You have questions, we have answers: Submit them here by April 11. 📧

Peak earnings season has arrived and it’s true that we always get a bit giddy this time of year. Who can blame us? Earnings season is like a 10-week stock market bonanza where investors get hundreds of opportunities to make quick-hit trades with super-short “risk windows” of just five days.

And we were especially excited after Tuesday’s live kickoff event when Landon and I dished our most coveted secrets to trading the most profitable 40 days of the year.

To those of you who joined us live, thank you. We hope you walked away with everything you need to make this April-to-June earnings season your best trading opportunity of 2023, and we’ll be in your corner throughout it all.

To those of you who missed it, don’t worry – although the clock is ticking to get ready to follow our moneymaking plays, I have the replay for you right here.

This earnings season is particularly special because it’s the first full one we’ll navigate together in Derby City Daily.

Simply reading this right now means you already have a key advantage over the rest of the market: Every single day in Derby City Daily we bring you fresh insights and opportunities based on what real people are saying about the products, services, brands, and trends that the big Wall Street investors haven’t discovered yet.

Since we launched this initiative, we’ve covered everything from high-tech sectors like electric vehicles (EVs) and artificial intelligence (AI) to stalwart favorites like fashion and makeup – all of which will play a vital role in how we trade this current earnings season.

With April underway and new earnings announcements on deck, this is the perfect time to revisit some of the stocks we’re following in these sectors to see how they’re performing and when we can expect those all-important revenue numbers.

Let the earnings countdown clock begin…

Stock No. 1: Tesla (TSLA)

Originally featured in Derby City Daily on March 7: Tesla Keeps Cutting Prices on Its EVs. Here’s How Its Affordability Campaign Could Impact Investors.

⏰ Earnings Countdown Clock: 10 Days (expected April 19)

Americans want electric vehicles (EVs) in 2023. As of this writing, our data puts EV demand up 86% from last year. Tesla (TSLA) knows this. And it’s doing just about everything in its power to make sure its EVs are the top choice – including slashing its prices to make its luxury vehicles available to the masses.

The company kicked off 2023 with a massive 20% price cut on its EVs and has rolled out four additional price reductions.

And since we covered Tesla’s affordability campaign on March 7, we’re happy to report that it seems to be working…

Earlier this week, Tesla announced record-setting production and delivery numbers for the first quarter:

- 440,808 vehicles produced in Q1 vs. 439,701 in Q4

- 422,875 vehicles delivered in Q1 vs. 405,278 in Q4

Shares are trading 80% higher so far this year. And this is exactly the kind of follow-through in execution that investors are hoping to see.

Not only were Tesla’s across-the-board price cuts effective in sparking consumer demand but the company proved it can execute better than any other company in the business.

