A poll by Forbes found 39% of consumers set improved fitness as one of their New Year’s resolutions for 2023.

Less than half of those folks will stick with it for the full year, though.

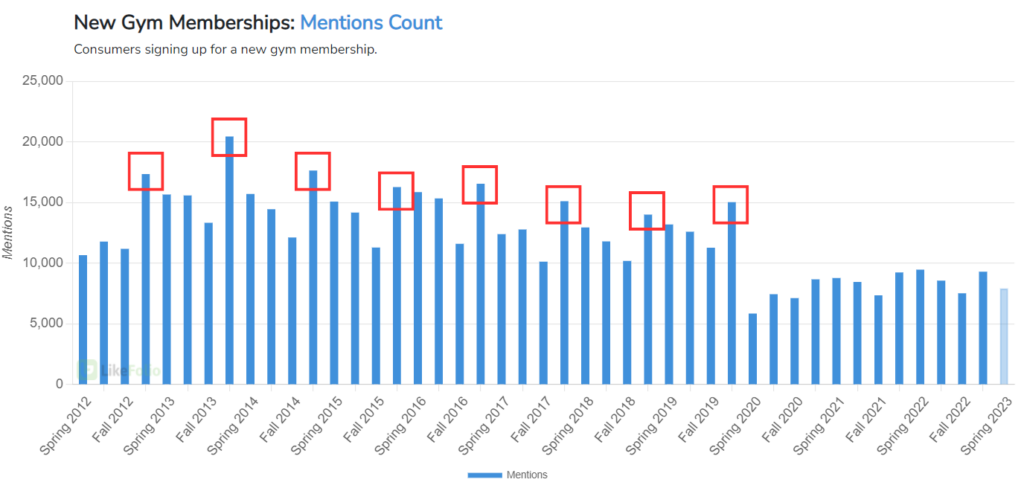

Fitness trends are highly seasonal: There’s the New Year’s resolution bump that happens in the winter months, then a notable drop-off in the spring, summer, and fall months… like clockwork.

That seasonality is clear as day in LikeFolio trend data:

At least… That’s how it was until COVID changed everything.

Starting in 2020, going to the gym fell out of favor as folks isolated at home – again, clear as day in the chart above.

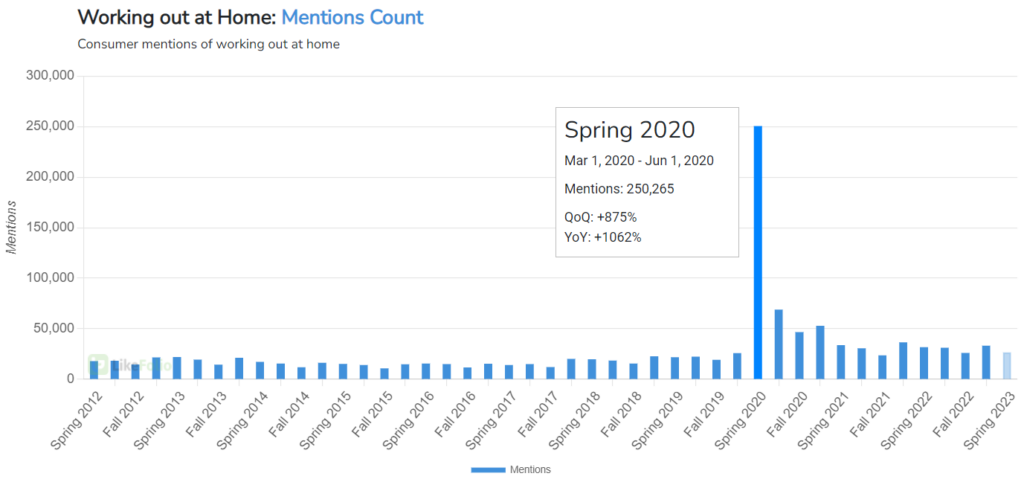

Rather than heading to the gym, folks started working out at home. Look at that spike in chatter working out at home chatter we picked up between March and June 2020:

Peloton (PTON) had a field day.

Its expensive at-home exercise bikes, complete with interactive workout streams to keep you connected while isolated, were highly desirable – and suddenly worth the price.

Investors piled in and sent PTON shares to new heights – surpassing the hundred-dollar mark by the end of 2020, then surging to a fresh peak nearing 200 in January 2021.

But the federal COVID-19 Public Health Emergency declaration officially ended on May 11.

