Cruise stocks have soared over the last year as consumers break free from COVID-era lockdown and book long-awaited trips out of town.

That rising demand lifted all boats during “Wave Season.”

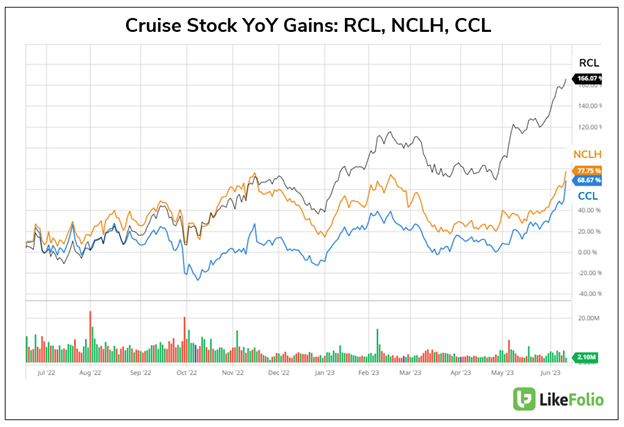

On a year-over-year basis:

- Royal Caribbean (RCL) shares have gained 166.07%

- Norwegian Cruise Line (NCLH) shares are up 77.25%

- And Carnival (CCL) shares have risen 68.67%

Royal Caribbean caught the biggest wave – greatly outperforming peers in stock price gains alongside booming demand.

That’s because Royal Caribbean found itself in the travel industry sweet spot by catering to a higher-end – and therefore more insulated from inflation – clientele.

Its price point and perceived value are right in the middle of NCLH (on the high end) and CCL (on the low end), making it kind of like the “Goldilocks” of cruise liners.

That edge is clearly captured in LikeFolio’s consumer data: When we covered these cruise stocks in the March 21 Derby City Daily issue, RCL demand was accelerating the fastest of the group.

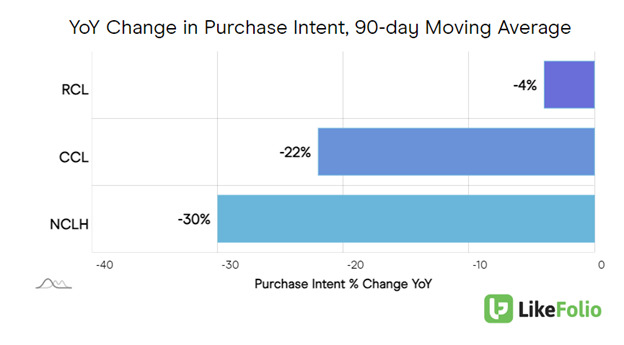

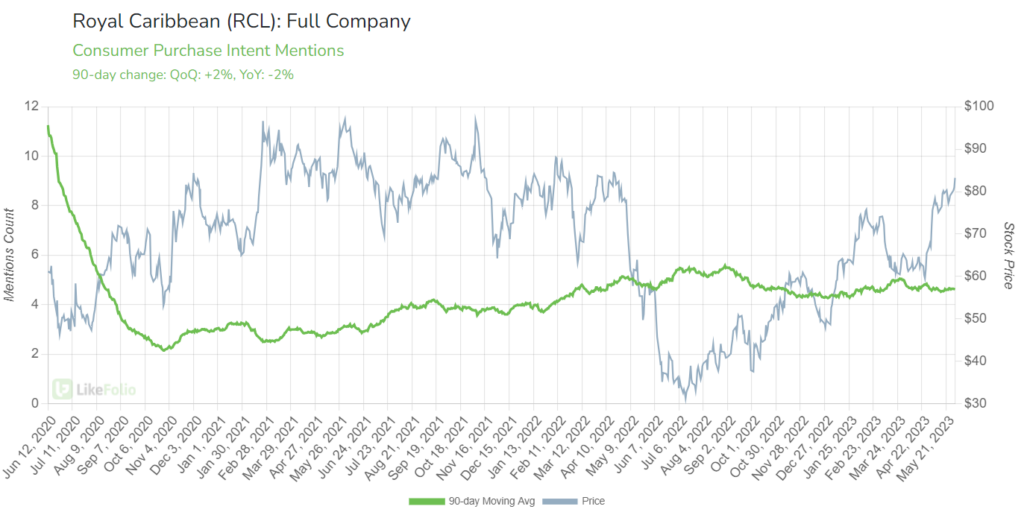

And RCL continues to lead the pack in demand, as you can see from the chart below:

But take another look at that chart and you’ll see why my alarm bells are starting to go off.

RCL demand has fallen by 4% year-over-year; Purchase Intent growth for CCL and NCLH is even worse, sliding by 22% and 30%, respectively.

Let’s take a deeper dive into the data to see what the future could hold for this favorite cruise stock…

Travel Demand Is Running Out of Gas

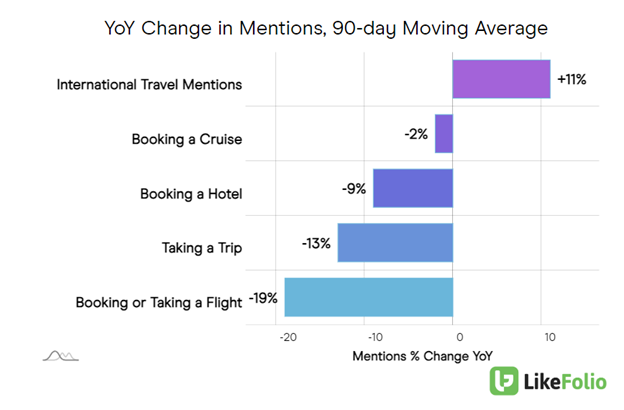

Despite tremendous gains in RCL (and underlying results to support those gains), travel trends show troubling signs of slowing down… especially over the last month.

Mentions of consumers booking a cruise are down 2% year-over-year while chatter around taking a trip more broadly is down by 13%.

Data around “booking a cruise” mentions is extremely forward-looking. Folks talking about booking a cruise haven’t actually gone on their cruise yet, for example.

But it may be an early sign of trouble for an industry that has proven resilient, even amid economic tightening.

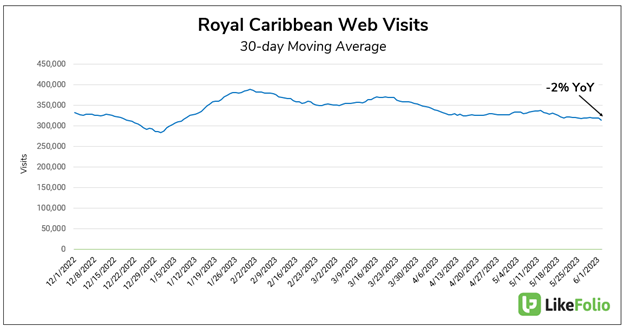

E-commerce data confirms a slowdown: Royal Caribbean website visits are slipping by 2% year-over-year.

Compare that to a quarter ago, when web visits were up by 47% year-over-year.

Royal Caribbean reported better-than-expected results last quarter driven by bookings at higher prices, increased onboard spending, and “favorable timing of operating costs.”

A strong wave season set the bar high.

And that optimism could develop into an opportunity for investors…

A Bearish Divergence in the Making

RCL’s Earnings Score just slipped into negative territory (-20).

And we can now see a divergence between consumer demand and RCL’s stock price forming clearly in the chart below:

Members will be alerted if demand continues to degrade and a bearish opportunity appears ripe for the taking.

Until next time,

Andy Swan

Founder, LikeFolio