A month ago, Landon, Megan, and I made some bold predictions.

We selected three companies we believed were poised for an earnings surprise:

- Netflix (NFLX)

- Starbucks (SBUX)

- On Holding (ONON)

We’ve been right on two of those calls – so far. ONON is up next week.

Our secret to nailing earnings predictions? It’s not some crystal ball… It’s cold, hard data.

We engineered a powerful social media machine that sorts through 2,777 Twitter posts per minute – each of which is sliced, diced, analyzed, and distilled into proprietary metrics like Purchase Intent, Consumer Happiness, Buzz, Macro Trends, and more.

Armed with real-time consumer insights, we’re then able to spot shifts in demand well before a company reports its numbers to Wall Street.

And with Netflix, Starbucks, and On, at least one of our predictive indicators was throwing up a flare – signaling a potential opportunity at play.

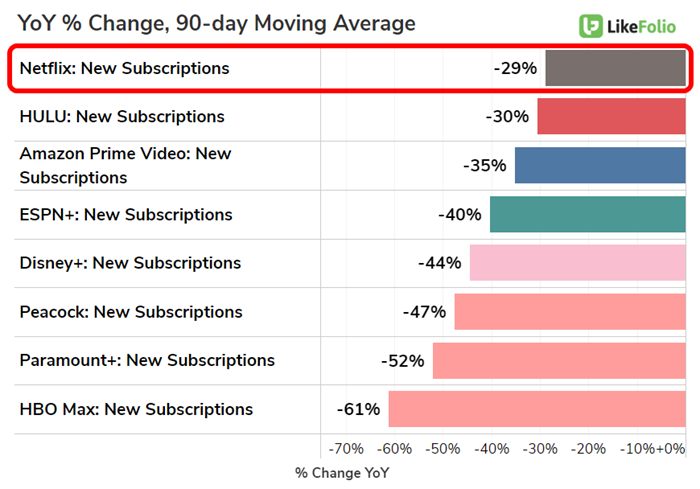

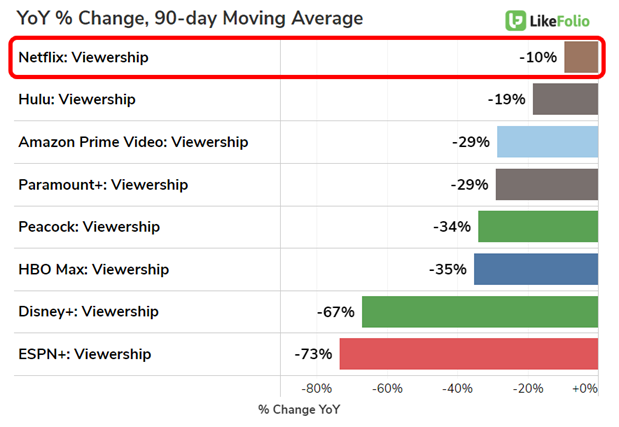

For Netflix, we saw a dip in two key trends – new subscriptions and viewership – that let us know something was amiss.

With both trends flipping into the negative, we worried about Netflix’s growth prospects – and rightly so. Netflix missed revenue estimates and shares traded as much as 10% lower following its report.

For Starbucks, the data tipped us off to a critical slide in demand, just in time for it to impact guidance. (More on that in a minute.)

And for On – well, just wait until you see what kind of signals are flashing for this shoemaker ahead of Tuesday’s earnings announcement.

Can we go three-for-three on our earnings predictions?

Let’s do some due diligence on how we nailed our bearish Starbucks call and how our ONON outlook is shaping up for next week…

How We Nailed SBUX Bearish

When a consumer takes to Twitter to post about a product or a brand, our data-crunching tech captures their message in real-time, cross-references the 425-plus companies and 10,767 brands in our database, and checks for thousands of keywords to tell us whether or not that person spent their hard-earned cash.