We’ve entered a fresh post-pandemic era.

Consumer preferences have shifted – in some cases, drastically.

Health and wellness trends are in.

Social activities are filling up our calendars.

Perhaps most exciting of all: Memorial Day’s fast approach means it’s pool season.

And those exercise habits that many consumers jump-started at the start of the New Year? Time to see how those are holding up…

In this post-pandemic era, LikeFolio data reveals three critical shifts in exercise trends that tell us fitness stocks are in for a shakeup…

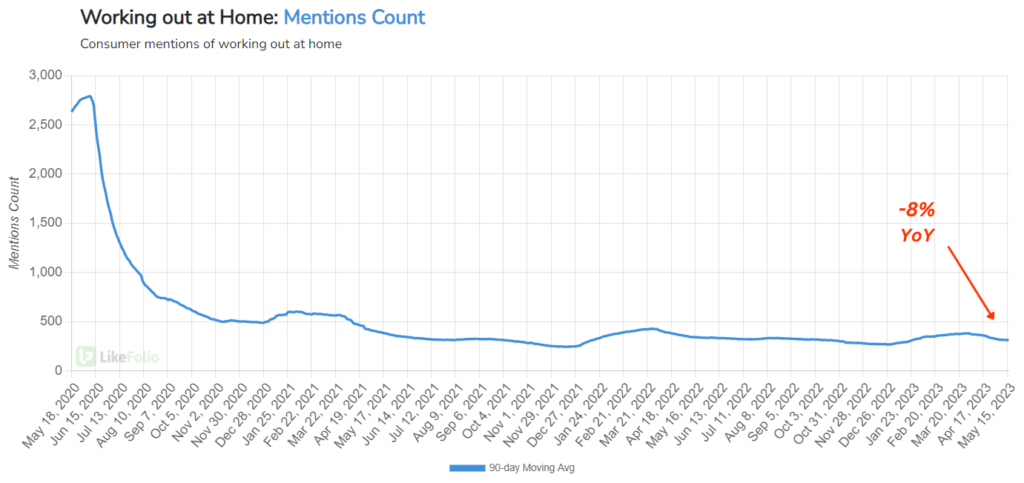

No. 1: Consumers Are Over Working Out at Home

You saw above how working out at home mentions spiked drastically during COVID. It’s safe to say… consumers are officially “over” their home gyms. Mentions of working out at home have dropped off 8% year-over-year and 10% quarter-over-quarter.

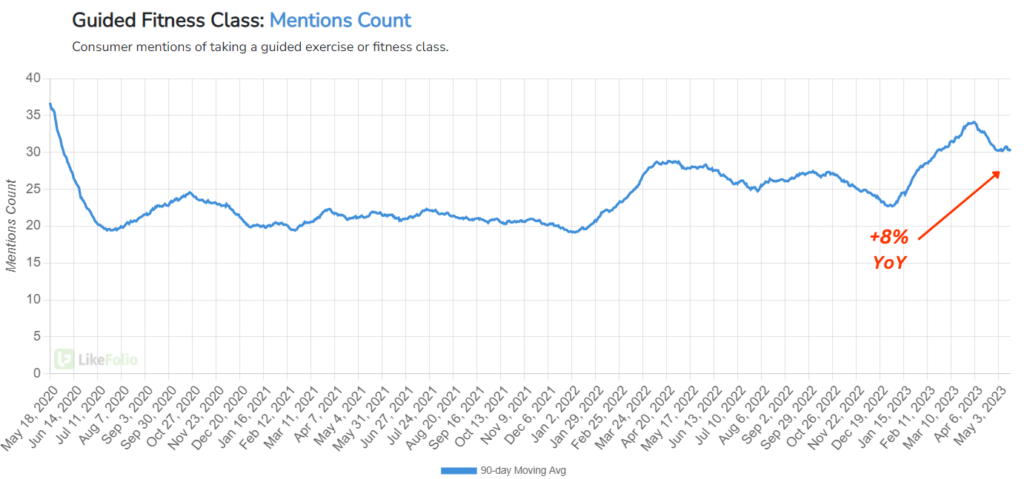

No. 2: Guided Fitness Classes Are Growing in Popularity

Instead of hitting the Peloton, folks are increasingly headed to the gym – more specifically, for guided fitness classes where they can work out in groups to quell that social urge and get professional-level guidance at the same time.

LikeFolio trend data is currently recording an 8% uptick in mentions around guided fitness classes year-over-year.

