📝 Pop Quiz: Health and wellness trends are in – but which diet is hottest with consumers?

As folks are shaking off their winter hibernation with travel plans and socializing, we’re seeing interest in health and wellness reignited.

After all, if more people are getting out and about, it only makes sense that they want to find ways to look and feel their best.

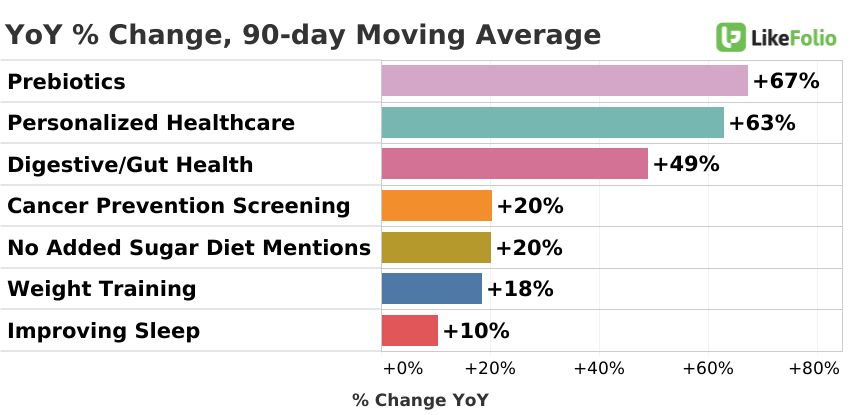

Chatter around weight loss drugs is all-out skyrocketing, while trends like personalized healthcare, digestive health, and weight training are having a moment of their own:

And along with things like prebiotics and weight training, it comes as no surprise that food is a focal point of health and wellness.

But it’s a certain kind of food for diet and health plans that we’re seeing increased social chatter around.

This has caused a once buzzed-about stock to get kicked to the curb, while another offers a divergence opportunity that could put more money in your pockets…

📝 Pop Quiz Answer: Health and wellness trends are in – but which diet is hottest with consumers?

A. Gluten-Free

B. High-Protein ✔️

C. Vegan

D. Ketogenic

E. Plant-Based

Consumers Have Spoken: Vegan Is Out, Protein Is in

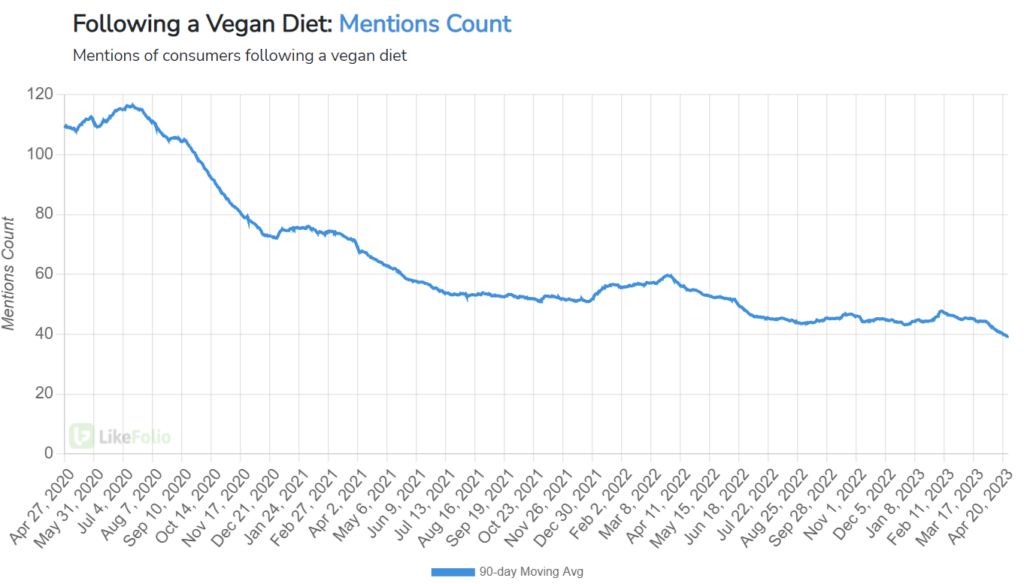

Consumers have spoken – and vegan is officially “out.”

