“Know your strengths.” It’s one of those sage bits of life advice that can be applied to investing and trading, too.

I know because, in the decade since my brother Landon and I brought LikeFolio to life, we’ve figured out where the strengths lie in our data.

The verdict: Our predictive social media insights give us a significant edge with the lesser-known, off-the-radar names that are just starting to show signs of explosive growth.

And since those “signs” we’re talking about come straight from Main Street – in the form of our proprietary consumer metrics like Purchase Intent (demand), Consumer Happiness (sentiment), and Macro Trends – we’re able to spot the next breakout stocks before Wall Street ever even catches wind.

It’s a powerful system that works with remarkable accuracy, leading our followers to double, triple, heck, even quadruple-your-money winners like:

- Crocs (CROX) in 2020 for 213% gains…

- Celsius Holdings (CELH) in 2021 for a 327% profit…

- WW International (WW) earlier this year for a 174% return…

- And the one I’m about to share with you today.

Thing is, we’ve been at this a while now – feeding the LikeFolio data engine 500 million data points every… single… day… each one only improving its predictive power.

In short: The brainchild we brought to life all those years ago is the best it’s ever been at identifying tomorrow’s big winners, while our newly upgraded Social Heat Score makes it easier than ever to spot them.

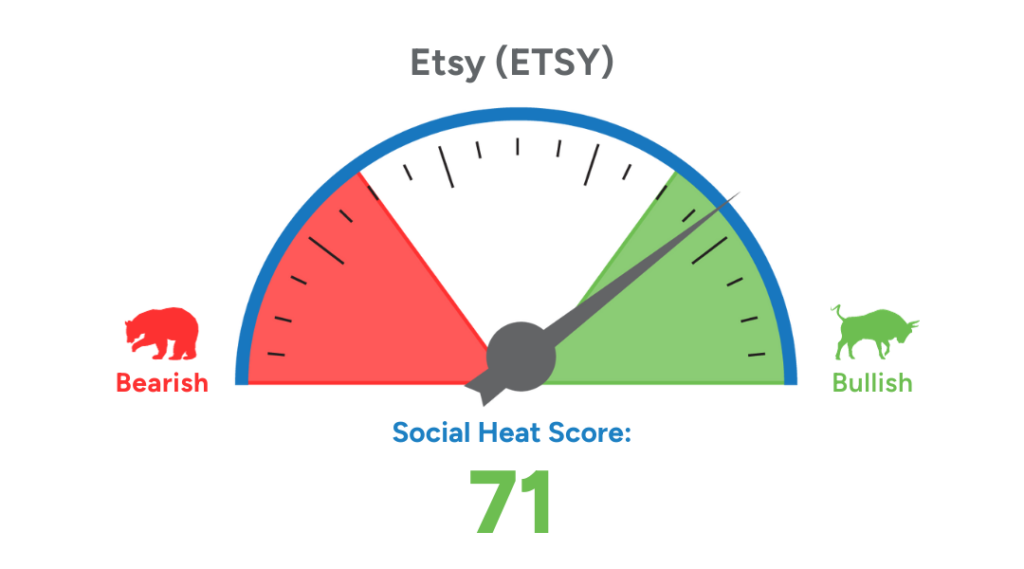

This AI-driven device distills all the data we get for a company into a single metric that tells us what to trade and when.

It works like this: If a stock registers a Social Heat Score over 70, you buy it. If it registers below 30, you short it.

This tool took four long years and $5 million to develop – so we typically reserve it for our paid-up members. (You can see the Social Heat Score in action here.)

But when we saw one stock’s score zoom from a bearish 21 to a bullish 71 last week, we knew we had to share this red-hot opportunity with all our Derby City Daily readers.

It’s one we’ve made money on before – including a 337.22% windfall in 2022 and a quick 50% profit this year.

Let me show you how we’re playing this proven moneymaker a third time for triple-digit profit potential…

Want to get alerted as soon as our database IDs the next potential quadruple-your-money winner?

Join LikeFolio Investor today to unlock real-time profit alerts, and we’ll let you in on a $2 AI play that’s already delivered max gains of 180% since first hitting our radar. (Spoiler alert: It’s gearing up for another surge as we speak.) Get started here.

Etsy’s Journey: From Bullish to Bearish and Back Again

Editor’s Note: This profit alert was originally issued to LikeFolio Investor subscribers on September 27, 2023, with an entry price of $62.39. Paid-up members can access their full trade instructions here.