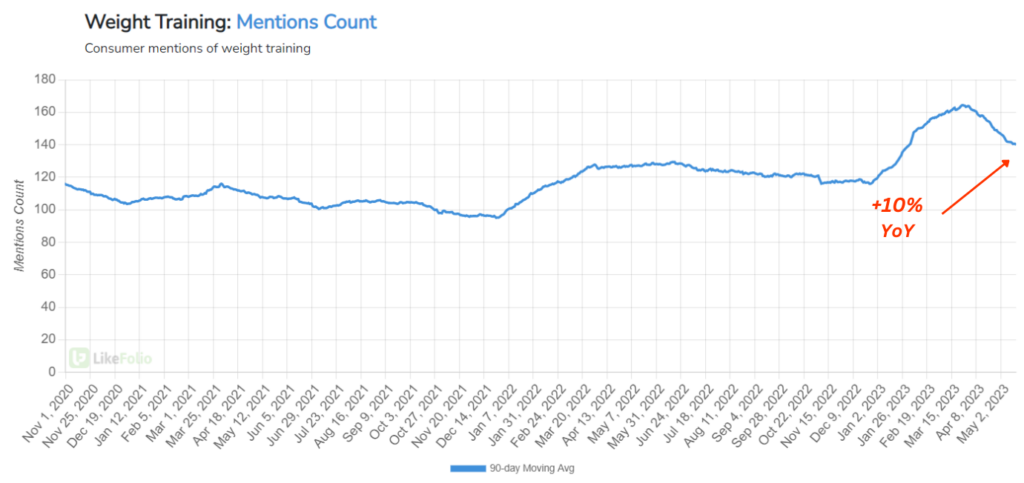

No. 3: Consumers Are Refocusing on Weight Training

Along with interest in guided fitness classes, consumers seem to be refocusing on weight training – mentions are trending 10% higher year-over-year as of this writing:

At-home fitness players like Peloton are in for more trouble – while boutique fitness class providers like this one are seizing the opportunity…

Peloton: Downhill from Here?

Peloton’s stock has been on a downhill ride for the last two years, shedding more than 90% in value as it coasts off COVID-induced highs.

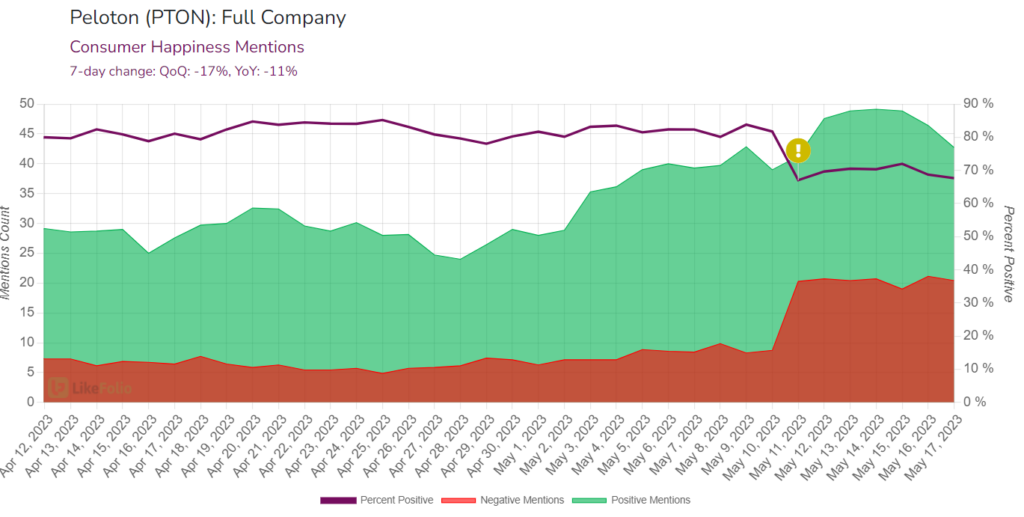

Last week, it announced some bad news – for users and investors alike: a seat recall.

Turns out, all those bikes Peloton sold during its COVID craze are in need of a seat upgrade. Thirteen injuries have been reported over faulty seats that fall off during use.

This news is minor compared to early 2021 when the company recalled all of its Tread+ and Tread treadmills after a child’s death and multiple injuries.

But it still sent Peloton’s Consumer Happiness tanking by 11% on a year-over-year basis.

