The recent U.S. debt downgrade by Fitch Ratings has set the financial world abuzz.

America’s credit rating is no longer a perfect “AAA,” according to the agency.

Big deal.

I didn’t need a “downgrade” to tell me the U.S. debt situation is problematic… and that there are only two ways out of this: Federal fiscal responsibility or inflate it away. History tells us it will be the latter.

I’m not here to rehash old news, either.

At LikeFolio, we really don’t care much about “headline events” like this one – or moves by the Federal Reserve.

Our “edge” comes from understanding consumer behavior – what “real Main Street people” are doing – before it becomes news on Wall Street.

Regardless of the macro environment, there are always big profit opportunities in individual companies and assets.

We’ve made it our business to uncover them with a consumer insights machine capable of tapping into the collective consciousness of America.

And amid the turmoil, we see one star shining brighter than ever…

Debt Downgrade = Bitcoin Upgrade

Ready for a hot take? 🔥 Bitcoin (BTC) could be the biggest winner of the debt downgrade.

And here’s why.

- Bitcoin Thrives Amid Market Volatility

The debt downgrade triggered a wave of market volatility this week. And while this turbulence can be a concern for traditional investors, it’s a different story for Bitcoin.

Volatility is par for the course in crypto, for starters.

But more to the point: Bitcoin has often shown strength in times of market instability.

Remember the banking crisis earlier this year? Bitcoin got a big boost.

And this week, as stocks fluctuated, Bitcoin made a significant leap from under $29,000 to over $30,000.

That’s a big “tell” that Bitcoin is becoming an instinctive hedge against market volatility.

And those long-term fiscal challenges I just mentioned… they could boost Bitcoin’s appeal.

- Bitcoin as the New Safe Haven?

In uncertain times, investors often turn to “safe haven” assets like gold and government bonds.

Bitcoin is increasingly being recognized as a digital alternative: As a decentralized currency not tied to any country’s fiscal policy, Bitcoin could be seen as a safer long-term investment.

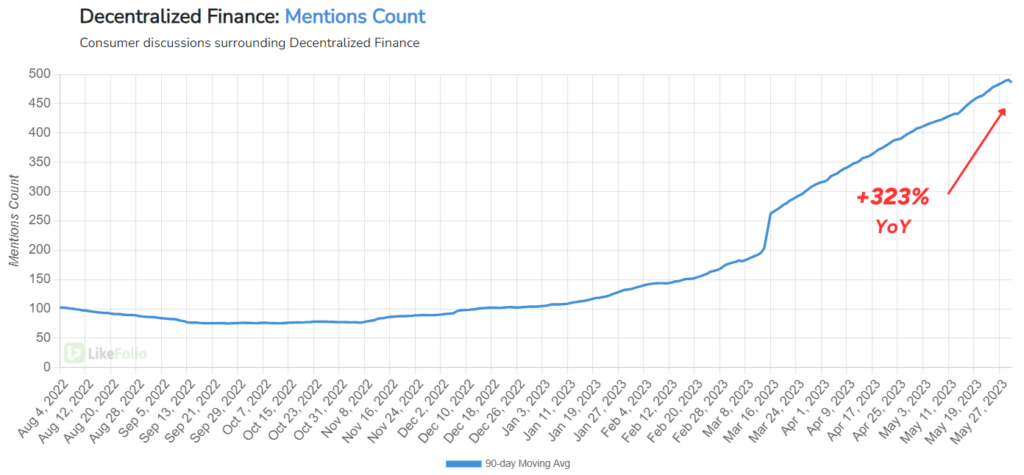

We saw a similar scenario play out when traditional banks took a hit this year. LikeFolio trend data on crypto and DeFi (decentralized finance) went through the roof… and has been surging ever since.

The debt downgrade could further solidify Bitcoin’s position as a “digital gold,” attracting more investors seeking stability in the face of economic uncertainty.

- Long-Term Fiscal Challenges Boost Bitcoin’s Appeal

Fitch’s downgrade was based on concerns about long-term fiscal challenges that the U.S. needs to address.

“The numbers speak for themselves,” Fitch exec Richard Francis said, noting that the country’s debt accounts for a “pretty alarming” 113% (and mounting) of U.S. economic output.

These challenges could potentially lead to economic instability, making Bitcoin’s decentralized nature more appealing.

Consumers have shown a booming interest in decentralized finance and its potential applications, as we’ve seen in LikeFolio trend data – which shows mentions accelerating a remarkable 323% year-over-year:

As a currency not tied to any country’s fiscal policy, Bitcoin could be seen as a safer long-term investment.

- Bitcoin’s Positive Reaction

Amid the chaos of the downgrade, Bitcoin reacted positively – popping 3% between Tuesday and Wednesday, when the debt downgrade was announced.