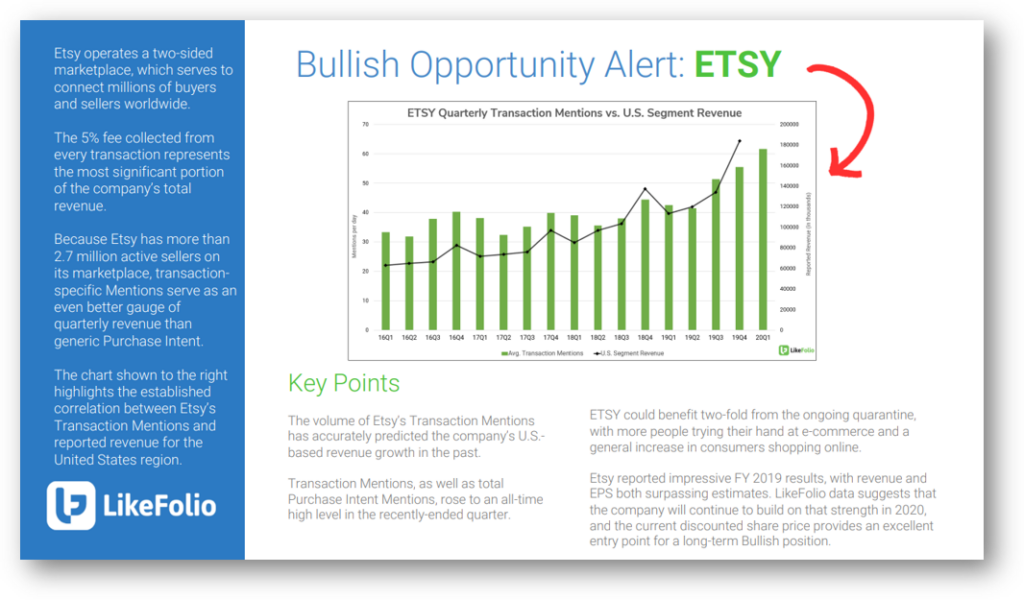

Back in April 2020, the world was realizing the quarantine would last longer than the week we were hoping for – and we were issuing a bold bullish call on Etsy (ETSY) that would pay off in an incredible 337.22% profit.

For those who may not be familiar, Etsy is a two-sided global marketplace that specializes in handcrafted, one-of-a-kind goods. There are over 45 million unique items to discover – from jewelry, clothes, crafts, party supplies… with plenty of rare and vintage finds in between.

We’ve got more than a few Etsy “power users” lurking around the LikeFolio and TradeSmith offices, so I can tell you: The folks who use it, use it often – and they absolutely love it.

Scrolling through eye-catching product listings for unique things you wouldn’t be able to find anywhere else… (Seriously: 87% of buyers say, “Etsy has items I can’t find anywhere else.”)

It’s a great way to spend downtime – which most of us had plenty of back in 2020.

And thanks to our real-time social data, we could see folks talking about purchasing from Etsy at record levels.

We noticed that as Etsy demand mentions rose to new highs, its stock was selling off – trading roughly 45% down from 2019 levels.

The realization that quarantine wouldn’t be some momentary fling was the final trigger.

We believed Etsy could benefit two-fold from all the time we were spending at home – on the seller side, with more people trying their hand at e-commerce, and on the buyer side, from a general increase in consumers shopping online.

We were right. The stock went skyward.

And we cashed out our gains as soon as our data indicated a slowdown in consumer momentum.

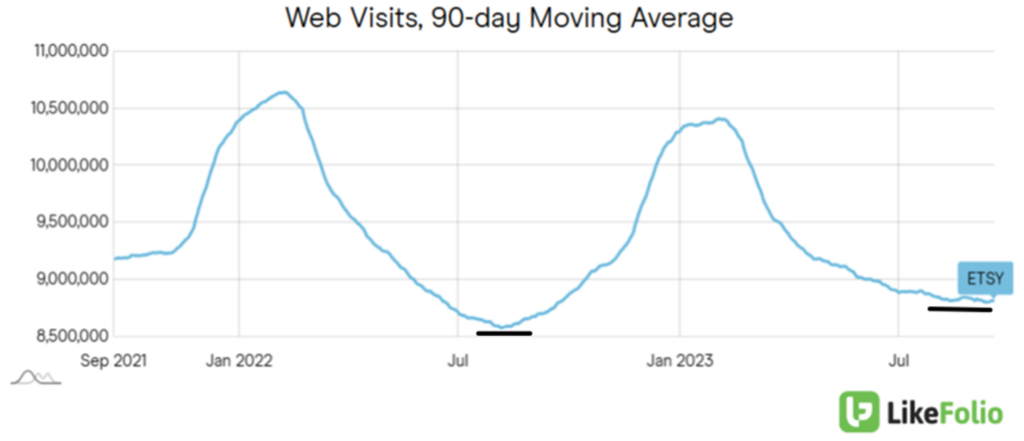

By December 2022, LikeFolio data around Etsy sent its Social Heat Score firmly into bearish territory amid declining page views and buzz…

We recommended a setup on ETSY for our MegaTrends subscribers, and they were able to make a solid 50.36% on that trade here in 2023.

But as I mentioned, Etsy’s Social Heat Score has zoomed all the way to 71 since then, putting Etsy firmly into bullish territory.

