Her team didn’t take home the championship, but there’s no doubt Caitlin Clark made this year’s women’s March Madness tournament must-watch television – and must-wager sports betting.

Sunday’s star-studded showdown between the South Carolina Gamecocks and the top-seeded Iowa Hawkeyes drew more viewers (18.7 million) than the men’s NCAA final (14.8 million) for the first time in history.

For BetMGM (MGM), DraftKings (DKNG), and FanDuel (FLUT), the 2024 women’s NCAA championship game also set the record for the most-bet women’s sporting event of all time.

All told, the American Gambling Association (AGA) estimates that U.S. gamblers wagered more than $2.72 billion on this year’s NCAA tournaments, nearly doubling the betting volume of the Super Bowl.

The sports betting sector is on fire right now – and surging interest in women’s sports is one of the top catalysts fueling its growth. Caesars Sportsbook logged an incredible 190% increase year-over-year in bets on women’s college basketball games this year.

Also driving those wagers, of course, are increased legalization – sports betting is now legal in 38 states plus D.C., with six more states considering legislation – and the normalization of online betting at large.

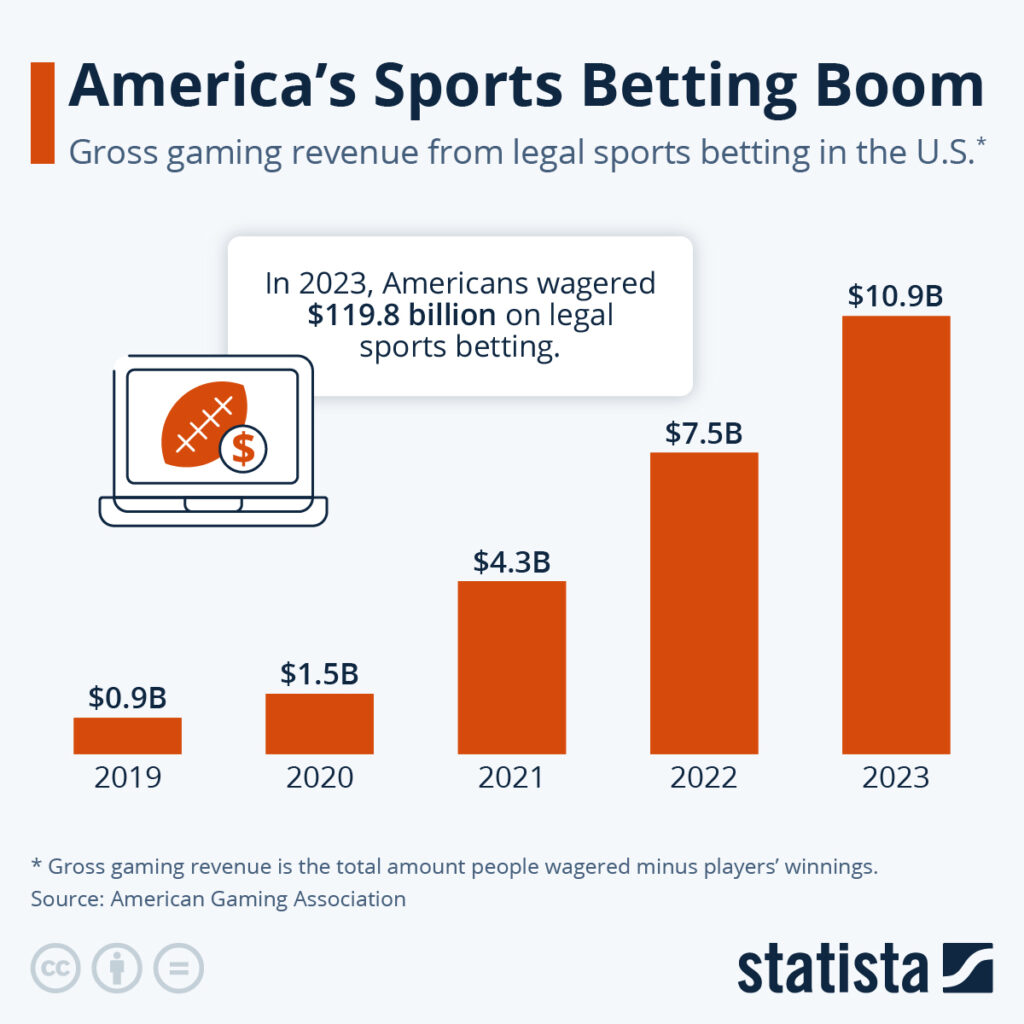

Since the Supreme Court lifted the federal ban in 2018, America’s legal sports betting industry has grown into a profit powerhouse, bringing in $10.9 billion in revenue in 2023.

We’ve been tracking the winners and losers of sports betting as legalization sweeps the nation. And we’ve delivered our MegaTrends subscribers 31%, 59%, and 217% wins along the way.

Now that this year’s March Madness tournament has come to its epic conclusion, let’s check in to see where our favorite players stand – and what comes next for investors like you.

Who’s Winning the DraftKings-FanDuel Rivalry Now?