This immediate positive response not only highlights Bitcoin’s resilience but also its potential for growth during economic upheavals.

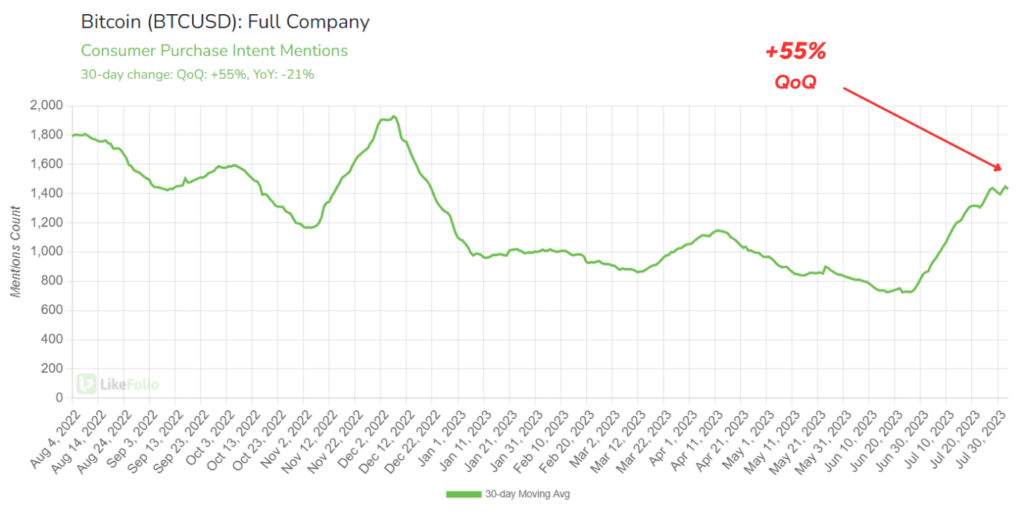

While we can’t know exactly how this all will play out, LikeFolio consumer data provides a glimpse at how consumers are feeling in real time.

Looking at a 30-day moving average, we can see Bitcoin Purchase Intent mentions have rocketed 55% quarter-over-quarter:

And chatter around trading crypto remains 42% higher year-over-year.

Bitcoin’s initial reaction to the debt downgrade news indicates a strong potential for the cryptocurrency in both the near and long term.

But look, I know crypto’s not for everyone…

That’s where Coinbase (COIN) comes in.

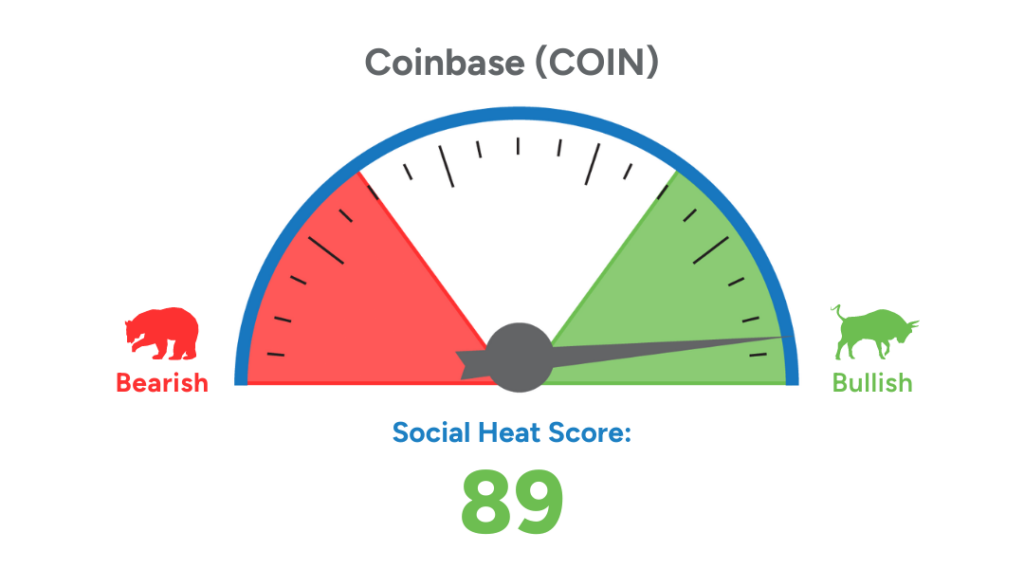

Our system has the publicly-traded, U.S.-based crypto exchange registering a Social Heat Score of 89.

Out of 100 – and considering that everything scoring above 70 signals a “buy” – that’s a great bet. And it makes sense: If Bitcoin does well, Coinbase does well.

COIN is up nearly 60% since the Social Heat Score flagged it as a “buy” less than three months ago.

Now, our Social Heat Score is targeting five more stocks with even bigger profit potential.

Until next time,

Andy Swan

Founder, LikeFolio