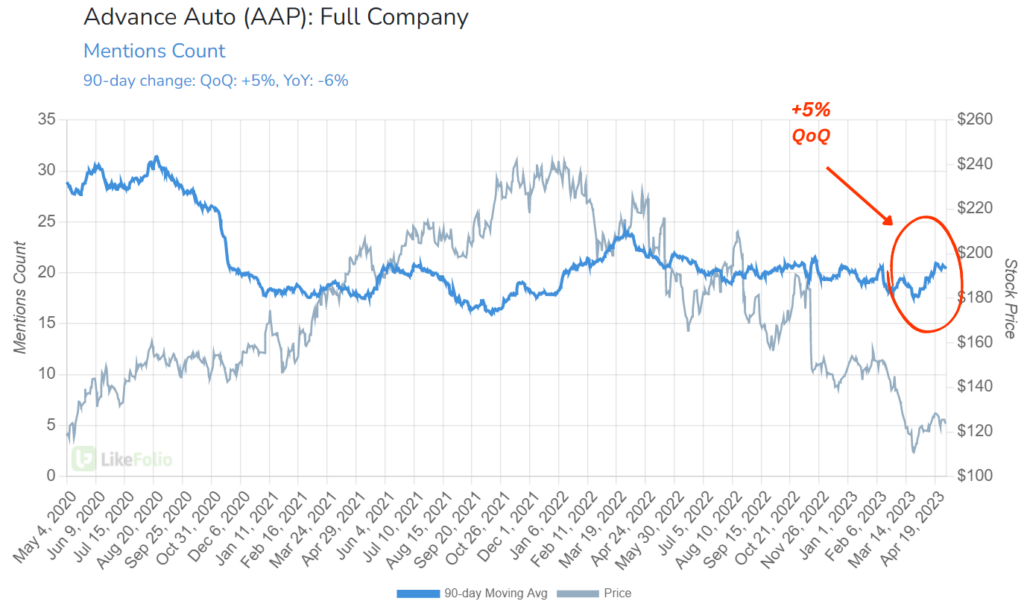

Keep in mind the sample size is still relatively low for this metric (as you can see on the left-hand y-axis), but overall mentions seem to be ticking higher as well, rising 5% on a quarterly basis:

We’ll be keeping a close eye on the auto parts sector for opportunities over the coming weeks.

Until next time,

Andy Swan

Co-Founder