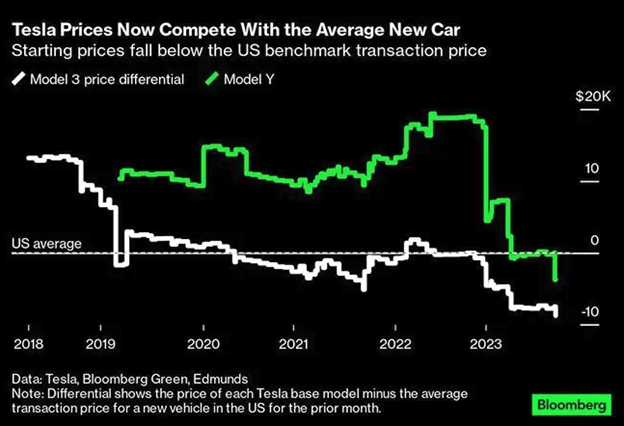

Everyday Americans who are looking to trade in their old vehicles for a fresh set of wheels have more incentive to go for a Tesla (TSLA) than ever before.

After a string of aggressive price cuts, and with federal tax credits sweetening the pot, the cost of a Tesla Model 3 sedan is now in the same price range as the 2024 Toyota Corolla.

While some analysts have loudly lamented the cost of Tesla’s price-slashing campaign, we’ve always viewed it as a strategic move.

Tesla’s profit margins simply can’t be beat – by traditional automakers or its EV competitors. Even with price cuts, Tesla’s core margins remain above 18%.

And throughout the year, we’ve watched it only solidify Tesla’s dominant position in the electric vehicle (EV) market.

Those of you who’ve followed along with our long-term bullish outlook in Derby City Daily have the profits to show for it. Tesla shares have gained 50% since May.

But this week will deliver a fresh opportunity for Tesla investors.

The EV maker is due to report earnings Wednesday, October 18, after the bell – and this single event could trigger a massive move in TSLA’s stock price over a few short days.

We know because we’ve accurately predicted Tesla’s earnings moves every quarter of 2023 so far…

| Earnings Season | LikeFolio Earnings Signal | Stock Move (%) |

|---|---|---|

| 2023 Q1 | Bullish (+14) | +23.8% ✔️ |

| 2023 Q2 | Bearish (-42) | -11.7% ✔️ |

| 2023 Q3 | Bearish (-51) | -10.5% ✔️ |

And you can bet we’re looking to go four-for-four with another big win.

In fact, our AI-driven earnings algorithm just issued the strongest earnings signal for TSLA yet this year.

Paid-up Earnings Season Pass members are already armed with the details of a TSLA trade that could have them cashing out their winnings by Friday. (Want in?)

But for the rest of our Derby City Daily readers, here’s a sneak peek at the data ahead of this major profit catalyst…

Accelerating into 2024

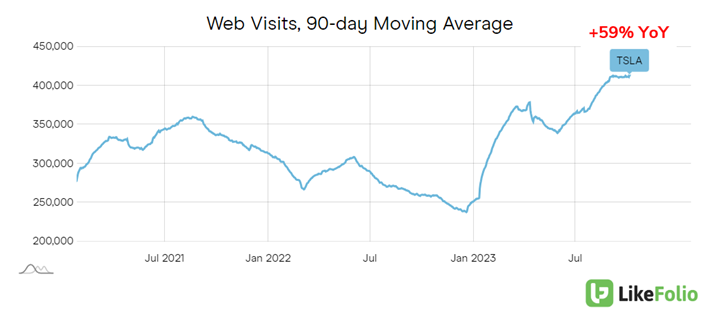

With LikeFolio’s x-ray view into company web traffic data, we can tell you that Tesla web visits are hitting multi-year highs right now – surging nearly 60% year-over-year.

That’s a clear indication that the price cuts are generating demand and making Tesla vehicles more accessible to a broader consumer base.

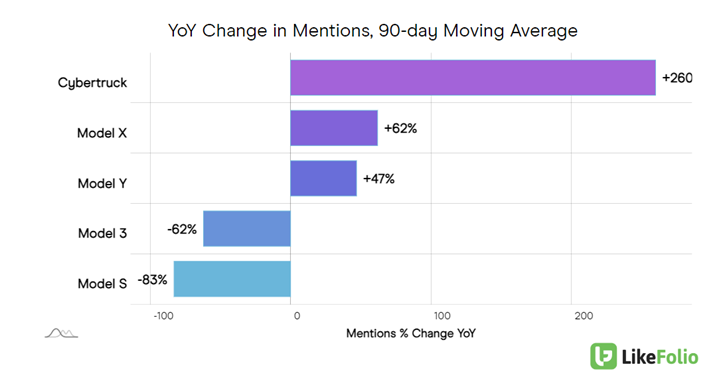

The buzz around Tesla’s Models X, Y, and the much-anticipated Cybertruck is palpable.

You can see Cybertruck mentions surging a whopping 260% year over year before it’s even been released to the public.

The first 2024 model was reportedly auctioned at the Petersen Auto Museum for a staggering $400,000.

Just imagine the excitement when this futuristic truck becomes a common sight on the roads.

Telsa’s Wild Card

In the meantime, Tesla’s introduction of a $300 Cybertruck-inspired wireless charger – compatible with devices like Apple’s (AAPL) iPhone – has us eyeing a potential convergence with mobile tech.

🗞️ Now Available: Apple Investor Report 2023

The Hits, the Misses, the Game-Changers, and the Bottom Line

Rumors of a potential “Tesla Phone” have been swirling for a few years now. And they might have been just that – rumors.

But the lines between cars and smartphones are blurring. And this move could hint at potential competition between tech behemoths like Apple and automotive innovators like Tesla in the future.

As vehicles transition to be more software-centric, Tesla, with its advanced vehicle software, is perfectly positioned to lead this transformation.

It’s a wild card, sure.

But from a big-picture perspective, the rising demand for EVs is undeniable – especially as gas prices remain elevated – which plays well for Tesla as the EV leader.

The Bottom Line

Our long-term bullish stance on Tesla remains unchanged, and any sell-offs due to price cuts should be viewed as accumulation opportunities for long-term investors.

Just remember, with earnings around the corner, investors could be in for some extra volatility this week.

Wall Street expects weakness in China and a potential 30% hit to Tesla’s bottom line.

But our AI-driven earnings predictor indicates those detractors could be in for a surprise.

To get immediate access to our full TSLA earnings analysis with detailed trade instructions, along with over a dozen actionable trade ideas to play earnings this week (and hundreds more over the next nine weeks), click here.

Until next time,

Andy Swan

Founder, LikeFolio

Up Next: Must-Watch Stocks for October 2023 (and Beyond)

This fall, new consumer insights out of LikeFolio have us crowning the winners (and ditching the losers) in fast food, AI, beer, and more….

The Top Player in Fast Food Today

Fast-food giants are integrating digital accessibility, drive-thru convenience, and compelling loyalty programs to win over consumers in 2023… But which tops them all?

The “Undercover” AI Winner Under $3

Demand mentions for this “undercover” AI company are surging over 100% year-over-year this fall. Better yet? You can still grab shares for under $3 if you act fast…

The Big Winner of the Bud Light Meltdown

Six months into the Bud Light backlash, was the King of Beers able to withstand the heat? Or will another beverage company rise to the top? See what’s on tap…