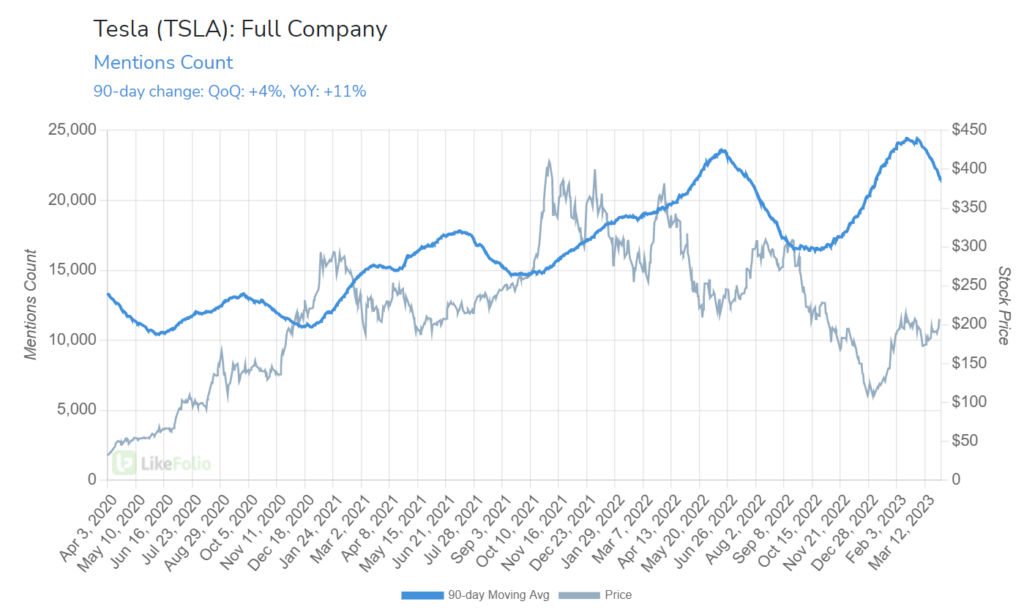

The initial buzz it garnered from slashing prices has tempered somewhat but still remains 11% higher on a year-over-year (YoY) basis:

Stock No. 2: Nvidia (NVDA)

Originally featured in Derby City Daily on March 2: This AI Stock Is Right in the ‘Sweet Spot’

⏰ Earnings Countdown Clock: 45 Days (expected to report May 24)

From creepy search engines to straight-up inappropriate chatbots, we’ve seen enough AI flubs in 2023 that President Joe Biden felt the need to hold an urgent meeting with his science and tech advisors on the “risks and opportunities” AI tech presents.

Ever since ChatGPT catapulted AI into the global consumer consciousness, it seems like every “innovator” out there is scrambling to claim their piece of the AI profits. If there was an AI bandwagon, Nvidia (NVDA) didn’t just hop on – it’s the one driving.

Nvidia invented the GPU (graphics processing unit) in 1999… You know, those computer chips that make just about everything in your life “go,” including ChatGPT?

We’re talking about an “OG” AI stock, which is why we had to put it on your radar back on March 2. Well, in the month and some change since then, its share price has shot up 20%.

And considering the transformative power of AI done right…

With full adoption of AI by 2030, this technology has the potential to quadruple worker productivity, bring fully-autonomous vehicles to life, and create $90 trillion in enterprise value…

We’re confident this is just the beginning for NVDA.

Nvidia’s Consumer Happiness has improved by two points since we published that original story – a bullish signal that bolsters our long-term outlook on the opportunity.

In the more immediate future, though, NVDA is benefitting from the continuing surge in consumer buzz around AI, which is still trending 372% higher year-over-year (YoY), according to our database.

Remember that AI is one of the top consumer trend tailwinds on this season’s “Earnings Cheat Sheet.” Watch this space closely over the next 10 weeks.

Stock No. 3: Hims & Hers (HIMS)

Originally featured in Derby City Daily on March 9: 50% Gains and Counting for This Telehealth Company in 2023 (And More Upside Ahead)

⏰ Earnings Countdown Clock: 29 Days (expected to report May 8)

Compared to its more storied healthcare competitors, Hims & Hers (HIMS) would be the “underdog,” bringing in a fraction of the revenue of Teladoc ($2.4 billion) and Weight Watchers ($1.09 billion) in 2022 with just $526.9 million.

Thing is, for our underdog, that represented 94% annual revenue growth.

Teladoc only grew revenue by 18%, and WW’s revenue actually fell by 11%.

Ever since we first brought you this opportunity on March 9, demand for Hims & Hers tastefully packaged over-the-counter (OTC) products, telehealth services, and doctor-prescribed treatments has only ramped up – in a big way.

At that time, Consumer Purchase Intent (PI) Mentions were registering an impressive 119% higher than the year prior.

As I write this, that demand metric is now up 193% from the year prior – and even more telling in terms of the shorter-term outlook, 76% quarter-over-quarter (QoQ):

Now that the first quarter is in the books, we know that consumer buzz surrounding this “trendy” healthcare company hit record levels:

And that bodes extremely well for the company as it gears up to report those Q1 2023 revenue numbers next month.

