Last week’s Derby City Daily Earnings Sneak Peek featured three big wins with Crocs (CROX), Snapchat (SNAP), and Pinterest (PINS), each of which saw their stock price sink on earnings…

Exactly like we predicted they would.

- CROX shares fell off a cliff, plummeting from $147.78 as of close on April 26 to a low of $116.61 on April 27 for a steep 21% loss…

- SNAP tumbled from $10.50 as of close on April 27 to a low of $8.41 as of this writing for a fast 19% drop…

- And PINS shares lost 18%, falling from $27.27 to around $22 between April 27 and April 28.

Today, we’re back with another exciting preview into this week’s earnings headliners.

Welcome to Week 3 of earnings season – and with about 100 companies in our database set to report, this is going to be a big one…

📅 Earnings Headliners This Week (May 1 – 5, 2023)

- Starbucks (SBUX): Reports Tuesday, May 2

- AB InBev (BUD): Reports Thursday, May 4

- Coinbase (COIN): Reports Thursday, May 4

- WW International (WW): Reports Thursday, May 4

Starbucks (SBUX): Reports Tuesday, May 2

Outlook: Cautiously Bearish

One of the top three earnings plays we love is coming up this week with Starbucks (SBUX), which reports its latest quarterly numbers tomorrow (May 2) after the market close.

Two big red flags are tipping us off that a bearish outcome could be on the table:

- Starbucks demand is slipping…

- And consumers aren’t happy.

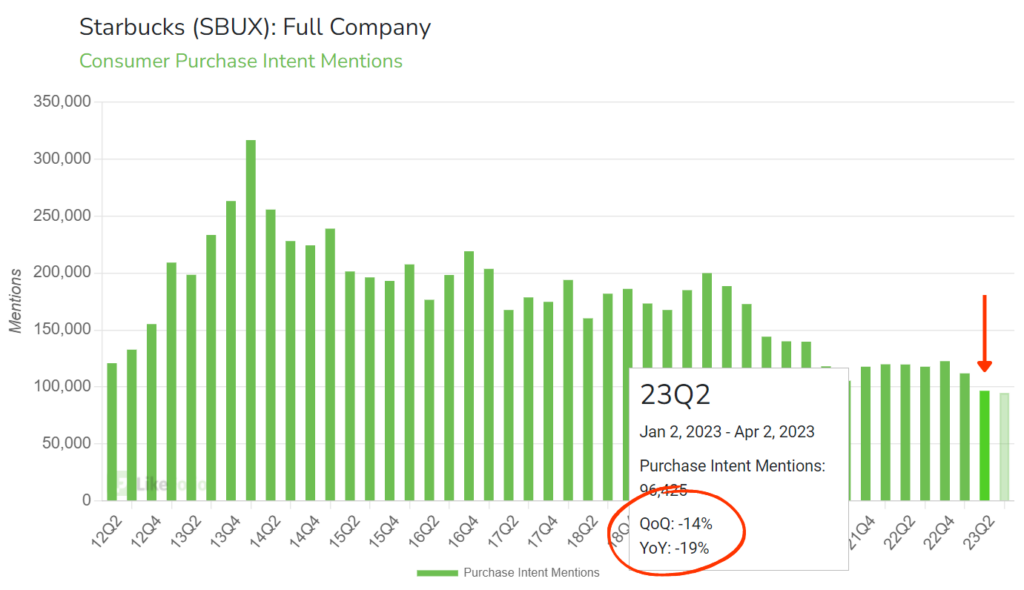

LikeFolio predictive consumer data shows that SBUX Purchase Intent (PI) Mentions for the quarter being reported on came in 19% lower on a year-over-year basis:

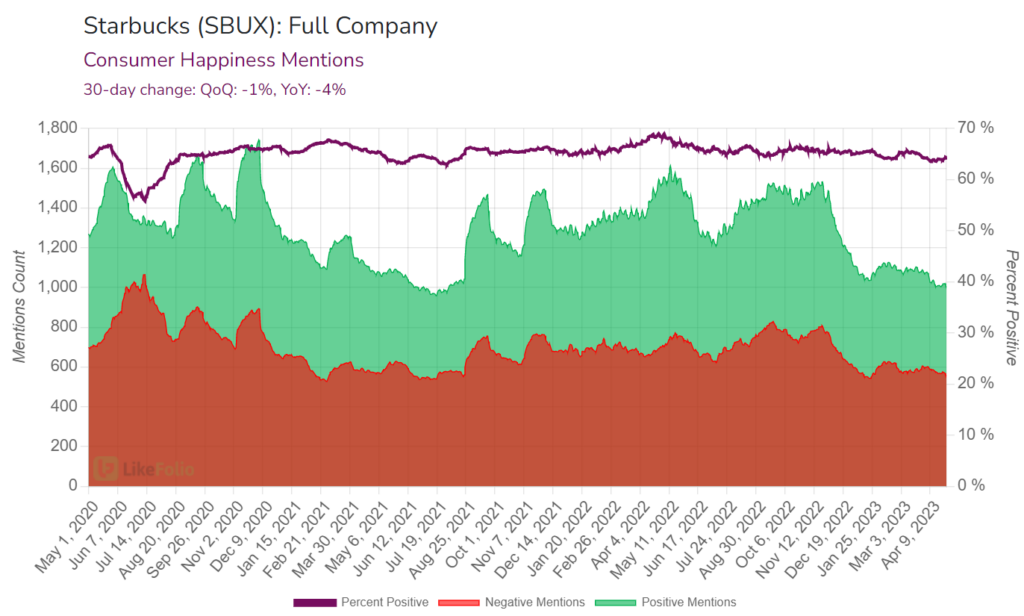

Meanwhile, Starbucks’ Consumer Happiness levels have lost a solid four points from the year prior:

Overall buzz around the coffee chain is down, too. And part of that can be traced back to a major consumer trend we’ve been tracking in 2023: food price concerns.

Social media mentions expressing concern about food prices or the inability to afford groceries are still registering 18% higher than last year’s levels.

And considering a Grande (aka medium) cold brew will set you back $6 at Starbucks, it’s not surprising that many folks are opting for more affordable options in this inflationary economy.

The kicker: While LikeFolio consumer data paints a bearish picture, SBUX stock has been pulsing higher – gaining 10% over the last month and nearly 6% just since last Monday.

And that’s our favorite time to be bearish.

AB InBev (BUD): Reports Thursday, May 4

Outlook: Wild Card

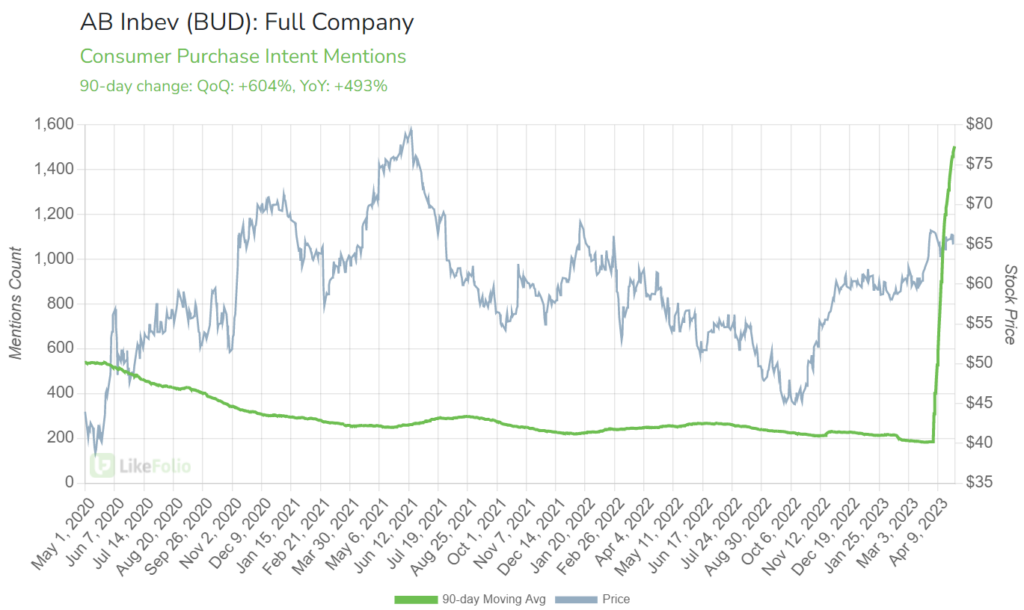

AB InBev (BUD) found itself in hot water last month and the ongoing fallout should make for an interesting market reaction this Thursday.

