Ulta Beauty (ULTA) is a force to be reckoned with in the $646.2 billion global beauty industry.

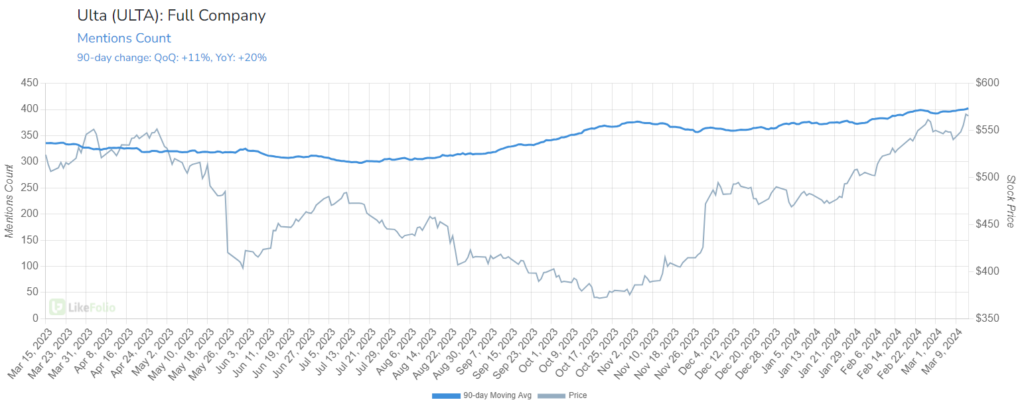

Mention volume is up 20% year over year, boosted by a strong holiday season and spring special event.

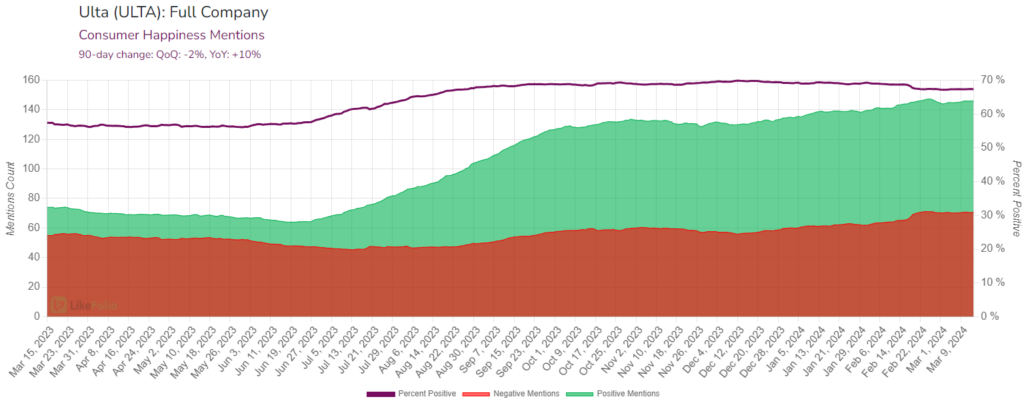

More impressive: Consumer Happiness levels have surged 10% in the same time frame, near 70% positive.

Mentions are filled with consumers stocking up on facial products and high-end cosmetics brands, including Charlotte Tilbury and Fenty.

Last quarter, we correctly predicted a major post-earnings move to the upside, as the beauty retailer’s audience expands to a younger audience and overtakes Sephora, thanks in part to its wide range of offerings, from drug store staples to prestige brands.

This allows the retailer to capitalize on splurges of high-dollar products while also capturing any trade-down shoppers looking for more affordable options.

This quarter, Ulta came through with a “better-than-expected” performance driven by “healthy traffic, record brand awareness, and strong member growth” during the holiday season, according to CEO Dave Kimbell.

Net sales were up 10.2% in Q4 to $3.6 billion, gross profit grew 10.6% to $1.3 billion, and diluted earnings per share soared 21% to $8.08.

The stock is down more than 4% today, but we’re not worried.

Ulta Is Unmatched

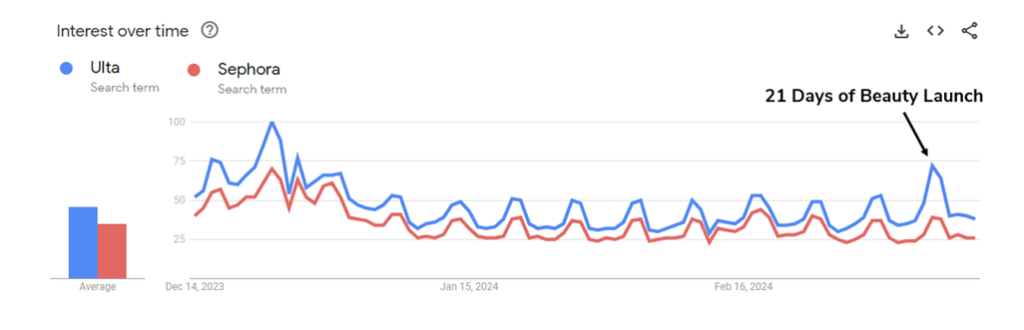

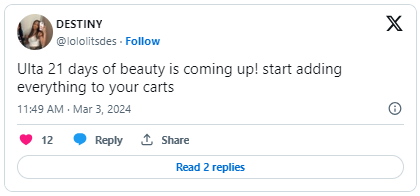

Google Trends data suggests the gap between Ulta and Sephora is widening in Ulta’s favor, with Ulta mentions spiking last week, thanks to its Semi-Annual Beauty Event that launched on March 8.