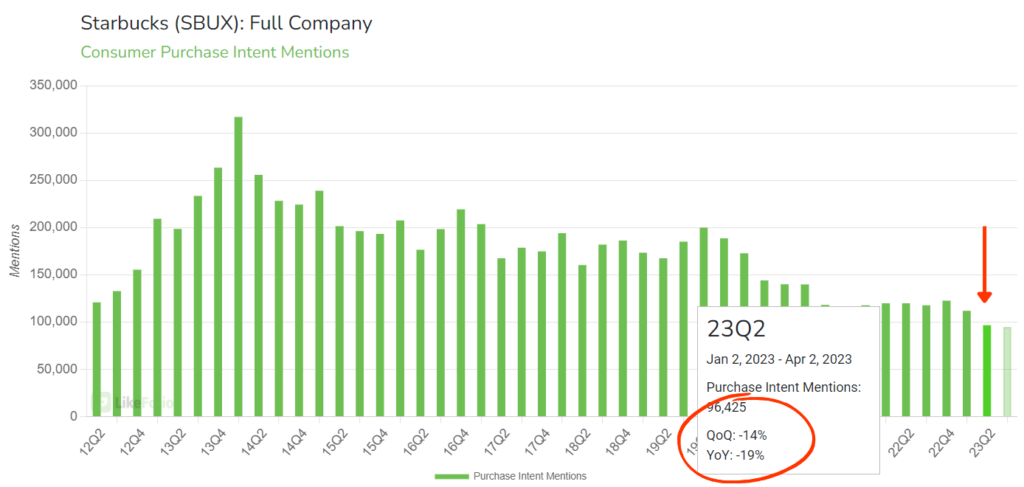

Those mentions are then logged under LikeFolio’s proprietary consumer demand metric called Purchase Intent.

That’s how Starbucks inched its way into our bearish scoring band just ahead of the earnings season. Purchase Intent mentions revealed demand was slipping (among English speakers) near the end of March and into early April:

And that wasn’t all.

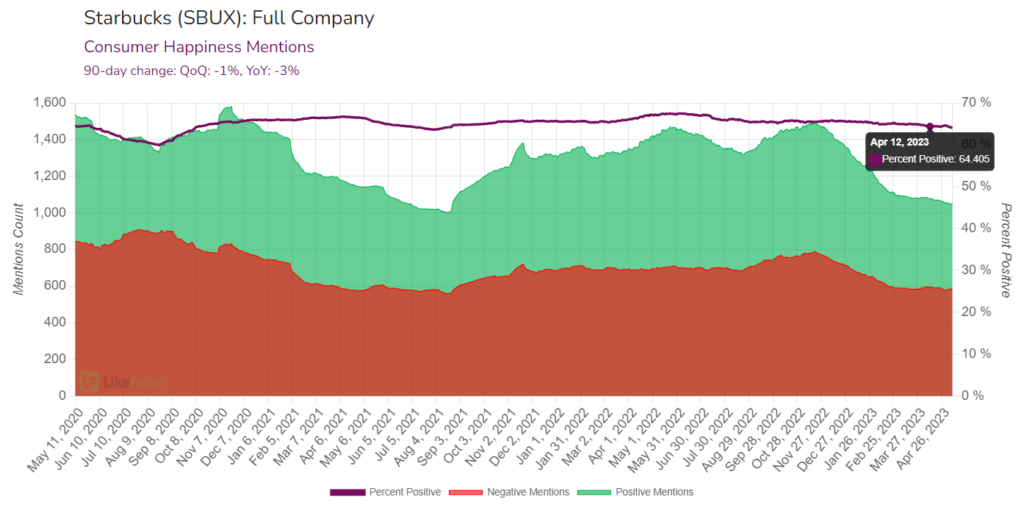

See, while our social media database is figuring out consumer demand it’s also checking sentiment to see whether the poster expressed positive or negative feelings about the company or brand.

Those data points get filtered into our Consumer Happiness metric – which for Starbucks, was falling at an even quicker pace:

Turns out, costly coffee runs were proving a tough pill to swallow for consumers, who have been struggling across the board with rising food costs.

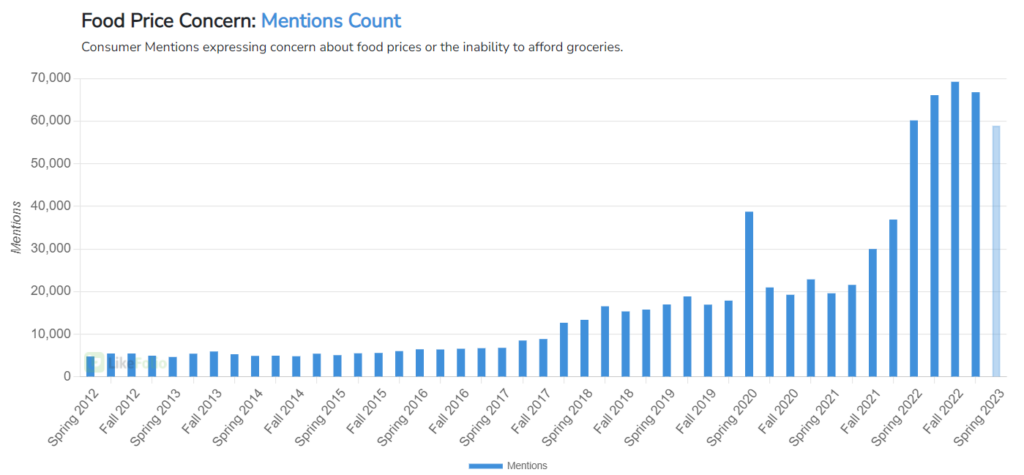

You can see how our database was increasingly picking up chatter around food price concerns, and how that trend has escalated over the last couple of years:

Our take going into Starbucks’ first-quarter report on May 2 was that forward-looking guidance could be in trouble. And it was.