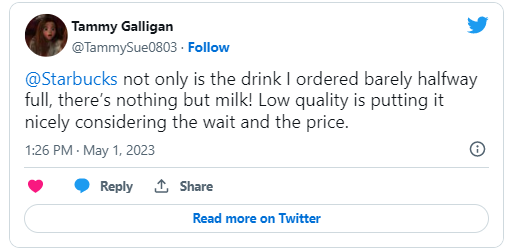

The company managed to tick off a core section of Bud Light drinkers over its new partnership with trans activist Dylan Mulvaney, and the backlash got heated – fast.

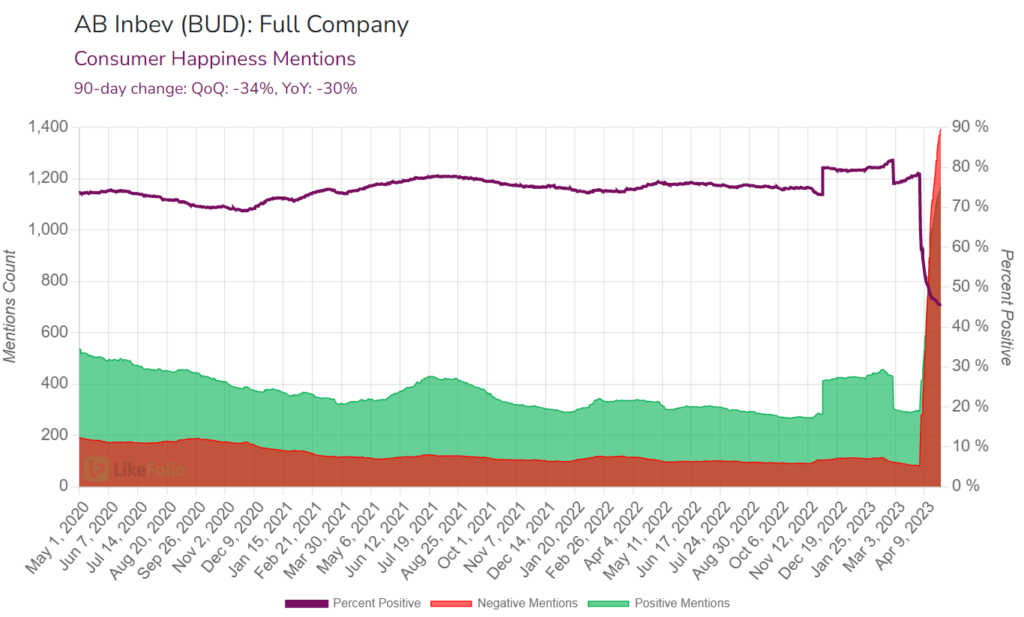

Folks taking to social media to boycott the brand created so much “viral” buzz around BUD that it caused one of the largest (and fastest) drops in Consumer Happiness we’ve ever seen here at LikeFolio:

Others took to social media to defend the brand in droves…

And the polarized Twitter reaction was so volatile that it temporarily “broke” our demand metric, sending BUD Purchase Intent (PI) Mentions vertical in a way we’ve never quite seen before:

This earnings outlook is unpredictable – and will be more fun to watch than trade.

We’ll be listening to see how much of an impact the boycott had on BUD sales, and for any long-term implications if a large swath of consumers truly make the brand switch to Coors (TAP) like they’ve threatened.

Read up on the beer battle brewing between BUD and TAP here.

Coinbase (COIN): Reports Thursday, May 4

Outlook: Very Bullish

Cryptocurrency exchange Coinbase (COIN) gets the prestigious honor of having our strongest Earnings Score signal of the week at +81 – very bullish.