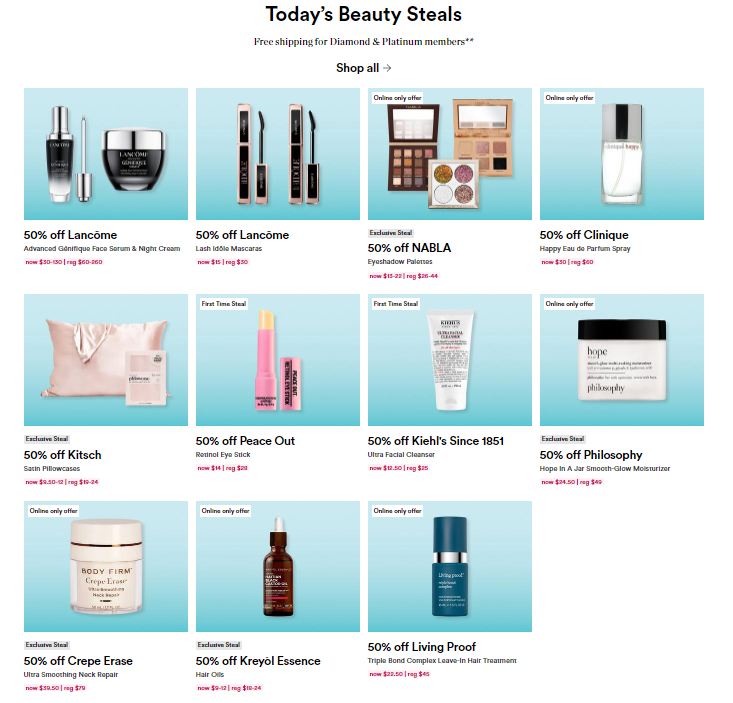

The campaign, which runs through March 28, offers daily deals where consumers can snag their favorite beauty products up to 50% off in store and online.

Every time this event rolls around (which was formerly called 21 Days of Beauty), like clockwork, LikeFolio picks up a surge in Ulta mentions.

It’s hard to compete with Ulta when it comes to customer loyalty.

Ulta is the number-one beauty choice for Zoomers, according to Piper Sandler’s 2023 Teen Survey, with a whopping 63% of those female respondents reported being part of Ulta’s lucrative rewards program, Ultamate Rewards.

The more you spend, the more rewards you collect, like special discounts, free gifts, early access to new products and deals, free shipping, and more.

Sephora launched its own competitive event but doesn’t appear to be garnering the same consumer response.

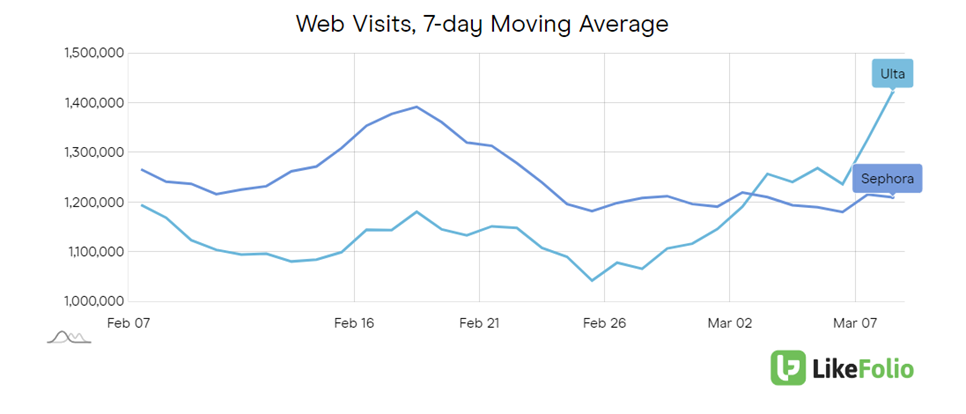

Web visits show Ulta traffic pacing 17% higher year over year compared to Sephora’s +8%.

Long term, Ulta is likely to benefit from increased foot traffic at partner store, Target (TGT), which reported a notable shift in momentum in the fourth quarter.

The Bottom Line

The bar was high for Ulta going into last night’s report. We’re not surprised to see this post-earnings dip – and it doesn’t change our view.

Since we last “bought the dip” on ULTA in August, the stock has gained 32%.

This is a name we like for the long haul.

Tesla (TSLA), Costco (COST), and now ULTA… we’ve seen some great accumulation opportunities in the market recently.

While every investor is stuck reacting to short-term earnings moves, we see these dips as strategic entry points on long-term winners.

That’s the beauty of LikeFolio’s forward-looking data.

Now, we invite you to level up that edge – and unlock the full power of our consumer insights – right here.

You’ll learn all about our proprietary stock-picking device, the Social Heat Score, and the next five stocks it’s targeting for explosive profit potential.

Until next time,

Andy Swan

Founder, LikeFolio

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

Tesla Is Playing the Long Game. You Should, Too.

Wall Street has turned against the EV king. Here’s how to make Tesla’s loss your gain…