Stock No. 4: Ulta (ULTA)

Originally featured in Derby City Daily on March 18: The Lipstick Index Holds True in 2023: But Which Beauty Retailers Are Sitting Pretty?

⏰ Earnings Countdown Clock: 46 Days (expected to report May 25)

During the early 2000s recession, then-Estee Lauder Chairman Leonard Lauder famously discovered a contrarian trend that he coined “The Lipstick Index.”

He found that lipstick sales actually rose during that time – indicating that women facing economic uncertainty were turning to beauty products as an affordable luxury.

Facing economic uncertainty once again, LikeFolio data has added more evidence to this theory as consumer mentions of purchasing new makeup products paces over 20% higher in the spring of 2023.

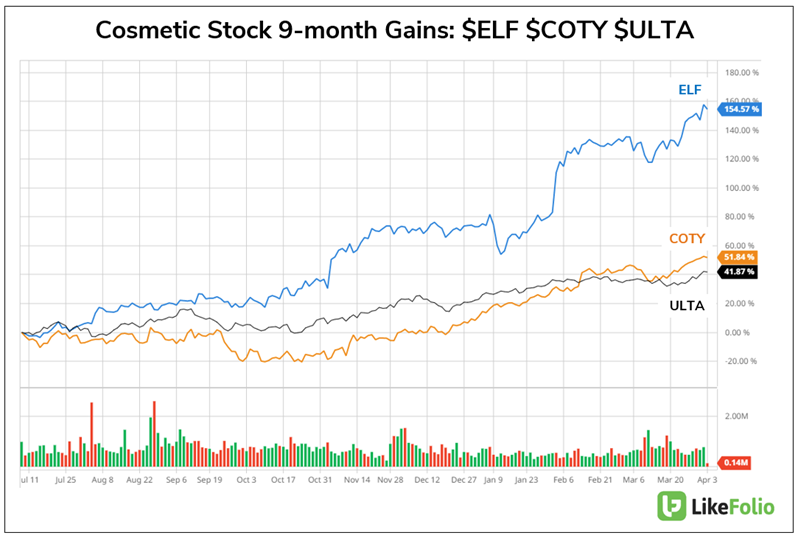

In March, we pitted the two big players in the beauty space against each other to see how they’re faring: Ulta (ULTA) and Sephora. On the surface, these beauty retailers offer the same products: It’s the average ticket size that differentiates them.

A tube of lipstick will cost you $15 at Ulta (on average). At Sephora, it’ll set you back $27.

We dubbed Sephora the winner for high-end luxury, but at the end of the day, both these brands are benefitting from this increased demand.

And earlier this week, ULTA shares cruised through 52-week highs as the company remains resilient against tightening economic conditions:

The question now is: Can Ulta continue its streak? New LikeFolio consumer data reveals a mixed bag:

- While makeup demand remains strong, the growth rate is cooling. When we initially covered this trend on March 18 demand was registering 27% higher compared to today’s levels at 22% higher.

- Web traffic data still shows Ulta digital demand gaining double-digits (+13% YoY) but Sephora is still leading in this metric.

- And perhaps most telling is that as Ulta’s share price races higher, buzz around the brand is slowing down – creating a divergence that suggests this could soon be an instance of a stock going too far, too fast.

The beauty of earnings season is that it doesn’t matter whether we’re bullish, bearish, or neutral on a stock heading into an earnings event… There’s always a way to trade it for profits when you have the right guys in your corner.

And fortunately for you, nobody does earnings season better than us.

Last quarter, out of 17 earnings trades employing our popular “high-probability” trade strategy, we had a win rate of 82% for an average gain of 21.89%… each time in five days or less.

But keep in mind that is just the average, and it only takes one right trade to hit a big homerun.

Get in on a stock that’s set to pop on earnings… Watch as the company reports its numbers… And get out with a hefty profit within five days.

That’s my plan, and if you go here now, I’ll show you how YOU can ride along with us.

You won’t want to miss this.

Until next time,

Andy Swan

Co-Founder