Mentions of following a vegan diet have fallen off in a big way, down 28% year-over-year:

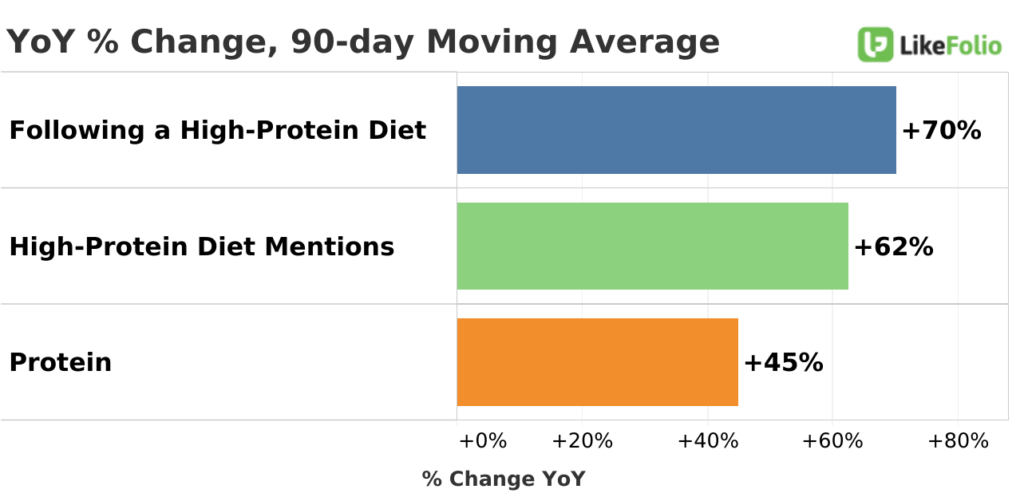

Now, it’s all protein all the time – with high-protein diet mentions soaring to new highs:

As more individuals turn to a protein-rich diet, brands and companies who operate in this space are benefitting in a big way – whereas the makers of plant-based meat alternatives… not so much.

One Stock Losing: Beyond Meat (BYND)

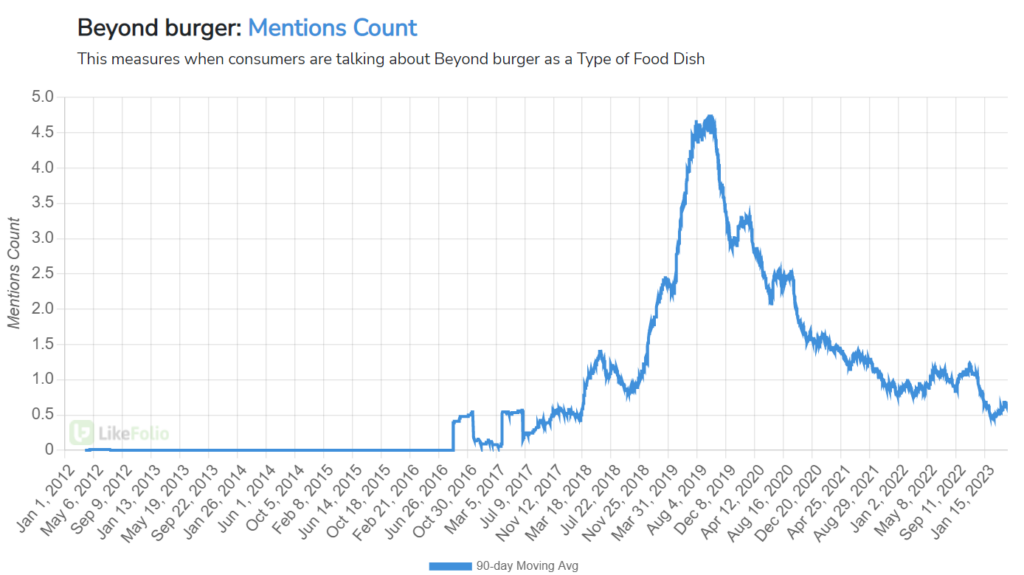

Back in May 2019, Beyond Meat (BYND) became the first plant-based meat company to hit the stock market – right as hype around its meatless burgers was reaching a fever pitch:

By July 2019, just two months later, the stock had hit $239.71. It was the best-performing IPO we’d seen in two decades.