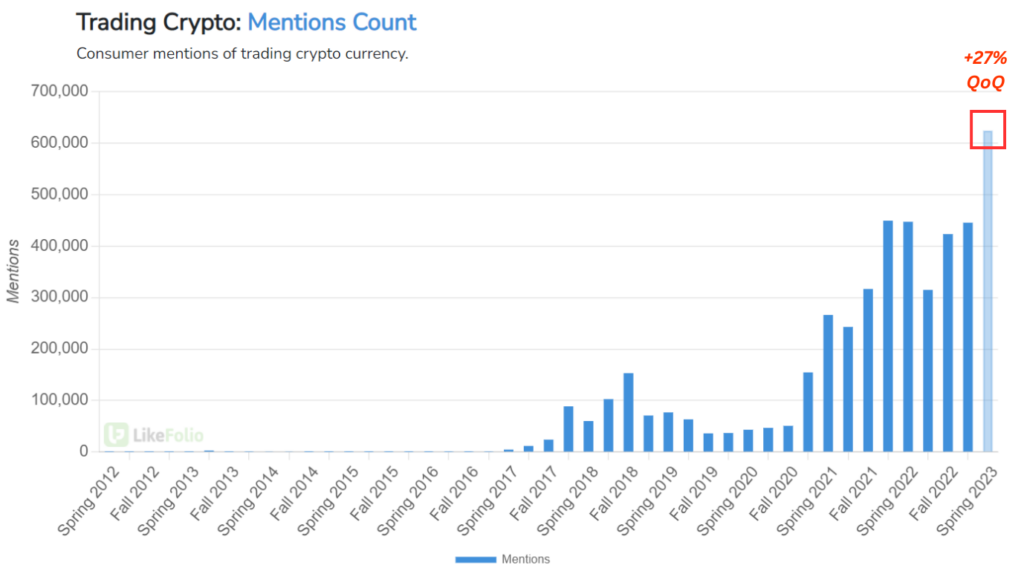

Because Coinbase’s performance is directly tied to interest in Bitcoin (BTC) and Ethereum (ETH) – the exchange collects a percentage on transactions – renewed interest in crypto in 2023 bodes well for its bottom line.

More folks buying BTC and ETH = more revenue for Coinbase.

And LikeFolio data shows consumer mentions of trading cryptocurrency are back on the rise, registering 27% higher quarter-over-quarter:

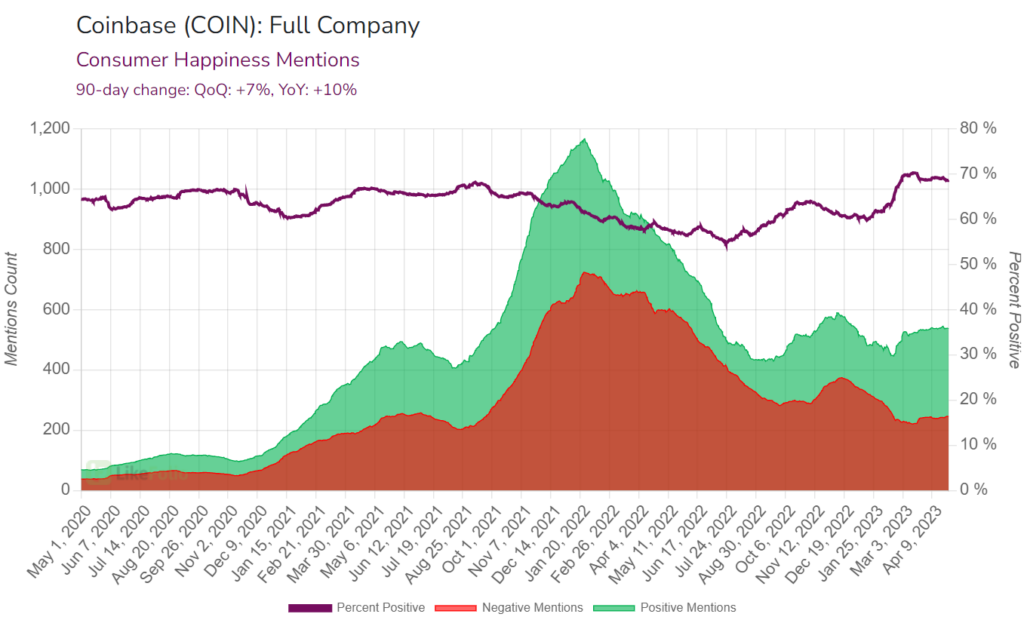

There’s also the impact of the banking disaster earlier this year, which has turned Coinbase into a sort of “safe haven” for investors.