Here’s what changed.

How Etsy Crafted a Comeback

Ever have trouble finding the right words to describe what you’re looking for? Me too.

That’s why Etsy launched a cool new visual search feature to help shoppers find what they need – and fast.

Now, when an iPhone user taps the new camera icon in the search bar and uploads or takes a photo, Etsy will curate visually similar items in the blink of an eye.

Consumers’ growing appetite for personalized products and service are accelerating digital transformations across the retail industry.

And so far, Etsy’s visual search rollout looks like a success.

Consumer mentions of buying a meaningful, homemade item on Etsy.com are trending 11% higher year over year.

And LikeFolio shows Etsy web traffic is experiencing a less steep seasonal “valley” this year, suggesting more interest from consumers and small businesses.

But it’s not stopping there.

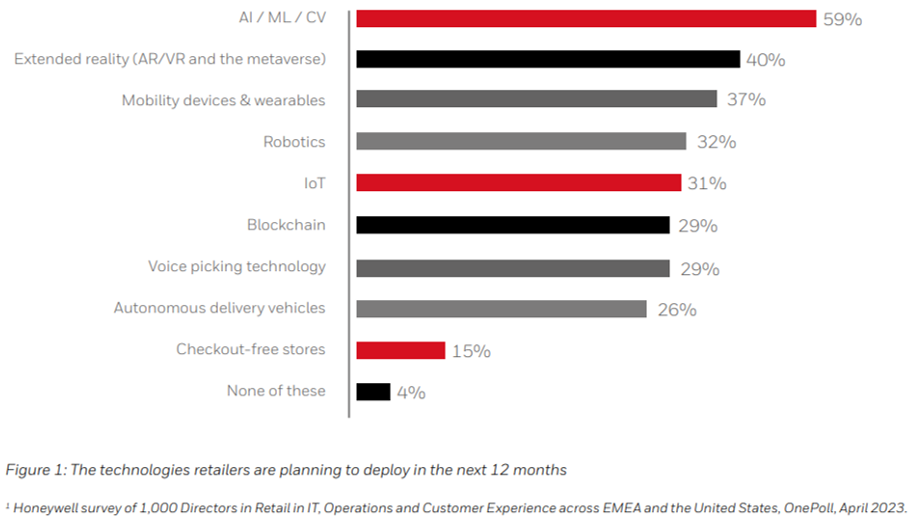

Nearly 60% of global retailers are turning to artificial intelligence (AI), machine learning (ML), and computer vision (CV) technologies to improve the shopper experience.

Etsy is keeping stride with those trends by investing in generative AI technology.

The company is already working on a “Curation at Scale” initiative to train machine learning datasets. Eventually, users will be able to ask a chatbot a question and get curated results that match what they’re looking for.

We can’t wait to see the final result.

But in the meantime, the fact that Etsy is experiencing growth in a challenging discretionary spending environment is huge on its own.

The number of active Etsy buyers and sellers increased significantly during the second quarter, contributing to growth in both marketplace and services revenue.

We’re talking 96.2 million folks browsing Etsy’s vast assortment of gifts and “self-indulgences,” which was a new all-time high for the company.

Many of those items are priced below $30, and that seems to be resonating with budget-conscious Americans, while big savings on Halloween decorations and costumes for kids, adults, and pets give them an affordable way to jumpstart the holiday season.

In a retail world full of commoditization and mass marketing, Etsy’s “Keep Commerce Human” mission is well-aligned with the values of its buyers and sellers – and that’s made clear by its consistently happy consumer base.

Shoppers turn to Etsy over a huge, faceless corporation like Amazon.com (AMZN) because they only have to deal directly with the maker of the goods, enabling a personalized shopping experience to match the ultra-personalized products you’ll find throughout its site.

Customers love the uniqueness and quality of the products, in addition to sellers’ personal touches, like handwritten “thank-you” notes, stickers, coupons, and bonus gifts.

That’s helped Etsy maintain a 71% Consumer Happiness level over the past three months.

Between growing consumer demand, a happy customer base, and the turbo-charged AI trends it’s tapping into, Etsy checks all the boxes we look for in a potential winner.

What takes this opportunity over the edge in to buying territory, though, is this: Even with entrepreneur and customer engagement rising, the stock is falling out of favor with the market. And that disconnect that could lead to significant upside.

I’d love to be able to deliver the next big-money winner straight to your inbox so the next time we’re having this conversation, those 337% gains are already in YOUR bank.

Here’s how to make our edge your edge – starting today.

Until next time,

Andy Swan

Founder, LikeFolio

In Case You Missed It…

🗞️ Special Issue: Apple Investor Report 2023

The Hits, the Misses, the Game-Changers, and the Bottom Line

In this just-released special report, we dive into Apple’s new product launches, consumer reactions, the potential game-changer of the USB-C switch, and whether the iPhone 15 lineup is living up to the hype…