Today, shares are trading for just $13.

See, Beyond Meat confused people: It was supposed to be this vegan-friendly meat substitute. Healthy, right?

Not so fast.

A Beyond Meat burger can contain nearly the same amount of saturated fat and more sodium than a meat-based burger. When over-consumed, saturated fat and sodium can increase the risk of heart disease and strokes.

So people started to learn that this thing that was supposed to replace real meat wasn’t that much better for you.

On top of that, one of the reasons consumer adoption of plant-based meat substitutes started to slow is because of elevated food costs. Protein alternatives are simply too expensive and consumers are trading down to either cheaper competitors or going back to traditional meats.

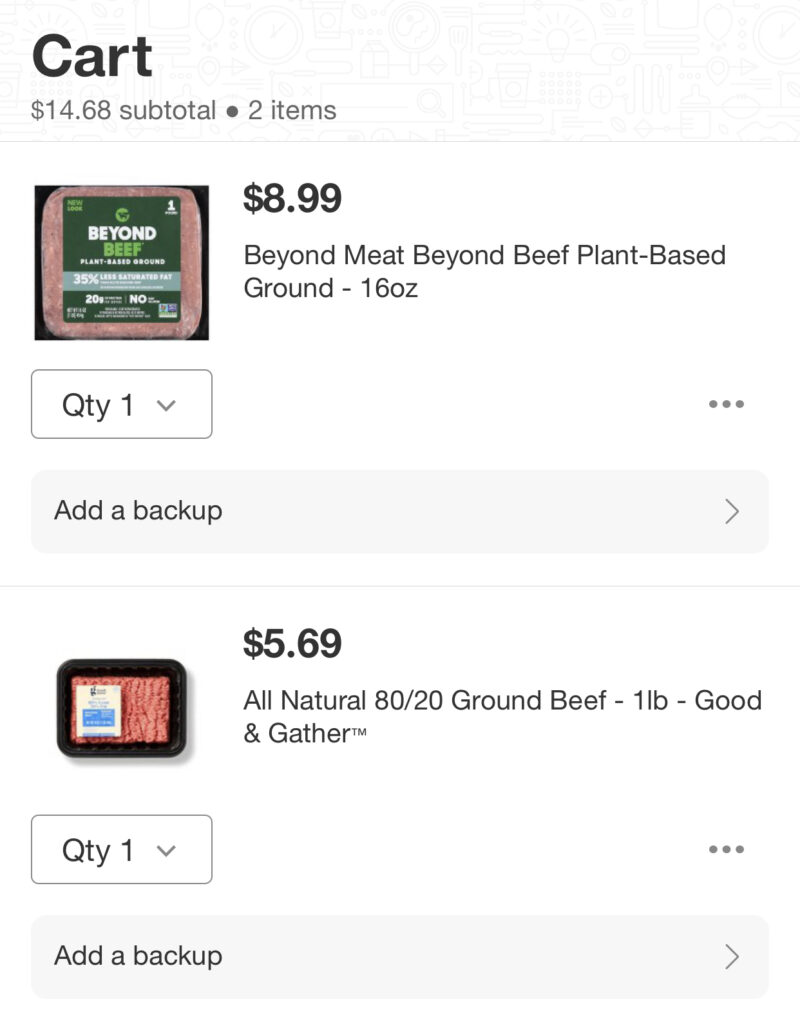

In terms of price, a pound of Beyond Meat plant-based substitute will cost consumers more than 1.5x as much at the register:

And with food price concerns near all-time highs, Beyond has become a tough sell…