Coinbase is the only publicly-traded crypto exchange of its kind. And because its financial statements are audited by a Big Four accounting firm, it provides a level of transparency that no other crypto exchange is able to.

That transparency and accountability have translated to a 10% year-over-year boost to Coinbase’s Consumer Happiness:

And with Coinbase demand starting to recover from its 2022 lows, we’re confident that an earnings beat is in the cards this week.

Just remember that where there’s crypto, there’s volatility. And that makes Coinbase an inherently risky play.

WW International (WW): Reports Thursday, May 4

Outlook: Neutral (Bearish Leaning)

To round out our earnings preview, I wanted to bring you the data on WW International (WW), aka WeightWatchers, as we’ve been keeping close tabs on this stock in Derby City Daily.

In our last WW report, we talked about how we scored a big win on WW, issuing a bullish alert after our real-time consumer insights signaled it was outperforming other weight management services and home fitness companies in demand while maintaining high levels of Consumer Happiness.

And when the company made a blockbuster acquisition with telehealth provider Sequence, its stock price doubled from $4 to $8.

So you might be surprised to hear our outlook on WW’s earnings report this week leans bearish.

The reason is simple: Any impact Sequence will have on demand won’t be factored into the results being reported on (Q1), as the acquisition only just happened in March.

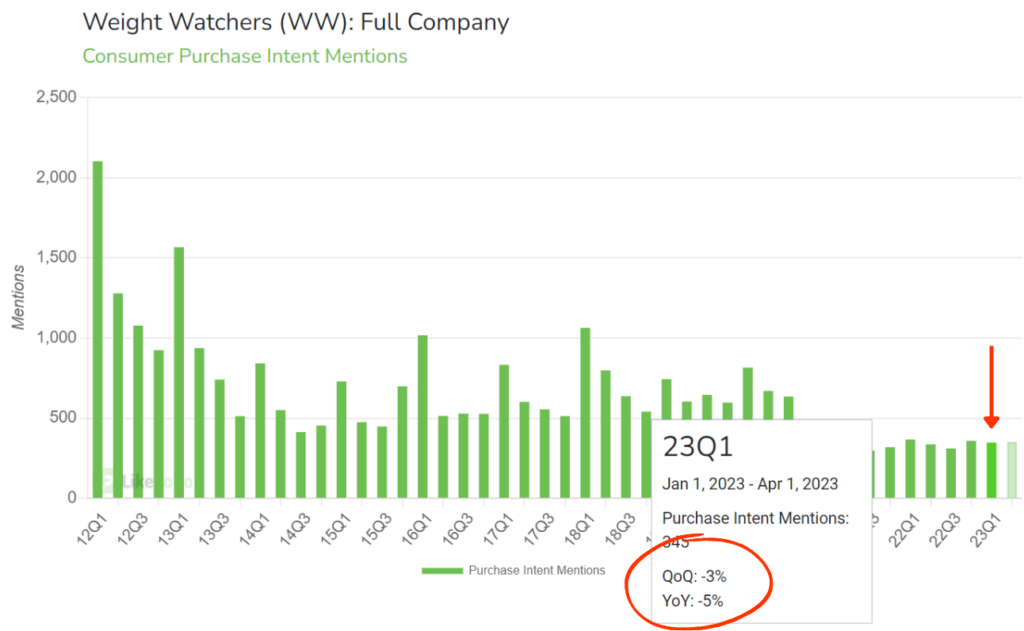

Instead, the results will more likely reflect weak demand, with LikeFolio data showing WW Purchase Intent declining five points during the first quarter of the year as monthly subscriptions became a tough sell for already stretched consumers:

Our long-term view on WW remains bullish. But we’re not betting big on a short-term earnings move.

Until next time,

Andy Swan

Co-Founder