Recalls haven’t proven to be a nail in the coffin in the past, but it’s not a good vote of confidence for Peloton’s struggling brand image.

More concerning for long-term investors is that Peloton’s consumer demand volume is cratering below 2018 levels, even amid product launches like the Peloton Row.

With Purchase Intent mentions down 61% year-over-year, the data doesn’t support a bet to the upside just yet.

But it does for this next name…

Xponential Fitness: Boutique Is “in”

Xponential Fitness (XPOF) is the parent company of some of the trendiest names in boutique fitness classes.

An impressive six of its 10 brands earned rankings on Entrepreneur’s 2023 Franchise 500 list.

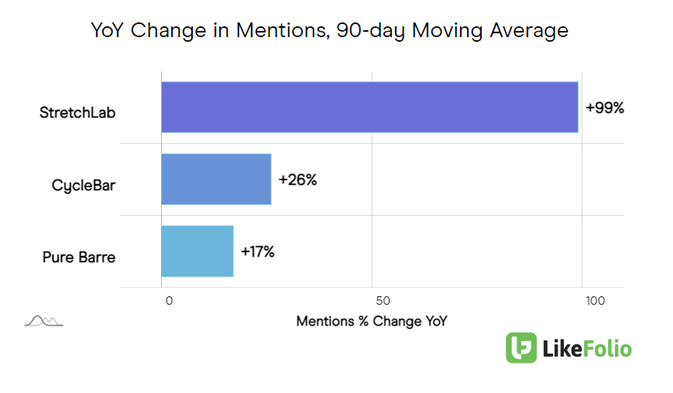

Names like CycleBar, Pure Barre, and StretchLab – which make up the lion’s share of XPOF’s mention volume and growth:

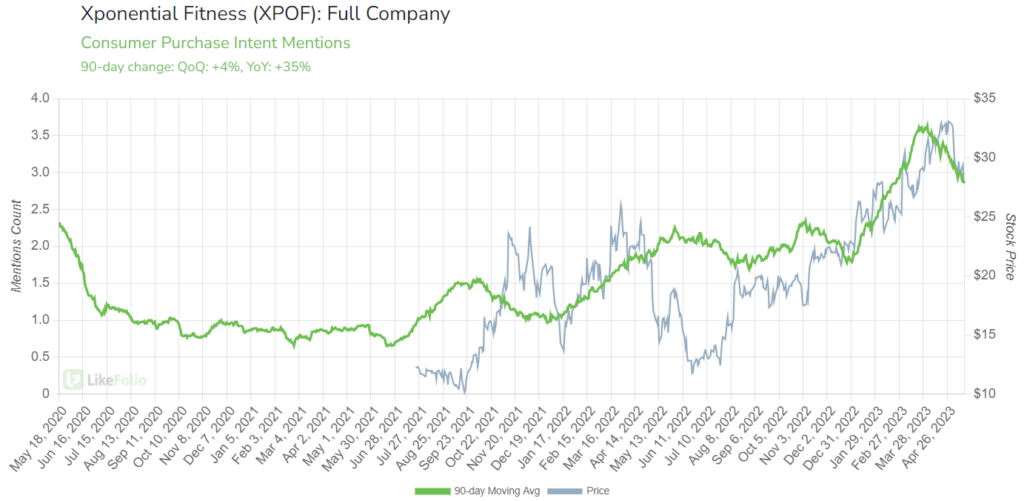

According to LikeFolio consumer demand data, social media mentions of taking one of Xponential’s fitness classes have risen by 35% year-over-year across the board.

While demand is tempering from its seasonal peak, this remains an impressive growth rate.

Last quarter, Xponential posted a surprising loss (analysts were expecting positive earnings) alongside a 40% year-over-year jump in revenue. The loss was attributed partially to $6.2 million in Rumble-related acquisition expenses.

Other key highlights:

- Growing userbase: North American memberships topped 665,000, up 31% year-over-year

- Rising engagement: Studio visits increased by 38% year-over-year

- Low churn: Membership freezes were at their lowest level since prior to the pandemic

LikeFolio issued a bullish alert on XPOF to Opportunity Alerts subscribers more than a year ago and members have raked in nearly 30% in gains since then.

However, the recent pull-back may prove to be overstated. Underlying consumer demand remains strong and boutique fitness continues to be insulated from churn compared to virtual fitness memberships and even some gyms.

We’re betting on XPOF.

Until next time,

Andy Swan

Co-Founder