Despite posting a strong report led by a recovery in China, the company reaffirmed its guidance on the lower end…

And shares fell 6% after hours.

⏰ Up Next: ONON Bullish

The final piece of our earnings prediction trifecta, ONON, is set to report Tuesday, May 16, after the bell.

A month ago, our signal was bullish – and we’re holding tight to that prediction.

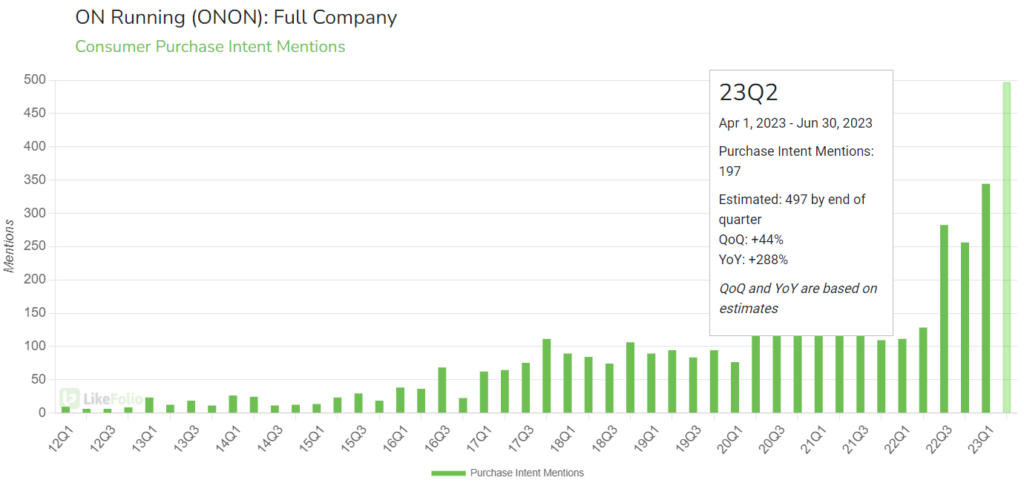

Demand growth for ONON has actually accelerated in the second quarter, which caps off at the end of June – by no less than 288% 👀.

That’s a fantastic positive indicator for ONON’s forward-looking guidance.

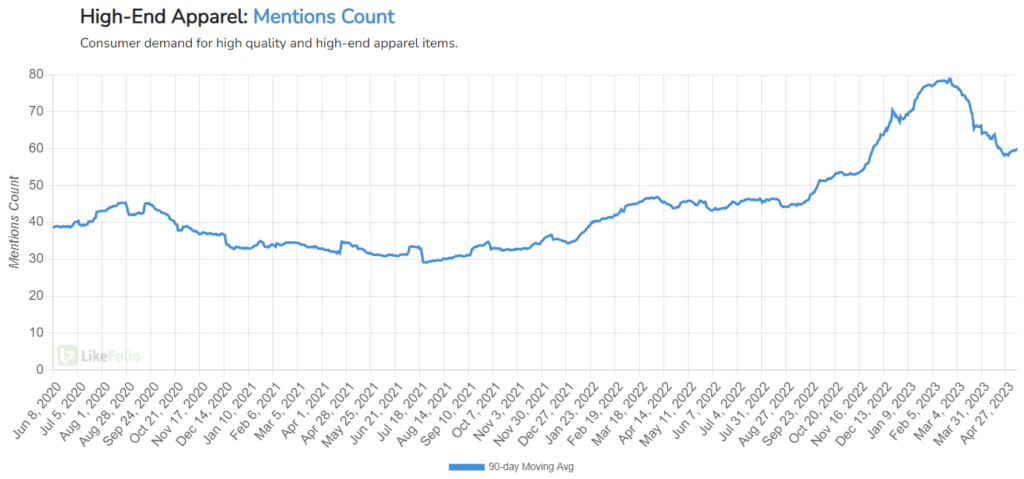

At the same time, consumer trend data suggests the premium shoemaker is still being bolstered by its luxury positioning and affluent audience.

Buzz around high-end apparel remains 32% higher year-over-year:

We’re officially bullish on ONON heading into Tuesday’s earnings call.

And members of our Earnings Season Pass service can expect actionable trade ideas for ONON and every other company slated to report next week in their Weekly Earnings Scorecard this Sunday.

Until next time,

Andy Swan

Co-Founder