We saw a major market shakeup this week when WW International (WW), better known as Weight Watchers, made a surprise entrance into the telehealth arena with its purchase of the virtual healthcare startup Sequence.

It was a move made possible, at least in part, by previous market leader Teladoc (TDOC) taking a potentially fatal blow to its reputation (and bottom line).

(If you missed yesterday’s issue, here’s the short version of what happened: Teladoc’s once-stellar BetterHelp therapy app was caught allegedly selling patients’ sensitive mental health data to companies like Facebook and Snapchat… Resulting in a data-sharing ban and a hefty $7.8 million fine from the Federal Trade Commission (FTC).)

Weight Watchers’ entrée into the lucrative telehealth space clearly made investors happy: WW shares soared from $4.10 as of market open on Monday to a high of $7.07 on Tuesday for a lightning-fast 72% gain.

That’s impressive. But there’s another contender in the telehealth space vying for the lead that has us even more excited.

Compared to its more storied competitors, this contender would be the “underdog,” bringing in a fraction of the revenue of Teladoc ($2.4 billion) and WW ($1.09 billion) in 2022 with just $526.9 million.

Thing is, for our underdog, that represented 94% annual revenue growth.

Teladoc only grew revenue by 18%, and WW – its revenue actually fell by 11%.

We’ve been keeping tabs on this telehealth small-cap stock as one of our favorite high-growth potential opportunities.

In fact, my brother Landon named it a stock that could triple in 2023 on our Thanksgiving podcast, back when shares of this company were trading just below $6.

It’s now a $10 stock – gaining nearly 70% in a matter of months, and 50% since the start of the year.

As much as I hate it when Landon’s right (brotherly rivalries are hard to kick), I have to admit… He nailed it with this one.

Because our data is telling us that this underdog is just getting started with plenty of upside still to capture – and I’ll show you why right now…

Meet Our Telehealth Underdog: Hims & Hers (HIMS)

Head to your local CVS or Target, and there’s a good chance you’ll find one of these endcaps featuring wellness products for everything from skincare to hair loss to dietary supplements…

That’s Hims & Hers, whose sleek packaging stands out among the typically overcrowded, chaotic shelves of most drugstores – where most products scream with never-ending ingredient lists, gaudy colors, and outdated fonts.

Hims & Hers over-the-counter (OTC) products are available in over 11,400 retail locations. Other than CVS and Target, you’ll find them at Walmart, Walgreens, Bed Bath and Beyond, and more… Open your Amazon.com app and you can buy products there, too.

The branding is on point: Its trendy, monochrome packaging speaks to the Millennial and Gen Z crowds.

But its products cater to the needs of any age group, with treatments for once-thought-to-be embarrassing ailments like hair loss, erectile dysfunction, and acne, just to name a few – all wrapped in its “No stigma, just treatment” messaging.

I know what you’re thinking: “I thought this was a telehealth company!”

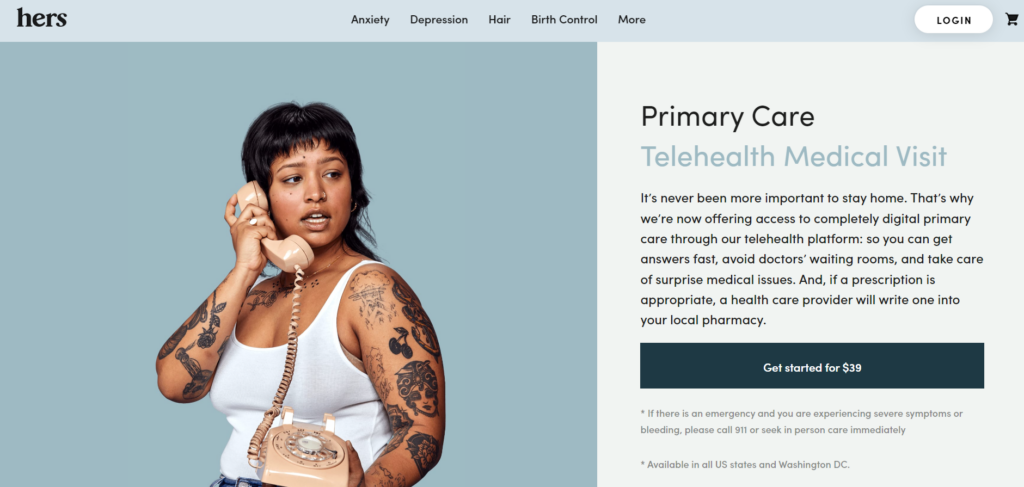

Head to the website, and you’ll see that it absolutely is. While Hims & Hers has bolstered its brand awareness by putting its OTC products in tens of thousands of brick-and-mortar retailers across the country, it also offers prescription drugs through its website, where you can book online consultations with its vast network of physicians for as little as $39.

