When Tesla (TSLA) was cutting prices in January and throughout the early part of 2023, the obituaries started piling up.

Everyone was worried that Tesla’s profit margins would take a hit… and in turn… Tesla would lose an edge in the uber-competitive electric vehicle (EV) space.

We maintained a bullish stance on the EV powerhouse even when the stock was hitting lows near a hundred bucks. Because with each round of price cuts, we watched as consumer Purchase Intent would swell for the discounted models.

That’s real consumer demand momentum that Wall Street couldn’t see building, telling us that the increase in sales Tesla could see by making its vehicles more affordable should more than compensate in terms of its bottom line.

Well, on Sunday, Tesla reported it delivered over 20,000 more cars than the anticipated 445,925, leaving analysts’ estimates in the dust.

The fuel for this acceleration: Buyer incentives, discounts, and a $7,500 federal tax credit under the U.S Inflation Reduction Act.

Tesla shares revved up by nearly 7% following the stronger-than-expected second-quarter delivery and production numbers.

Year to date, Tesla’s stock price has more than doubled, racking up 125% gains and counting.

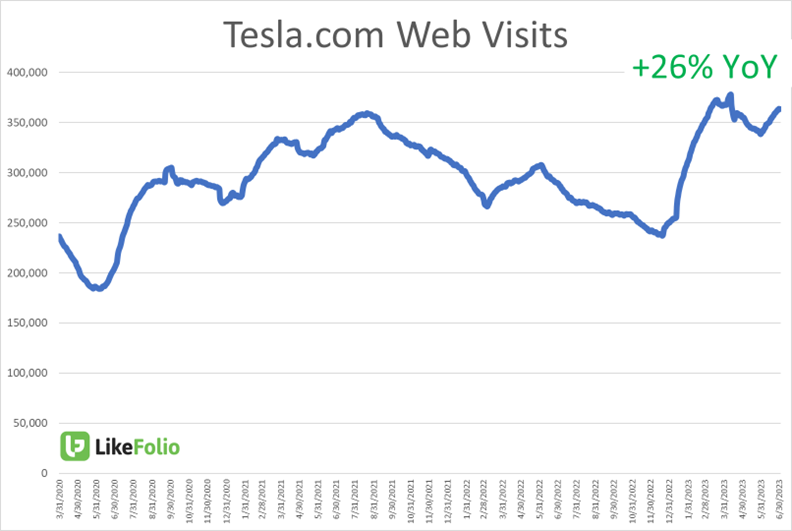

This rally has been reflected in the company’s web traffic too, with Tesla.com visits hitting all-time highs as they climb 26% year-over-year.

Just as we predicted, more consumers are buckling up for a ride with Tesla in their car shopping journey.

LikeFolio data shows overall EV demand growing on a long-term basis, up 40% year-over-year.

But we’re not here to take a victory lap.

Because what’s more important is what comes next.

And there’s another high-growth sector where we’re watching Tesla take over that could continue to juice the stock price higher…

What’s Next for Tesla

One of the most thrilling arenas where Tesla is leading is autonomous vehicles (AVs), or self-driving cars.

Each Tesla on the road is not just a car; it’s a data-collecting powerhouse, contributing to what could be the most extensive machine learning project in history.

So those 466,140 Tesla vehicles delivered in the second quarter? Every single one is powered by artificial intelligence (AI) technology, where millions of new data points help refine algorithms, improve system responses, and further Tesla’s lead in a self-driving future.

Despite the roadblocks ahead, Musk’s audacious pursuit of this vision underscores the massive potential he sees in mastering autonomous driving technology.

And let’s not forget the Cybertruck.

Our database has picked up a significant 80% year-over-year surge in social media chatter around this highly anticipated vehicle. The tone? Pure excitement.

And it’s not just talk.

Tesla seems to be gearing up to translate this consumer enthusiasm into tangible results.

Tesla’s recent performance, coupled with its strategic moves in the AI and EV space, paints a picture of a company that’s not just weathering the storm… But setting the pace for the entire industry.

We were bullish on Tesla when others weren’t. And we’re even more bullish now.

We’ll be bringing you more hot takes like that right here in Derby City Daily to keep you ahead of the curve.

Speaking of: Have you checked out our just-released special report, 3 Stocks That Could Triple This Year? If not, I recommend you head here next.

Until next time,

Andy Swan

Founder, LikeFolio