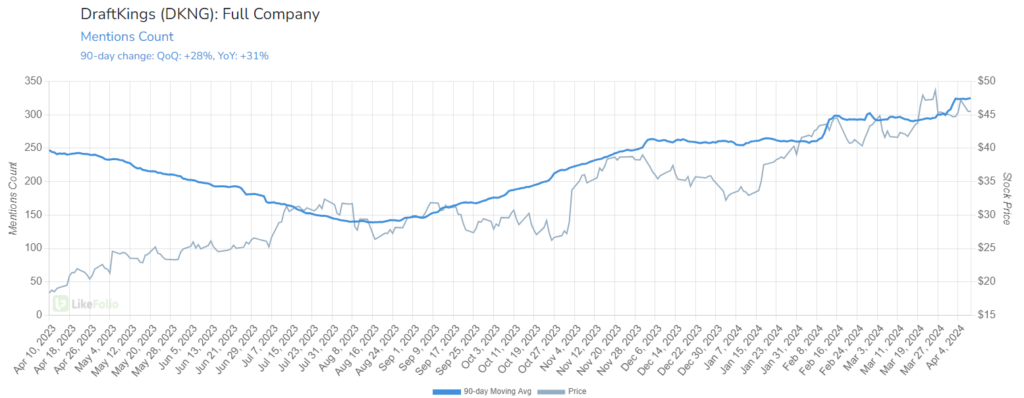

We named DKNG a top stock to build your wealth in 2024, and it’s racked up a nearly 25% gain since we issued that report. Hopefully you followed our lead.

During the 2024 March Madness tournament, DKNG mentions reached multi-year highs; in fact, DraftKings buzz is currently surging by 31% year over year:

But DraftKings faces stiff competition – namely from FanDuel, its top online rival.

FanDuel is owned by Dublin-based gaming giant, Flutter Entertainment (FLUT).

If you don’t recognize the stock ticker FLUT, it’s because Flutter traded under the stock ticker PDYPF until earlier this year, when it listed on the New York Stock Exchange (NYSE). (And yes, that move was directly aimed at maximizing the company’s exposure to America’s high-growth gambling sector.)

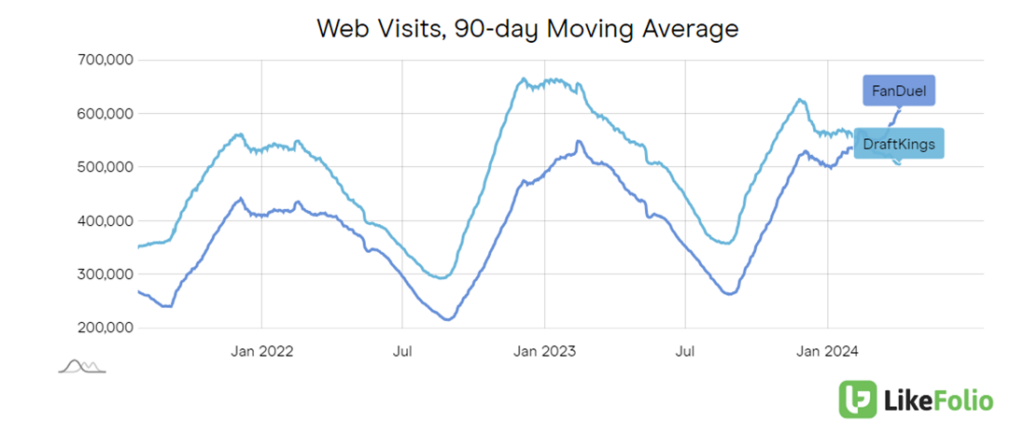

Now, for the first time in years, FanDuel has surpassed DraftKings in mention volume and web visits, according to LikeFolio metrics:

That recent outsized growth in consumer interest is attributed to superior payout speed, promotional variety, and live betting options. Moreover, FanDuel’s acceptance of PayNearMe for cash deposits gives it an edge. It’s a convenience DraftKings currently lacks.

Despite this rivalry, the sports betting market’s expansion is a collective lift that’s benefitting all players – DKNG included.

As new markets open, significant investment in promotions is essential, yet this also means increased profitability potential as these markets mature.

What Comes Next

In the fourth quarter of 2023, DraftKings saw its revenue surge 44% year over year to $1.23 billion, with a 37% increase in monthly unique payers to 3.5 million. The company also raised its revenue forecasts for the coming fiscal years, indicating confidence in sustained growth and sending shares higher (+36% over the last three months alone).

A new partnership with digital media company Barstool Sports has further enhanced DraftKings’ brand exposure, although its impact is yet to fully materialize. That announcement came in February of this year.

Our proprietary Social Heat Score identified DKNG early, triggering a buy alert for our MegaTrends subscribers when it was still trading under $12 a share. The stock has rocketed an astonishing 292% since. That’s the kind of profit potential we’re talking about here. (See for yourself.)

Looking ahead, we’re watching interesting ripple effects of another converging macro trend: artificial intelligence (AI).

AI’s role in personalizing betting experiences is significant, but it also brings cybersecurity risks, with potential losses from AI hacking during NCAA tournaments estimated at over $18 billion.

We’ve got a close eye on DKNG, but expect its shares to continue to benefit from (increasingly) nationwide adoption.

The next big betting event happens to be our personal favorite: The Kentucky Derby. DraftKings will be ready to capitalize on The Derby with its DK Horse app – and we’ll be on the sidelines on Derby Day experiencing the action firsthand.

This is an exciting place to be as an investor… So, stay tuned for more developments to come.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

The Magic of Disney’s $60 Billion Bet on Experiences

Consumers want high-end experiences, and Disney is delivering in a massive way…

From Ugg to Hoka: This Is the New “Ugly Shoe” Powerhouse

For Deckers Outdoor, it’s out with the Ugg, in with the Hoka…