We’re talking everything from birth control to anti-depressants – making Hims & Hers a true one-stop shop for health and wellness.

Even better? Sticking to its “No stigma, just treatment,” mantra, Hims & Hers delivers everything to your door in discreet packaging.

It’s a great concept. But let me show you how the company stacks up against our Trifecta checklist so you can see the true scope of the opportunity…

The Derby City Trifecta Checklist

✔️ Strong Consumer Demand

✔️ High Consumer Happiness

✔️ Macro Trend Tailwinds

When we find a company that’s hitting on all three prongs of our “Trifecta Box” of investing…

We know we’ve found a winner.

Strong Consumer Demand ✅

Between its extensive retail presence, impeccable branding, and no-judgment promise, it’s no wonder consumers are clamoring for these products…

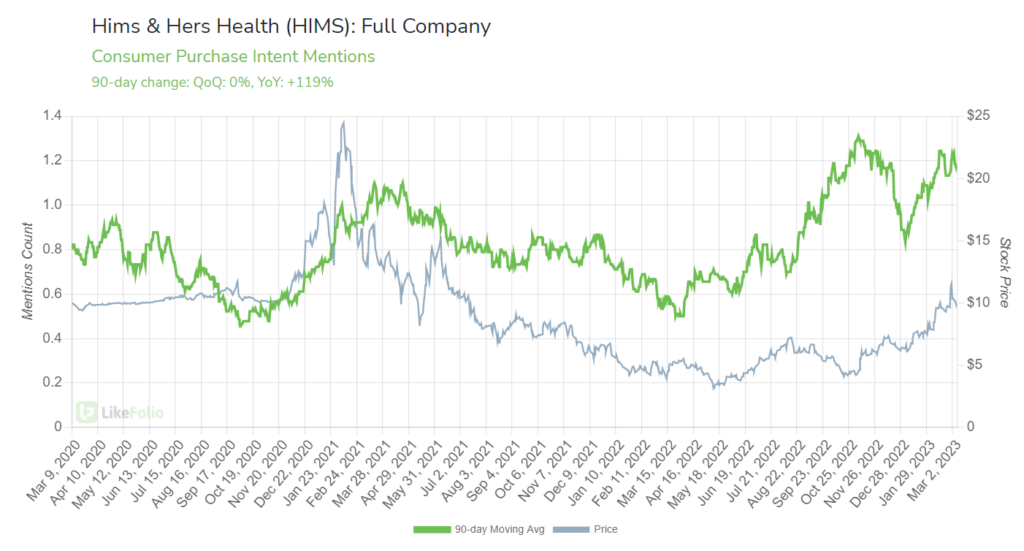

Our data shows demand for Hims & Hers has more than doubled from last year, with Consumer Purchase Intent (PI) Mentions up 119%:

(Notice how its stock price has followed the same trend?)

High Consumer Happiness ❔

Demand is sky-high. Now, the question is: Do Hims & Hers products actually stand up to the hype?

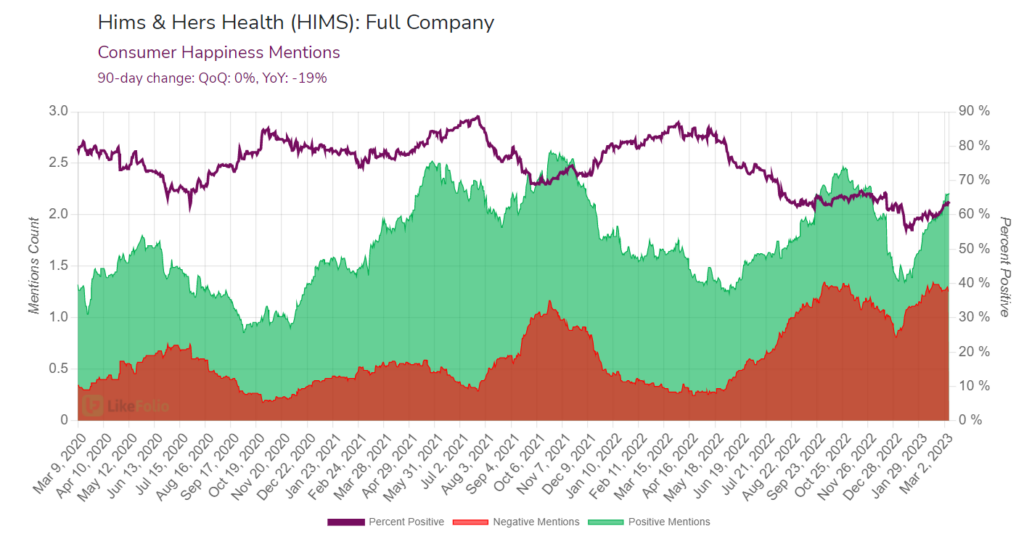

The answer, according to our data, is not as clear-cut. Right now, Consumer Happiness is relatively flat – even waning if you compare Consumer Happiness Mentions to the year prior:

What we really want to see to check the box on High Consumer Happiness is for the percentage of positive mentions to be at or above 70%.