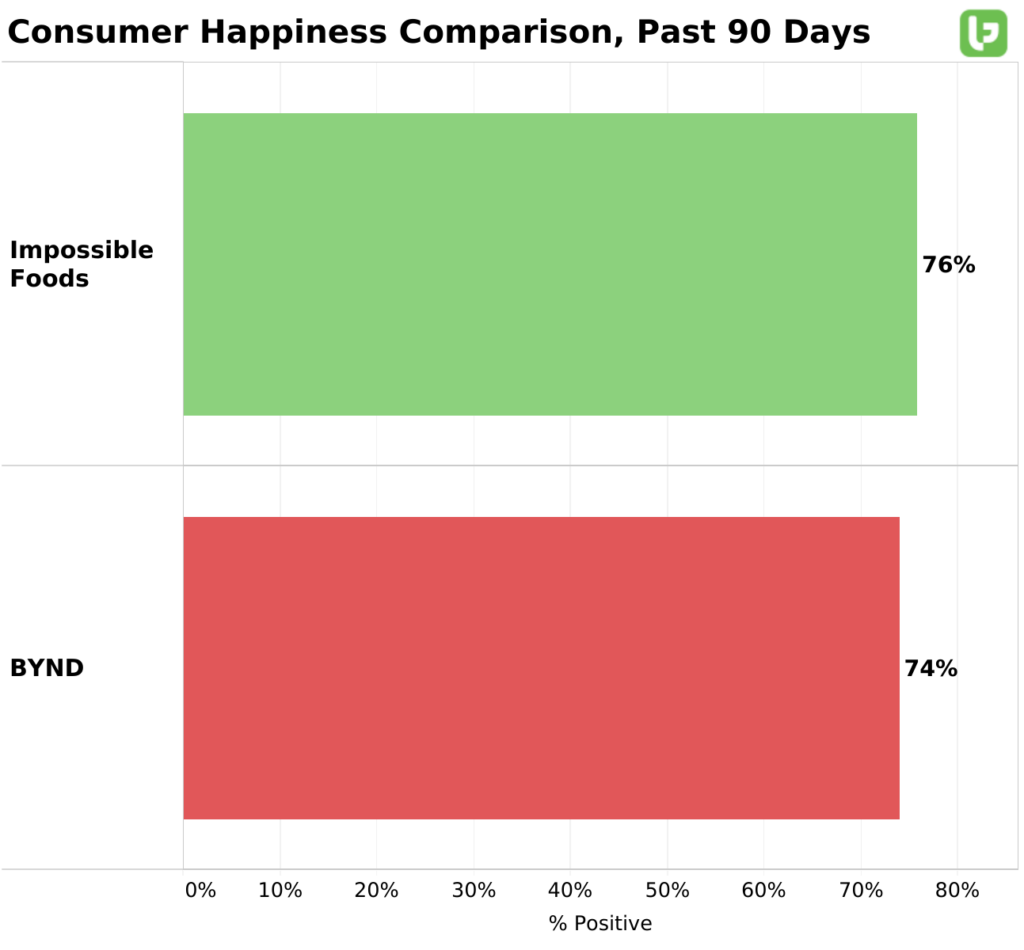

Even strictly vegan consumers prefer Impossible Foods, which beats Beyond Meat in Consumer Happiness by two points:

The demand decline has gotten so bad that Beyond Meat is now getting hit with “low utilization” charges and termination fees from co-manufacturers, and the company has had to reduce its co-packers from eight to three in response.

One Stock Winning: Simply Good Foods (SMPL)

Packaged foods company Simply Good Foods (SMPL) is meeting the demand for high-protein snacks better than most.

Its Quest and Atkins product lines boast the sought-after macronutrient combination of low carbs and high protein and satisfy that urge to snack any time of the day.

Both brands feature ready-to-drink protein shakes, protein-packed meal replacement bars, and other types of nutritious snacks available in your local Walmart (WMT), Target (TGT), and online through Amazon.com (AMZN), making them easily accessible to most American households.

