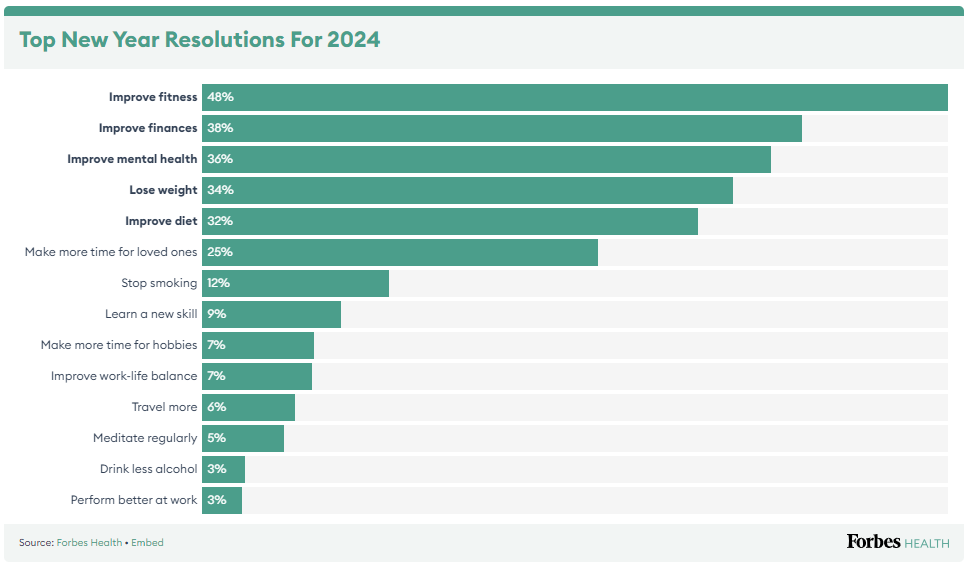

One-third of U.S. adults started 2024 with a New Year’s Resolution. And for a whopping 48% of those goal-setters, “improve fitness” is the top priority, according to Forbes’ annual survey.

In fact, four of the five most popular resolutions for 2024 revolve around health and wellbeing, with 36% looking to improve mental health, 34% aiming to lose weight, and 32% setting out to improve their diet.

I’m more interested in making money in 2024 – and since you’re reading this, I’ll bet you are too.

So let’s put this intel to good use.

Understanding which changes consumers are making and which companies are likely to benefit is extremely powerful for investors.

You can’t just invest in any old fitness stock and call it a day.

With every major consumer trend, there will be winners – and losers. And this is where LikeFolio real-time insights give us a massive edge.

Every year, we monitor our predictive data to find the companies that could benefit from New Year’s Resolutions… identify which are gaining real momentum with consumers… and use that data to place our trades before the rest of the market.

In 2024, these are the picks that made our shortlist of stocks most likely to see a New Year’s Resolution bump…

2024 New Year’s Resolution Watchlist

No. 1: Duolingo (DUOL)

Learning a new skill is at the top of many consumers’ resolution list. And with the surge in post-COVID travel interest, many people are looking to learn a new language to prep for an upcoming trip.

Nowadays, people are learning everything online, including new languages. This bears out in LikeFolio data.

And it’s why we’re keeping a close eye on language learning app Duolingo (DUOL).

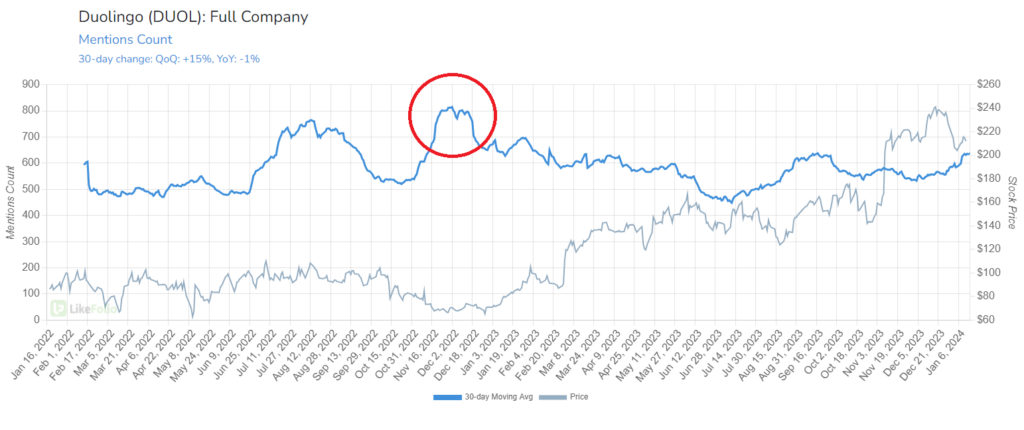

DUOL has been an enormous winner for our LikeFolio Investor subscribers, gaining 124% since we recommended it as a buy in March 2022.

But thanks to expanded offerings beyond language to other areas, like math, and incorporating artificial intelligence (AI), we believe Duolingo has plenty of room to grow in 2024.

By leveraging the latest advancements in generative AI, the company is able to offer a more personalized and engaging learning experience, while also creating new content at a faster pace.

DUOL should get an adoption bump to kick off the new year, like the one last year circled in red:

2024 is still young, so we’re waiting to see this trend play out.

But early results are promising: Looking at a 30-day moving average, Duolingo mentions have seen a 15% boost from last quarter.

No. 2: Celsius Holdings (CELH)

By now, most of you should already have Celsius Holdings (CELH) on your moneymaking watchlist. The company offers a line of energy drinks known for their niche among exercise enthusiasts.

LikeFolio Investor subscribers have racked up a 312% profit from this stock since January 2022; we doubled down on CELH in February 2023 for yet another double-your-money opportunity… in less than a year.

With fitness as the main goal among consumers this year, we’re watching for a Celsius demand boost. We expect mention volume in January to tick higher, like it has in years’ past:

One caveat here: While Celsius’s year-over-year mention growth is undeniable, its breakneck pace is slowing down. Consumer mentions for CELH are currently registering 67% higher on a 30-day moving average – down from 100% growth we’re seeing from a 90-day view.

The bar is high for Celsius, and we are watching for traction in real time.

No. 3: WW International (WW)

WW International (WW) stock received a tremendous boost after the company embraced weight-loss drugs like Ozempic via the acquisition of Sequence telehealth in mid-2023.

Once again, our LikeFolio Investor subscribers were well ahead of this run up, thanks to an opportunity alert delivered on the back of an early resolution season. That trade recommendation resulted in a 174% win for our paid-up members a few months back.

Now, early data suggests WW’s shift in mindset away from diet culture and into weight-loss drugs has legs.

WW mentions are accelerating here in 2024, up by 43% year over year, even following last year’s impressive New Year’s Resolution run-up:

Consumer interest in the kind of weight-loss injections WW now offers has skyrocketed to new heights over the past two years: more than 2,100%, according to LikeFolio metrics.

Take note of this early leader – and consider pullbacks in the stock as accumulation opportunities.

We’ll be watching the diet, fitness, and physical wellbeing sectors during earnings season and throughout 2024 to let you know which tickers our data points to as we follow this “mega” trend.

124%… 312%… 174%…

With access to real-time trade alerts, LikeFolio Investor subscribers were able to turn all three of these stocks into triple-digit profit opportunities in 2023.

We’ve got as many as 24 trades on deck for those members in 2024.

So if you’re serious about making money in the new year, joining LikeFolio Investor today is a no-brainer. We’ll get you where you need to be.

Until next time,

Andy Swan

Founder, LikeFolio