Right now, Hims & Hers happiness is hovering around 62%.

Some customers are decidedly happy with their service:

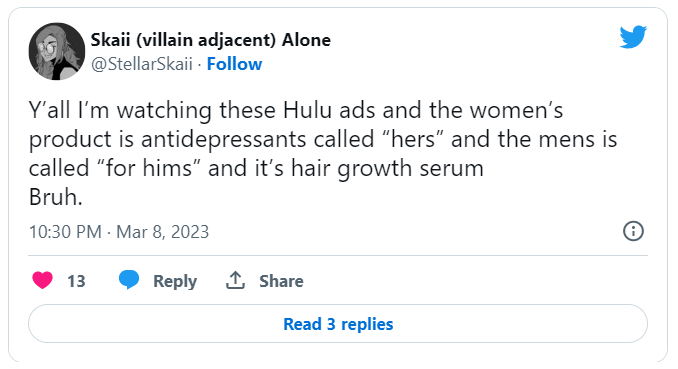

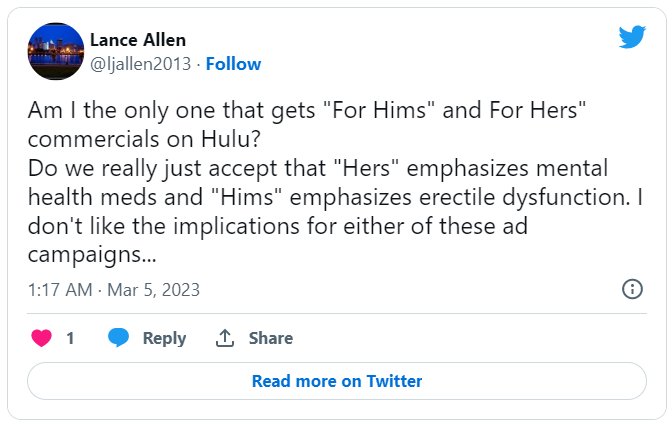

Others have grumbled about the company’s choice of advertising, which has rubbed some folks the wrong way:

Whether or not complaints about one specific ad campaign will have any lasting impact remains to be seen, but the comments above could indicate more of a short-term stumble.

We believe Hims & Hers has the goods to be a long-term player, especially considering the last item on our checklist – the powerful macro trend tailwinds pushing it forward…

Macro Trend Tailwinds ✅

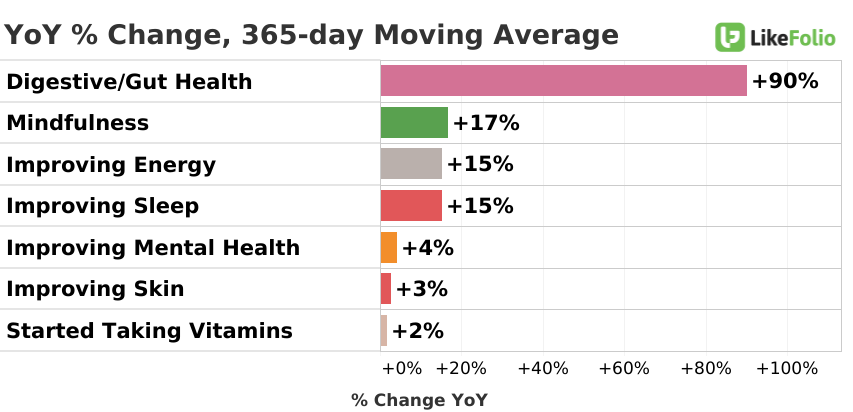

Not only is Hims & Hers benefitting from the telehealth trends we covered yesterday, but thanks to its line of OTC products, it’s getting an added boost.

Coming out of the pandemic, we’ve seen a strong resurgence in health and wellness trends. Americans are “on the go” once again – getting outside, socializing, and overall looking for ways to get healthy, be active, and look and feel good.

As you can see from the chart below, consumers are increasingly interested in improving energy, sleep, mental health, and digestive/gut health – all things Hims & Hers offers a solution for:

The Bottom Line 💰

While Hims & Hers isn’t sitting perfectly in our “Trifecta Box” of investing, it has plenty of catalysts lining up in its favor that have us feeling bullish on this underdog – and are confident in its ability to win over consumers.

Until next time,

Andy Swan

Co-Founder

Continued Reading: Move Over Red Bull, There’s a New King of the Energy Drink Market

For a company that IS hitting on all three prongs of our “Trifecta,” look no further than this new king of the energy drink market… Click here to read more.