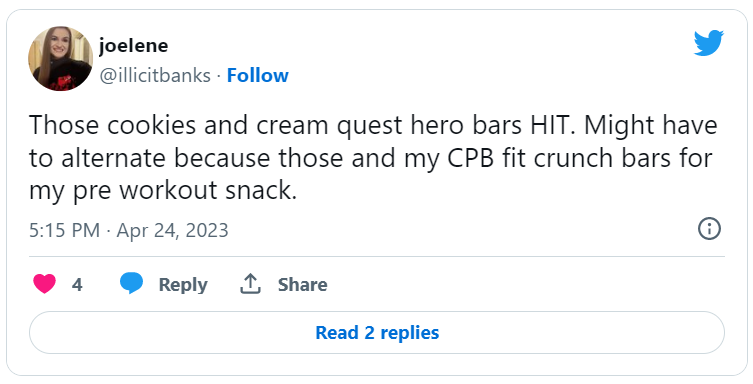

And better yet, these snacks are actually yummy: The company recently launched Quest Cheese Crackers in Cheddar Blast to take on the beloved Cheez-Its with real cheese, 10 grams of protein, and just five grams of carbs per serving.

In the first quarter of FY 2023, the company’s U.S. retail takeaway increased by 14%. And thanks to LikeFolio’s predictive consumer demand data, we can see just how much people are purchasing Simply Good Food products in real time.

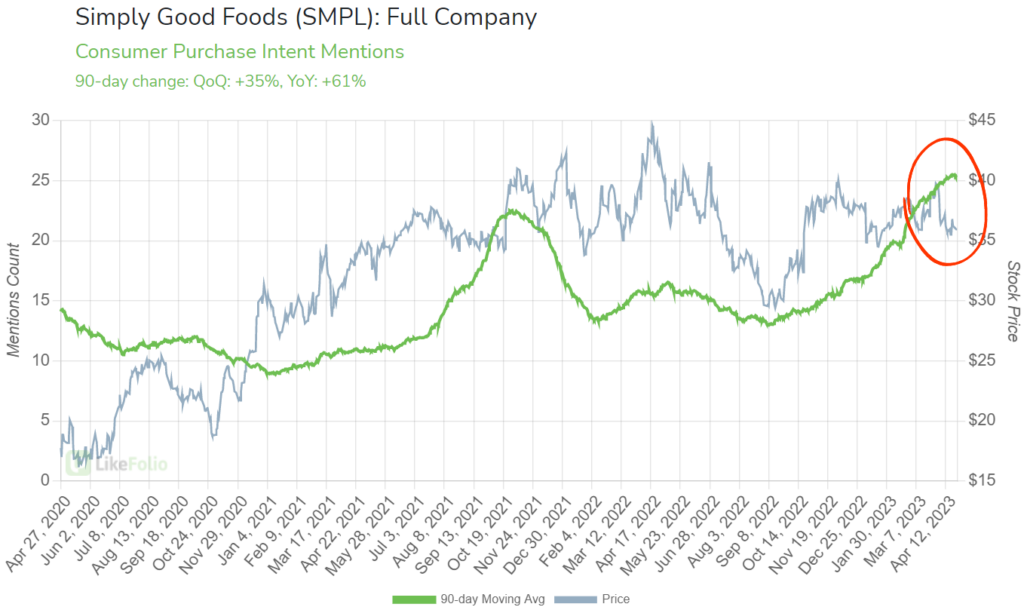

Consumer Purchase Intent (PI) Mentions of folks talking about spending their hard-earned cash on SMPL products are skyrocketing 61% year-over-year, and 35% quarter-over-quarter:

At the same time, SMPL shares have declined, creating what we call a “divergence” opportunity.

A “divergence” opportunity happens when a company’s stock price trends in the opposite direction of demand, which signals a reversal could be in the making.

When it comes to Simply Good Foods, that’s great news for you – because it means you can scoop up shares now while they’re priced low… Then sit back and watch as the market catches on to the opportunity and sends the stock price skyward.

Simply Good Foods’ health and wellness-sparked demand surge has pushed way past the typical New Years’ resolution bump.

And that bodes incredibly well for SMPL’s long-term prospects.

Until next time,

Andy Swan

Co-Founder

🍩 Up Next: As much as consumers are into health and wellness, they’re also loving donuts from the drive-thru: Check out how a donut at McDonald’s let to this sweet profit opportunity.